Palram Industries (1990) (TLV:PLRM) Might Have The Makings Of A Multi-Bagger

What are the early trends we should look for to identify a stock that could multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So on that note, Palram Industries (1990) (TLV:PLRM) looks quite promising in regards to its trends of return on capital.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Palram Industries (1990), this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = ₪208m ÷ (₪1.6b - ₪329m) (Based on the trailing twelve months to December 2022).

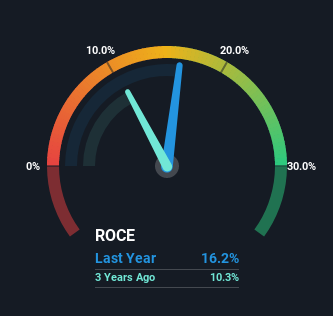

Thus, Palram Industries (1990) has an ROCE of 16%. By itself that's a normal return on capital and it's in line with the industry's average returns of 16%.

View our latest analysis for Palram Industries (1990)

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Palram Industries (1990)'s past further, check out this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

Investors would be pleased with what's happening at Palram Industries (1990). Over the last five years, returns on capital employed have risen substantially to 16%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 78%. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

One more thing to note, Palram Industries (1990) has decreased current liabilities to 20% of total assets over this period, which effectively reduces the amount of funding from suppliers or short-term creditors. So this improvement in ROCE has come from the business' underlying economics, which is great to see.

In Conclusion...

In summary, it's great to see that Palram Industries (1990) can compound returns by consistently reinvesting capital at increasing rates of return, because these are some of the key ingredients of those highly sought after multi-baggers. And with a respectable 74% awarded to those who held the stock over the last five years, you could argue that these developments are starting to get the attention they deserve. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

One more thing: We've identified 2 warning signs with Palram Industries (1990) (at least 1 which makes us a bit uncomfortable) , and understanding these would certainly be useful.

While Palram Industries (1990) may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:PLRM

Palram Industries (1990)

Operates as a manufacturer of extruded thermoplastic sheets and panel systems in Israel and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success