- Israel

- /

- Medical Equipment

- /

- TASE:SOFW

A Piece Of The Puzzle Missing From SofWave Medical Ltd.'s (TLV:SOFW) 31% Share Price Climb

SofWave Medical Ltd. (TLV:SOFW) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 20% is also fairly reasonable.

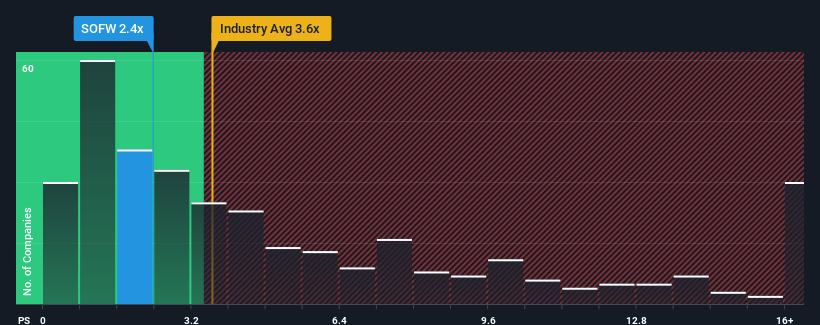

Although its price has surged higher, there still wouldn't be many who think SofWave Medical's price-to-sales (or "P/S") ratio of 2.4x is worth a mention when it essentially matches the median P/S in Israel's Medical Equipment industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for SofWave Medical

What Does SofWave Medical's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, SofWave Medical has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on SofWave Medical will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, SofWave Medical would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 60% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 23% shows it's noticeably more attractive.

With this information, we find it interesting that SofWave Medical is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does SofWave Medical's P/S Mean For Investors?

SofWave Medical's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision SofWave Medical's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for SofWave Medical that you should be aware of.

If you're unsure about the strength of SofWave Medical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SOFW

SofWave Medical

Engages in the development, production, marketing, support, and distribution of ultrasound technology for non-invasive skin rejuvenation and firming treatment in Israel and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives