These 4 Measures Indicate That Neto Malinda Trading (TLV:NTML) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Neto Malinda Trading Ltd. (TLV:NTML) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Neto Malinda Trading

How Much Debt Does Neto Malinda Trading Carry?

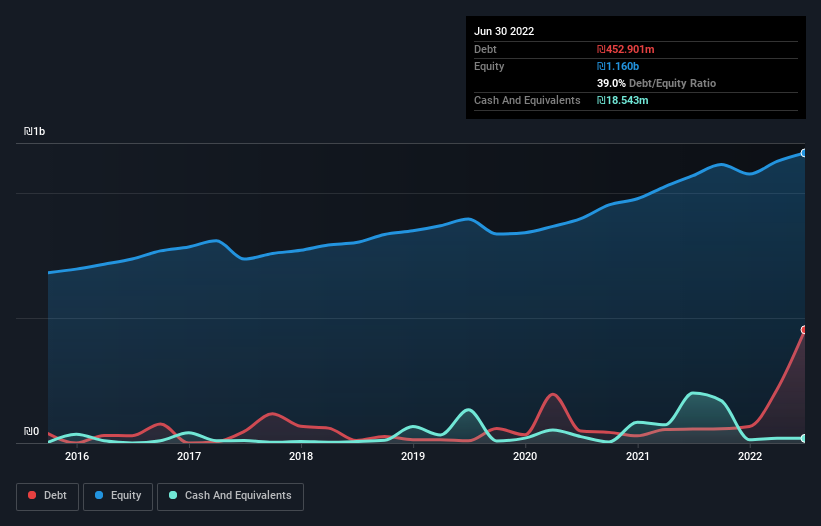

As you can see below, at the end of June 2022, Neto Malinda Trading had ₪452.9m of debt, up from ₪55.5m a year ago. Click the image for more detail. However, it also had ₪18.5m in cash, and so its net debt is ₪434.4m.

How Strong Is Neto Malinda Trading's Balance Sheet?

We can see from the most recent balance sheet that Neto Malinda Trading had liabilities of ₪741.6m falling due within a year, and liabilities of ₪83.0m due beyond that. Offsetting these obligations, it had cash of ₪18.5m as well as receivables valued at ₪1.11b due within 12 months. So it can boast ₪301.2m more liquid assets than total liabilities.

This short term liquidity is a sign that Neto Malinda Trading could probably pay off its debt with ease, as its balance sheet is far from stretched.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

We'd say that Neto Malinda Trading's moderate net debt to EBITDA ratio ( being 1.6), indicates prudence when it comes to debt. And its strong interest cover of 1k times, makes us even more comfortable. The good news is that Neto Malinda Trading has increased its EBIT by 7.5% over twelve months, which should ease any concerns about debt repayment. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Neto Malinda Trading will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Considering the last three years, Neto Malinda Trading actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

When it comes to the balance sheet, the standout positive for Neto Malinda Trading was the fact that it seems able to cover its interest expense with its EBIT confidently. However, our other observations weren't so heartening. To be specific, it seems about as good at converting EBIT to free cash flow as wet socks are at keeping your feet warm. When we consider all the elements mentioned above, it seems to us that Neto Malinda Trading is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Neto Malinda Trading you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Neto Malinda Trading might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:NTML

Neto Malinda Trading

Manufactures, imports, markets, and distributes kosher food products.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success