Assessing Harel Insurance (TASE:HARL) Valuation Following New Share Buyback Announcement

Reviewed by Simply Wall St

Harel Insurance Investments & Financial Services (TASE:HARL) just unveiled a share buyback program authorized by its Board of Directors. The company aims to repurchase up to ILS 100 million of its own shares using internal funds through October 2027.

See our latest analysis for Harel Insurance Investments & Financial Services.

The buyback news comes after a remarkable run for Harel Insurance Investments & Financial Services. Investor enthusiasm has sent the share price up 138% year-to-date and driven an impressive 225% total shareholder return over the past 12 months. With momentum firmly on its side, this latest move hints at management’s belief in the company’s continued growth potential.

If the buyback announcement has you thinking about other market leaders with strong momentum, now is a great time to check out fast growing stocks with high insider ownership

With shares up more than twofold this year, investors might wonder if Harel Insurance Investments & Financial Services is still undervalued after the buyback news, or if the market is already factoring in further gains. Is there a real buying opportunity here, or is future growth fully priced in?

Price-to-Earnings of 15.5x: Is it justified?

Harel Insurance Investments & Financial Services is trading at a price-to-earnings (P/E) ratio of 15.5x, closely matching its peer average but sitting below the IL market average. The company’s last close was ₪123.5.

The price-to-earnings ratio measures how much investors are paying for each unit of earnings, making it especially relevant for profitable insurance and financial firms. A P/E in line with peers suggests that the market values HARL’s current earning power similarly to its competitors and may be factoring in its recent growth streak.

However, when compared to the industry average in Asia, HARL’s P/E is notably higher than the sector norm of 11.1x. Furthermore, our estimates indicate that a fair P/E would be 13.1x, which is lower than where HARL currently trades. If the market values revert to this level, HARL’s price may become less defensible on valuation grounds.

Explore the SWS fair ratio for Harel Insurance Investments & Financial Services

Result: Price-to-Earnings of 15.5x (ABOUT RIGHT)

However, investors should note the slight premium to analyst price targets and the modest annual net income growth, which could challenge the case for further upside.

Find out about the key risks to this Harel Insurance Investments & Financial Services narrative.

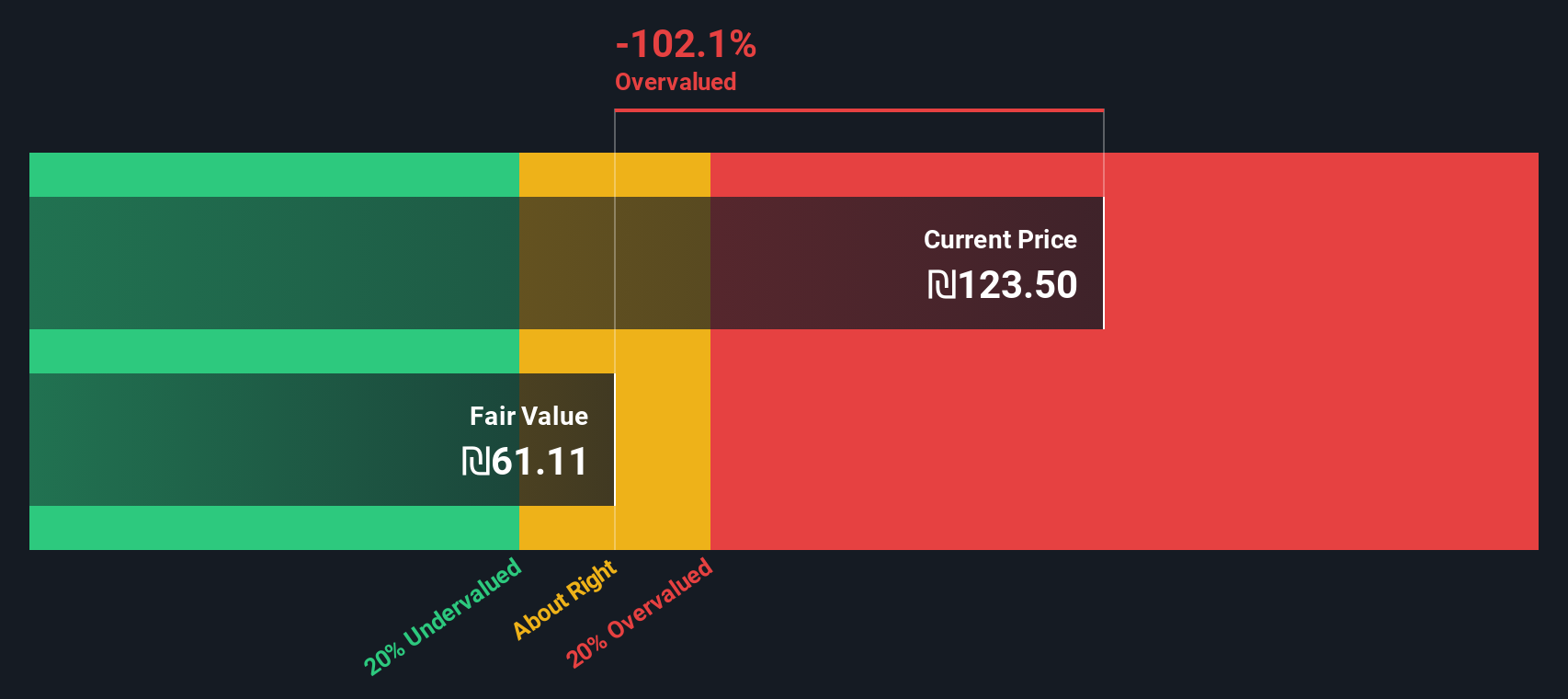

Another View: Our DCF Model Signals Overvaluation

While the current price-to-earnings ratio puts Harel Insurance Investments & Financial Services in line with peers, our SWS DCF model presents a starkly different picture. The DCF analysis suggests the shares are trading well above their fair value and points to potential overvaluation if future cash flows do not exceed expectations.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Harel Insurance Investments & Financial Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 859 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Harel Insurance Investments & Financial Services Narrative

If you want to reach your own conclusions or dive deeper into the numbers, you can craft a personalized investment thesis in just a few minutes. Do it your way

A great starting point for your Harel Insurance Investments & Financial Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by tapping into unique opportunities with Simply Wall Street’s powerful screener. Don’t let the market’s next big move pass you by.

- Explore emerging tech trends and see which leaders are shaping the next AI breakthrough by checking out these 25 AI penny stocks.

- Seek potential steady income streams by uncovering these 17 dividend stocks with yields > 3% currently delivering attractive yields.

- Take advantage of market inefficiencies and find potential bargains among these 859 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harel Insurance Investments & Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:HARL

Harel Insurance Investments & Financial Services

Offers insurance and financial services in Israel, Europe, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives