- Israel

- /

- Oil and Gas

- /

- TASE:NWMD

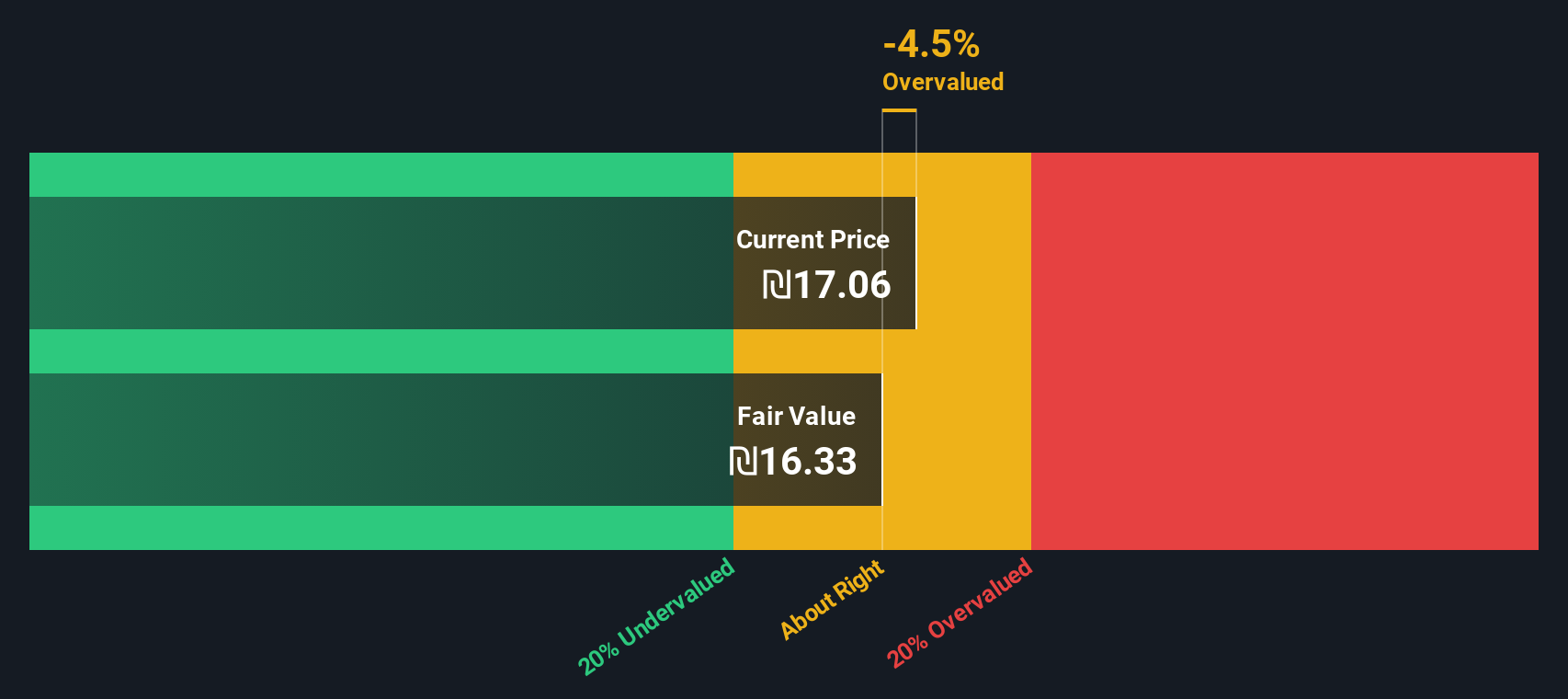

Assessing NewMed Energy (TASE:NWMD) Valuation Following Lower Q3 and Nine-Month Earnings Results

Reviewed by Simply Wall St

NewMed Energy, Limited Partnership (TASE:NWMD) just released its third quarter and nine-month earnings, reporting a decline in both revenue and net income compared to last year. Investors are watching how these numbers shape expectations going forward.

See our latest analysis for NewMed Energy - Limited Partnership.

Despite the dip in recent earnings, NewMed Energy Limited Partnership’s share price has surged 40% year-to-date, with a standout 48.09% total shareholder return over the last twelve months. This signals strong long-term momentum even as short-term volatility remains.

If you’re curious about what else is catching investors’ attention lately, now’s an ideal moment to broaden your radar and discover fast growing stocks with high insider ownership

With recent profits softening but the stock having delivered impressive returns, the question now is whether NewMed Energy remains undervalued or if the current price already reflects expectations for future growth. Is there still a buying opportunity?

Price-to-Earnings of 13x: Is it justified?

NewMed Energy's current share price translates to a price-to-earnings (P/E) ratio of 13, which puts it on par with oil and gas peer companies both regionally and across Asia. At a last close of ₪16.1, the stock appears attractively valued with respect to its recent earnings performance.

The price-to-earnings ratio gauges what investors are willing to pay today for a unit of current earnings. For an established energy company like NewMed Energy, this multiple helps frame expectations around earnings potential, sector prospects, and perceived risks.

NewMed Energy’s P/E ratio aligns closely with both its Asian industry average of 13.2x and its direct peer average of 13.6x. This suggests the market values NewMed on terms very similar to its closest competitors based on earnings, reflecting neither an obvious discount nor premium. There is currently no evidence indicating the market is about to re-rate NewMed’s earnings profile higher or lower in the near term.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13x (ABOUT RIGHT)

However, if revenue and net income growth slow or the share price retreats, the current market confidence in NewMed Energy could be quickly challenged.

Find out about the key risks to this NewMed Energy - Limited Partnership narrative.

Another View: DCF Model Offers a Second Opinion

While the price-to-earnings ratio shows NewMed Energy is fairly in line with its peers, our DCF model takes a different approach. Based on discounted future cash flows, the SWS DCF model suggests the stock is actually trading around 2.6% below its estimated fair value. This raises the question of whether the market is undervaluing NewMed’s long-term potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NewMed Energy - Limited Partnership for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NewMed Energy - Limited Partnership Narrative

If you see things differently or want to dig into the numbers on your own terms, you can easily craft your own perspective in just a few minutes. Do it your way

A great starting point for your NewMed Energy - Limited Partnership research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity, and Simply Wall Street makes it easy to find compelling stocks that match your goals in minutes.

- Discover opportunities for powerful yields by checking out these 16 dividend stocks with yields > 3%, which may deliver income above 3%.

- Explore the AI wave and enhance your potential by reviewing these 26 AI penny stocks, which are changing automation and intelligence.

- Find overlooked bargains by targeting these 926 undervalued stocks based on cash flows, aimed at investors seeking real value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewMed Energy - Limited Partnership might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NWMD

NewMed Energy - Limited Partnership

Engages in the exploration, development, production, and sale of petroleum, natural gas, and condensate in Israel, Jordan and Egypt.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives