- China

- /

- Electrical

- /

- SHSE:601369

Top Dividend Stocks Including Xi'an Shaangu Power And Two More

Reviewed by Simply Wall St

In the current global market landscape, rising U.S. Treasury yields have put pressure on stocks, with the S&P 500 Index finishing lower after a strong six-week performance streak. Amidst these fluctuations, investors are increasingly turning their attention to dividend stocks as a potential source of steady income and stability. A good dividend stock often combines reliable payout history with resilience in varying economic conditions, making it an attractive option for those navigating today's uncertain financial environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.08% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.90% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2013 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Xi'an Shaangu Power (SHSE:601369)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xi'an Shaangu Power Co., Ltd. offers systematic solutions and services in the People’s Republic of China, with a market capitalization of CN¥15.08 billion.

Operations: Xi'an Shaangu Power Co., Ltd. generates revenue through its systematic solutions and services in the People’s Republic of China.

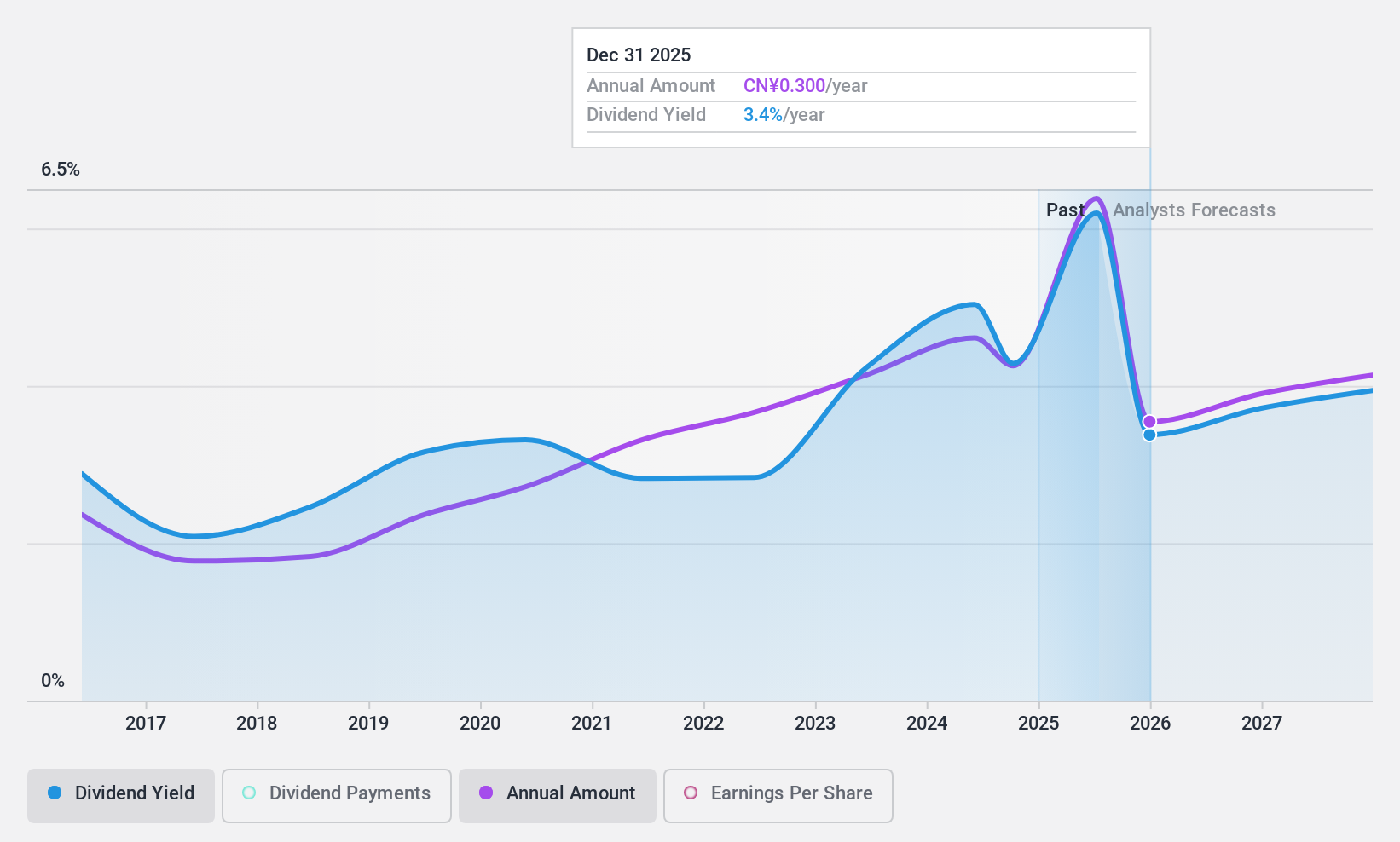

Dividend Yield: 4.1%

Xi'an Shaangu Power's dividend yield of 4.1% ranks it among the top 25% of dividend payers in China, yet its sustainability is questionable due to a high payout ratio of 101.2%. While dividends are covered by cash flows, they remain volatile and unreliable over the past decade. Recent earnings show slight revenue growth but a decline in net income, impacting dividend coverage from earnings. The stock trades at a favorable price-to-earnings ratio compared to the market average.

