- Israel

- /

- Capital Markets

- /

- TASE:ATRY

Undiscovered Gems In Middle East Stocks To Watch June 2025

Reviewed by Simply Wall St

As geopolitical tensions between Israel and Iran cast a shadow over the Gulf markets, most indices have seen declines, with Saudi Arabia's benchmark index dropping 1.4% and Dubai's main share index finishing 0.6% lower. Despite these challenges, discerning investors often seek opportunities in overlooked sectors or companies that exhibit resilience and potential for growth amidst regional instability.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Value Rating: ★★★★★★

Overview: Atreyu Capital Markets Ltd, with a market cap of ₪1.21 billion, operates in Israel offering investment management services through its subsidiaries.

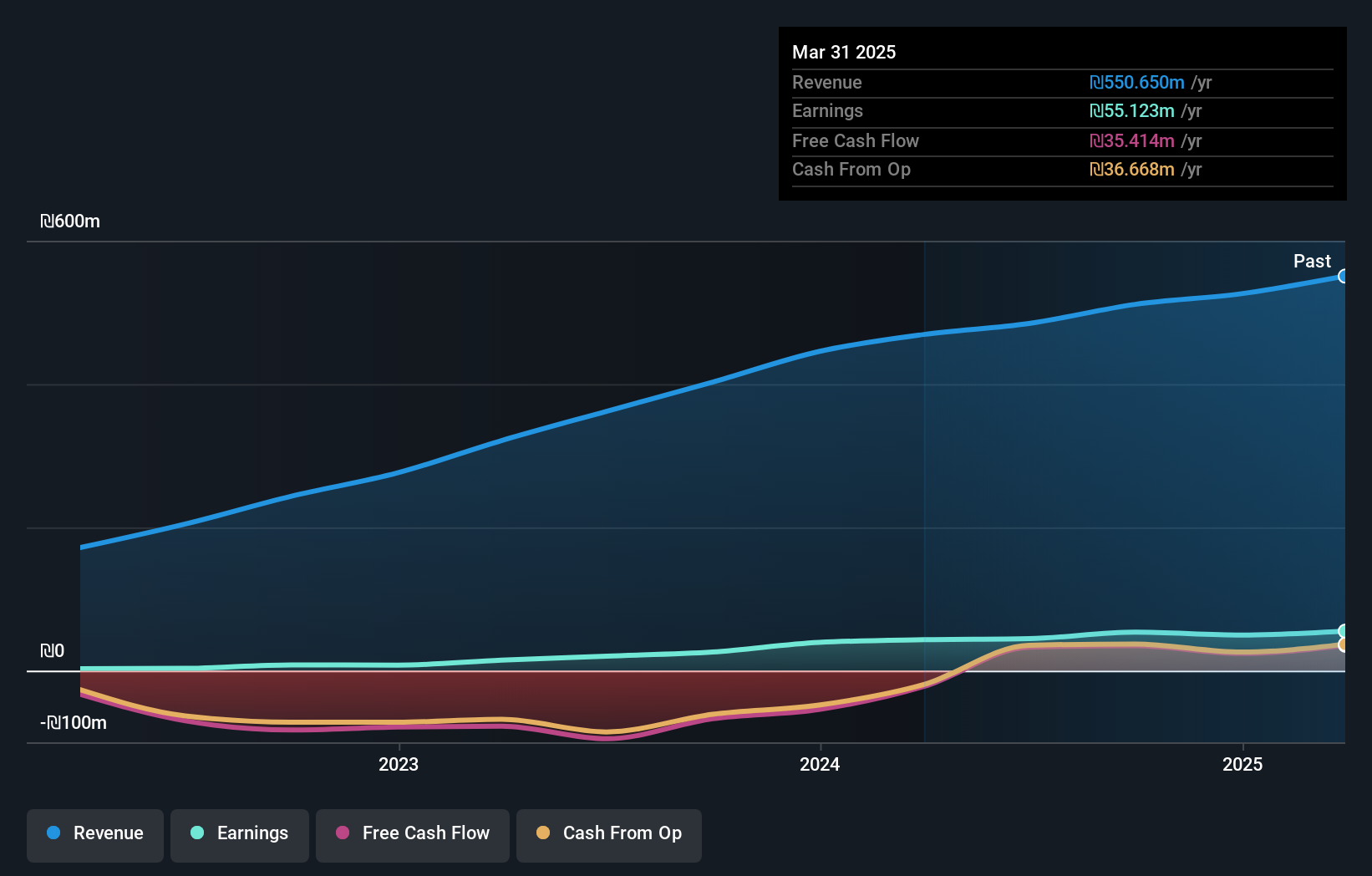

Operations: Atreyu Capital Markets generates revenue primarily from its investment management segment, which amounts to ₪102.64 million. The company's financial performance can be analyzed through its net profit margin trends.

