- Israel

- /

- Oil and Gas

- /

- TASE:EQTL

Equital (TASE:EQTL): Net Margin Drops to 11.9%, Challenging Bullish Value Narratives

Reviewed by Simply Wall St

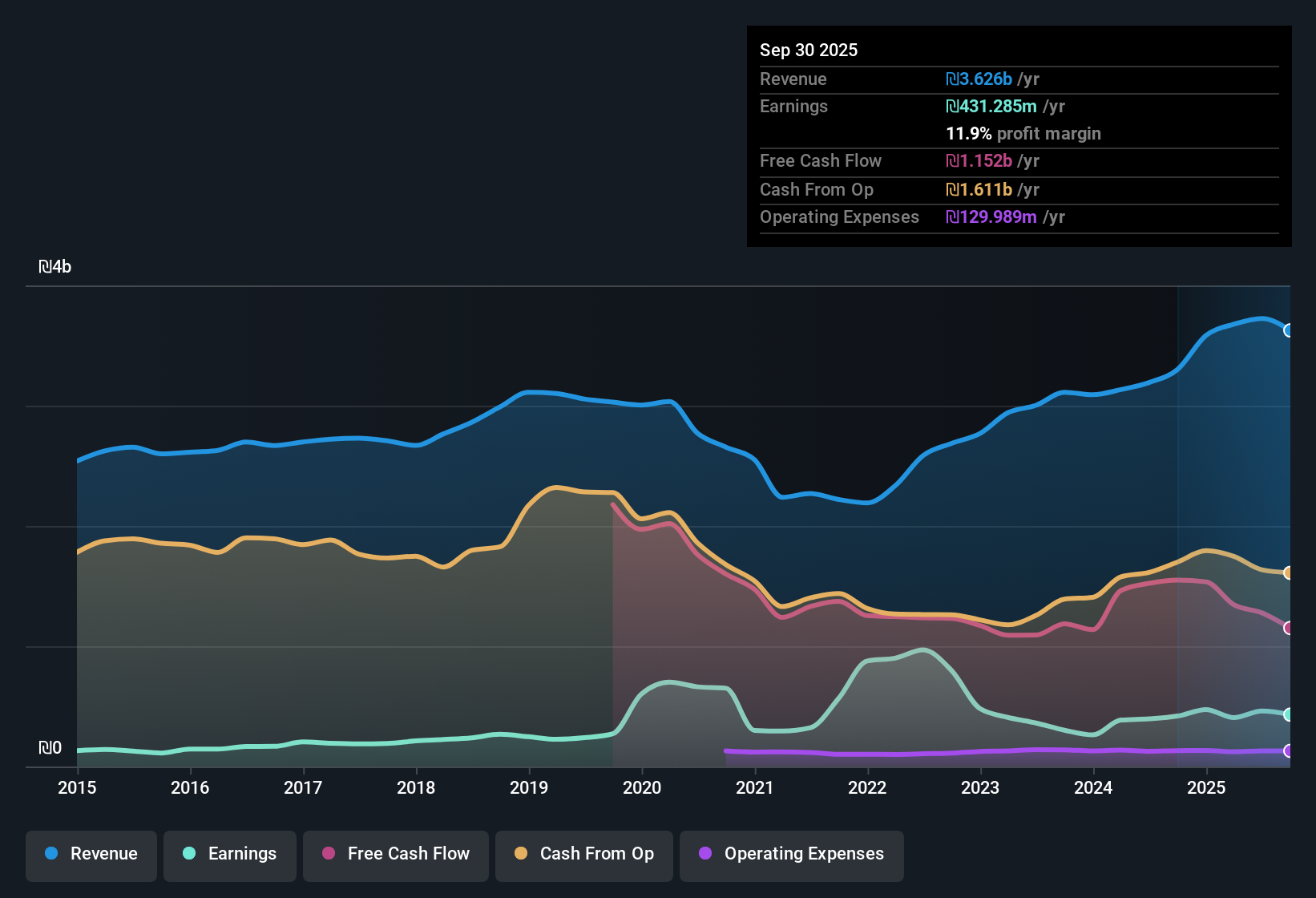

Equital (TASE:EQTL) has posted its Q3 2025 results, reporting revenue of 847.8 million ILS and Basic EPS of 3.2 ILS for the quarter. The company has seen revenue fluctuate over the past year, ranging from 947.4 million ILS in Q3 2024 down to 847.8 million ILS this quarter. EPS moved from 4.1 ILS to 3.2 ILS over the same period. Margins have come under pressure, keeping investors’ focus on future profitability trends.

See our full analysis for Equital.Next up, we will see how these reported figures compare to the prevailing narratives and expectations from the Simply Wall St community, and whether any long-held views are due for a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Slip to 11.9% Despite Sequential Profit Uptick

- Trailing twelve-month net profit margin fell to 11.9%, down from 12.7% the prior year, even as net income for Q3 2025 reached 101.4 million ILS. Revenue performance remained relatively stable.

- Analysis highlights that while Equital managed to turn around its longer-term trend of falling profits by growing earnings 2.8% over the last year, the margin compression draws scrutiny:

- The sequential profit improvement from Q4 2024 (64.5 million ILS) to Q3 2025 (101.4 million ILS) demonstrates resilience. However, the shrinking margin suggests rising costs or pricing pressures.

- During the previous five-year period, profits declined by an average of 7.7% per year, so the recent positive shift supports arguments for improving operating quality if margin pressure stabilizes.

Valuation Gap: 13.3x P/E and Deep Discount to Fair Value

- Equital is trading on a price-to-earnings ratio of 13.3x, lower than the peer average of 17.4x and well below its DCF fair value of 444.04 ILS per share. The current share price is 157.40 ILS.

- Broader market perspective points to strong value appeal for long-term investors:

- At a 64.6% discount to DCF fair value, the current price offers a sizable margin of safety. This draws value-focused attention in light of ongoing earnings stabilization.

- Discounted multiples may reflect persistent margin risk and historic profit declines, potentially limiting re-rating potential unless operating improvement proves durable.

Debt Coverage Lags, Potentially Limiting Flexibility

- Risks summary notes that operating cash flow does not fully cover Equital’s debt. This is a concern in the context of margin contraction and single-digit earnings growth.

- Critics point out this could restrict management’s room to maneuver:

- If margin compression continues, debt servicing becomes harder, reducing the ability to reinvest or respond to downturns.

- While short-term profit increased, balance sheet constraints persist as a key factor for investors tracking sustainable returns.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Equital's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Equital’s pressured margins and weak debt coverage raise red flags about its ability to sustain profits, especially when financial flexibility is limited.

If you want companies with stronger finances and fewer balance sheet headaches, check out solid balance sheet and fundamentals stocks screener (1942 results) for opportunities offering greater security and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:EQTL

Equital

Through its subsidiaries, engages in the oil and gas business in Israel and internationally.

Good value with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026