We're Watching These Trends At Kafrit Industries (1993) (TLV:KAFR)

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Although, when we looked at Kafrit Industries (1993) (TLV:KAFR), it didn't seem to tick all of these boxes.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Kafrit Industries (1993) is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.17 = ₪77m ÷ (₪685m - ₪229m) (Based on the trailing twelve months to September 2020).

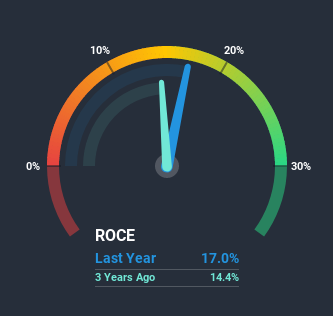

Therefore, Kafrit Industries (1993) has an ROCE of 17%. That's a relatively normal return on capital, and it's around the 15% generated by the Chemicals industry.

See our latest analysis for Kafrit Industries (1993)

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Kafrit Industries (1993)'s past further, check out this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

In terms of Kafrit Industries (1993)'s historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 17% from 22% five years ago. However it looks like Kafrit Industries (1993) might be reinvesting for long term growth because while capital employed has increased, the company's sales haven't changed much in the last 12 months. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

On a side note, Kafrit Industries (1993) has done well to pay down its current liabilities to 33% of total assets. So we could link some of this to the decrease in ROCE. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

The Bottom Line On Kafrit Industries (1993)'s ROCE

Bringing it all together, while we're somewhat encouraged by Kafrit Industries (1993)'s reinvestment in its own business, we're aware that returns are shrinking. Although the market must be expecting these trends to improve because the stock has gained 69% over the last five years. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

If you want to know some of the risks facing Kafrit Industries (1993) we've found 3 warning signs (1 is a bit concerning!) that you should be aware of before investing here.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade Kafrit Industries (1993), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kafrit Industries (1993) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:KAFR

Kafrit Industries (1993)

Offers customized masterbatches and compounds in Israel, China, Germany, Canada, and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success