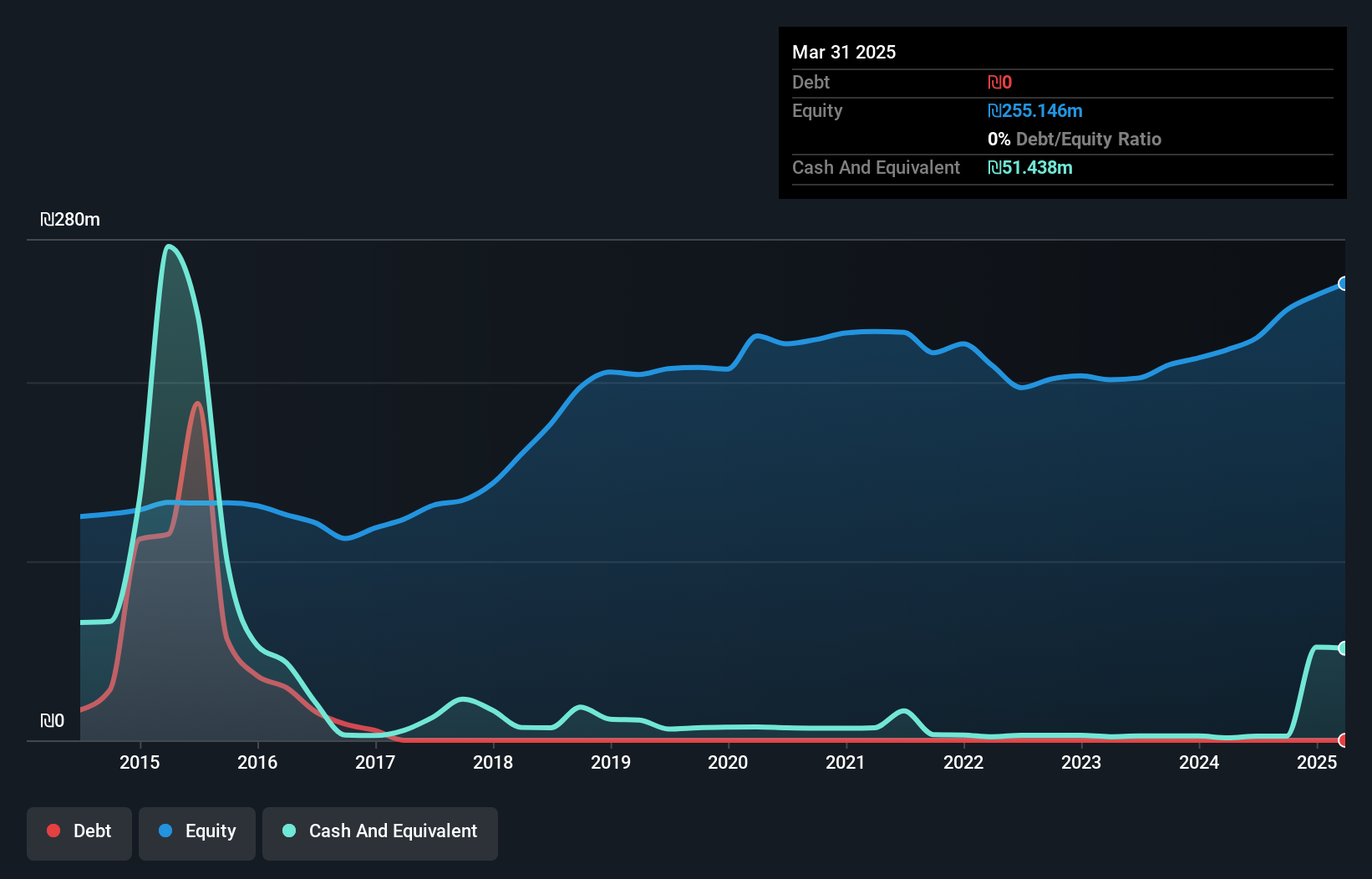

Atreyu Capital Markets, a nimble player in the financial sector, showcases strong performance with earnings growth of 29.3% over the past year, outpacing the industry average of 28.5%. The firm is debt-free and boasts high-quality earnings, underscoring its solid financial footing. With a price-to-earnings ratio of 12.2x, it trades below the IL market average of 14.3x, suggesting potential value for investors. Recent results highlight revenue climbing to ILS 27.56 million from ILS 22.23 million year-on-year and net income reaching ILS 26.53 million compared to last year's ILS 21.17 million—indicative of robust operational momentum.

I.D.I. Insurance (TASE:IDIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: I.D.I. Insurance Company Ltd. offers a range of insurance products and services to both individual and corporate clients in Israel, with a market capitalization of ₪2.81 billion.

Operations: I.D.I. Insurance generates revenue primarily from its Health and Life Insurance and Long-Term Savings segments, with health insurance contributing ₪282.21 million and life insurance adding ₪399.69 million to its income streams.

I.D.I. Insurance is making waves with its robust performance, showcasing a 49.1% earnings growth over the past year, outpacing the insurance industry's 45%. With an impressive debt-to-equity ratio drop from 82.7% to 42.2% in five years and more cash than total debt, it seems financially sound. The company's interest payments are well-covered by EBIT at 18.7 times, indicating solid financial health. Its price-to-earnings ratio of 9.9x undercuts the IL market's average of 14.3x, suggesting good value for investors seeking opportunities in smaller players within the Middle East insurance sector.