- Dive into the specifics of Xi'an Shaangu Power here with our thorough dividend report.

- The analysis detailed in our Xi'an Shaangu Power valuation report hints at an deflated share price compared to its estimated value.

Zhejiang Development GroupLtd (SZSE:000906)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Development Group Co., Ltd operates in commodity trading, financial leasing, online retailing, car sales and after-service, and warehousing logistics services both in China and internationally, with a market cap of approximately CN¥4.32 billion.

Operations: Zhejiang Development Group Co., Ltd generates revenue through its operations in commodity trading, financial leasing, online retailing, car sales and after-service, and warehousing logistics services.

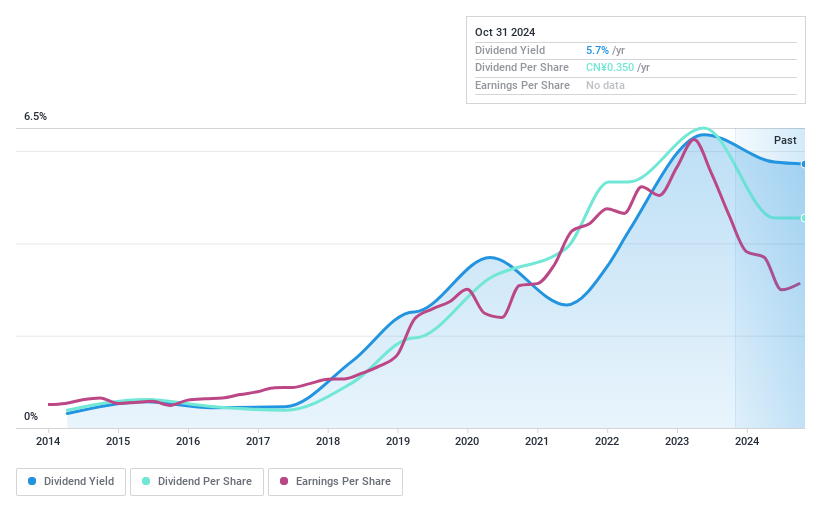

Dividend Yield: 5.7%

Zhejiang Development Group offers a high dividend yield of 5.72%, placing it in the top 25% of Chinese dividend payers, yet its dividends are volatile and not covered by free cash flows. Despite having a low payout ratio of 45.5%, earnings have declined, with net income dropping to CNY 418.17 million for the first nine months of 2024 from CNY 522.34 million last year, challenging dividend sustainability. The stock trades at an attractive price-to-earnings ratio of 7.1x against the market average.

- Unlock comprehensive insights into our analysis of Zhejiang Development GroupLtd stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Zhejiang Development GroupLtd is priced lower than what may be justified by its financials.

Menora Mivtachim Holdings (TASE:MMHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Menora Mivtachim Holdings Ltd operates in the insurance and finance sectors in Israel, with a market cap of ₪7.05 billion.

Operations: Menora Mivtachim Holdings Ltd generates revenue from various segments, including ₪2.22 billion from Health Insurance, ₪5.32 billion from Life Insurance and Long Term Savings - Life Insurance, ₪0.74 billion from Life Insurance and Long Term Savings - Pension, ₪0.56 billion from Life Insurance and Long Term Savings - Provident, ₪1.75 billion from General Insurance - Automobile Property Insurance, ₪0.89 billion from General Insurance - Compulsory Vehicle Insurance, and ₪0.41 billion from General Insurance - Property Divisions and Others.

Dividend Yield: 4.9%

Menora Mivtachim Holdings' dividend payments are well supported by earnings and cash flows, with a payout ratio of 36.1% and a cash payout ratio of 49.8%. However, the dividend yield of 4.9% is lower than the top IL market payers, and its track record shows volatility over the past decade. Recent impairments were reported alongside improved earnings for Q2 2024, with net income rising significantly to ILS 296.95 million from ILS 21.16 million year-over-year.

- Click to explore a detailed breakdown of our findings in Menora Mivtachim Holdings' dividend report.

- Upon reviewing our latest valuation report, Menora Mivtachim Holdings' share price might be too pessimistic.

Turning Ideas Into Actions

- Gain an insight into the universe of 2013 Top Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601369

Xi'an Shaangu Power

Provides systematic solutions and services in the People’s Republic of China.

Excellent balance sheet with proven track record and pays a dividend.