We Like Palram Industries (1990)'s (TLV:PLRM) Returns And Here's How They're Trending

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. And in light of that, the trends we're seeing at Palram Industries (1990)'s (TLV:PLRM) look very promising so lets take a look.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Palram Industries (1990) is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.27 = ₪282m ÷ (₪1.4b - ₪326m) (Based on the trailing twelve months to September 2020).

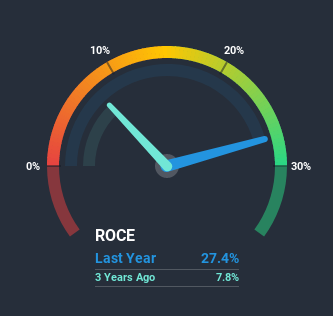

So, Palram Industries (1990) has an ROCE of 27%. In absolute terms that's a great return and it's even better than the Chemicals industry average of 15%.

See our latest analysis for Palram Industries (1990)

Historical performance is a great place to start when researching a stock so above you can see the gauge for Palram Industries (1990)'s ROCE against it's prior returns. If you'd like to look at how Palram Industries (1990) has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

Investors would be pleased with what's happening at Palram Industries (1990). The data shows that returns on capital have increased substantially over the last five years to 27%. Basically the business is earning more per dollar of capital invested and in addition to that, 43% more capital is being employed now too. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

In Conclusion...

In summary, it's great to see that Palram Industries (1990) can compound returns by consistently reinvesting capital at increasing rates of return, because these are some of the key ingredients of those highly sought after multi-baggers. And investors seem to expect more of this going forward, since the stock has rewarded shareholders with a 63% return over the last five years. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

One more thing, we've spotted 1 warning sign facing Palram Industries (1990) that you might find interesting.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

If you’re looking to trade Palram Industries (1990), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:PLRM

Palram Industries (1990)

Operates as a manufacturer of extruded thermoplastic sheets and panel systems in Israel and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success