- Unlock comprehensive insights into our analysis of I.D.I. Insurance stock in this health report.

Examine I.D.I. Insurance's past performance report to understand how it has performed in the past.

More Provident Funds (TASE:MPP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: More Provident Funds Ltd. operates in Israel, managing provident and pension funds with a market capitalization of ₪1.13 billion.

Operations: More Provident Funds generates revenue primarily from its provident sector, contributing ₪513.62 million, while the pension segment adds ₪27.20 million.

More Provident Funds, a smaller player in the Middle East financial landscape, has shown impressive earnings growth of 77% annually over the past five years. Despite this growth, its debt to equity ratio has climbed from 52% to 68%, indicating increased leverage. However, with interest payments well covered by EBIT at 11.5 times and more cash than total debt on hand, the financial footing appears solid. Recent earnings for Q1 2025 reported revenue of ILS 150.88 million and net income of ILS 17.52 million compared to last year's figures of ILS 126.28 million and ILS 11.97 million respectively, reflecting robust performance in a competitive industry environment.

- Dive into the specifics of More Provident Funds here with our thorough health report.

Evaluate More Provident Funds' historical performance by accessing our past performance report.

Make It Happen

- Reveal the 220 hidden gems among our Middle Eastern Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ATRY

Atreyu Capital Markets

Through its subsidiaries, provides investment management services in Israel.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives