Discovering Undiscovered Gems in Middle East Stocks November 2025

Reviewed by Simply Wall St

As Middle Eastern markets navigate a downturn in line with global shares, driven by concerns over stretched valuations, investors are increasingly on the lookout for opportunities amidst the volatility. In this environment, identifying stocks with solid fundamentals and growth potential can be particularly rewarding, offering a chance to uncover hidden gems that may thrive despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 19.37% | 17.10% | 23.35% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Dubai Refreshment (P.J.S.C.) (DFM:DRC)

Simply Wall St Value Rating: ★★★★★★

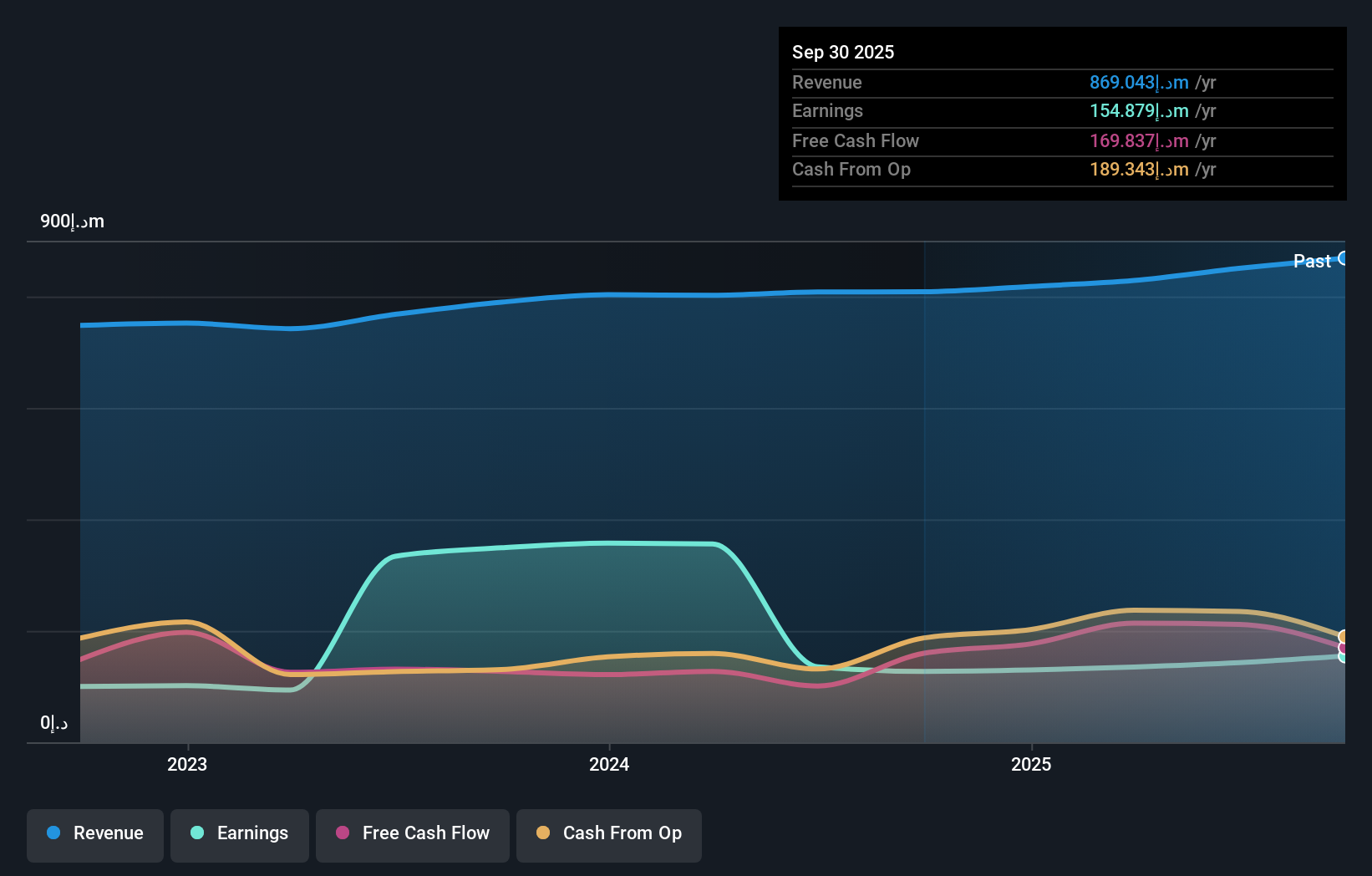

Overview: Dubai Refreshment (P.J.S.C.) is involved in the bottling and distribution of Pepsi Cola International products both within the United Arab Emirates and globally, with a market capitalization of AED1.96 billion.

Operations: The company generates revenue primarily through bottling and selling Pepsi Cola International products in the UAE and internationally. It operates with a market capitalization of AED1.96 billion.

Dubai Refreshment (P.J.S.C.), a nimble player in the Middle East market, showcases robust financial health with no debt, contrasting its past debt-to-equity ratio of 1.2 five years ago. The company's earnings have surged by 21.7% over the year, outpacing the Consumer Retailing industry's growth of 8.1%. Recent reports highlight sales reaching AED 238.75 million for Q3 and net income climbing to AED 47.48 million from AED 35.57 million last year, reflecting strong operational performance and high-quality earnings that position it well below its estimated fair value by about half, suggesting potential undervaluation opportunities for investors exploring regional markets.

- Take a closer look at Dubai Refreshment (P.J.S.C.)'s potential here in our health report.

Learn about Dubai Refreshment (P.J.S.C.)'s historical performance.

Sumer Varlik Yonetim (IBSE:SMRVA)

Simply Wall St Value Rating: ★★★★☆☆

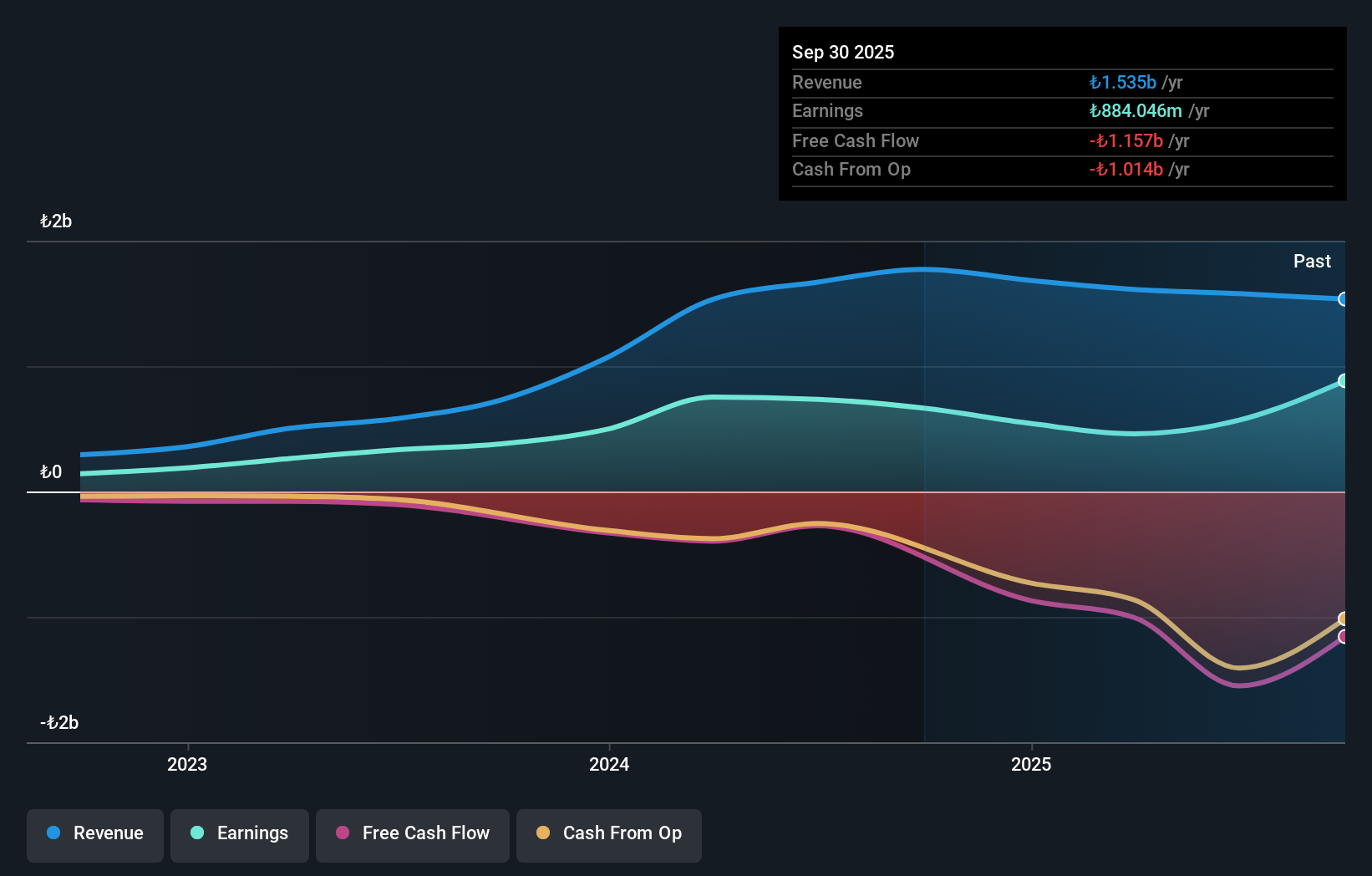

Overview: Sumer Varlik Yonetim A.S. is an asset management company with a market capitalization of TRY43.66 billion.

Operations: Sumer Varlik Yonetim generates revenue through its asset management services. The company's net profit margin is 18.5%.

Sumer Varlik Yonetim, a smaller financial player in the Middle East, has shown a significant turnaround despite revenue challenges. Over the past five years, its debt to equity ratio improved from 185.3% to 83.8%, indicating better leverage management. The company’s earnings surged by 33.1% last year, outpacing industry averages by a wide margin of -5.6%. However, interest coverage remains tight with EBIT covering interest payments only 2.2 times over—below the preferred threshold of three times coverage for comfort. Recent reports highlighted net income reaching TRY 369 million for Q3 compared to TRY 77 million previously, showcasing robust profitability improvements amidst declining revenues from TRY 375 million to TRY 332 million year-over-year.

- Get an in-depth perspective on Sumer Varlik Yonetim's performance by reading our health report here.

Understand Sumer Varlik Yonetim's track record by examining our Past report.

Equital (TASE:EQTL)

Simply Wall St Value Rating: ★★★★☆☆

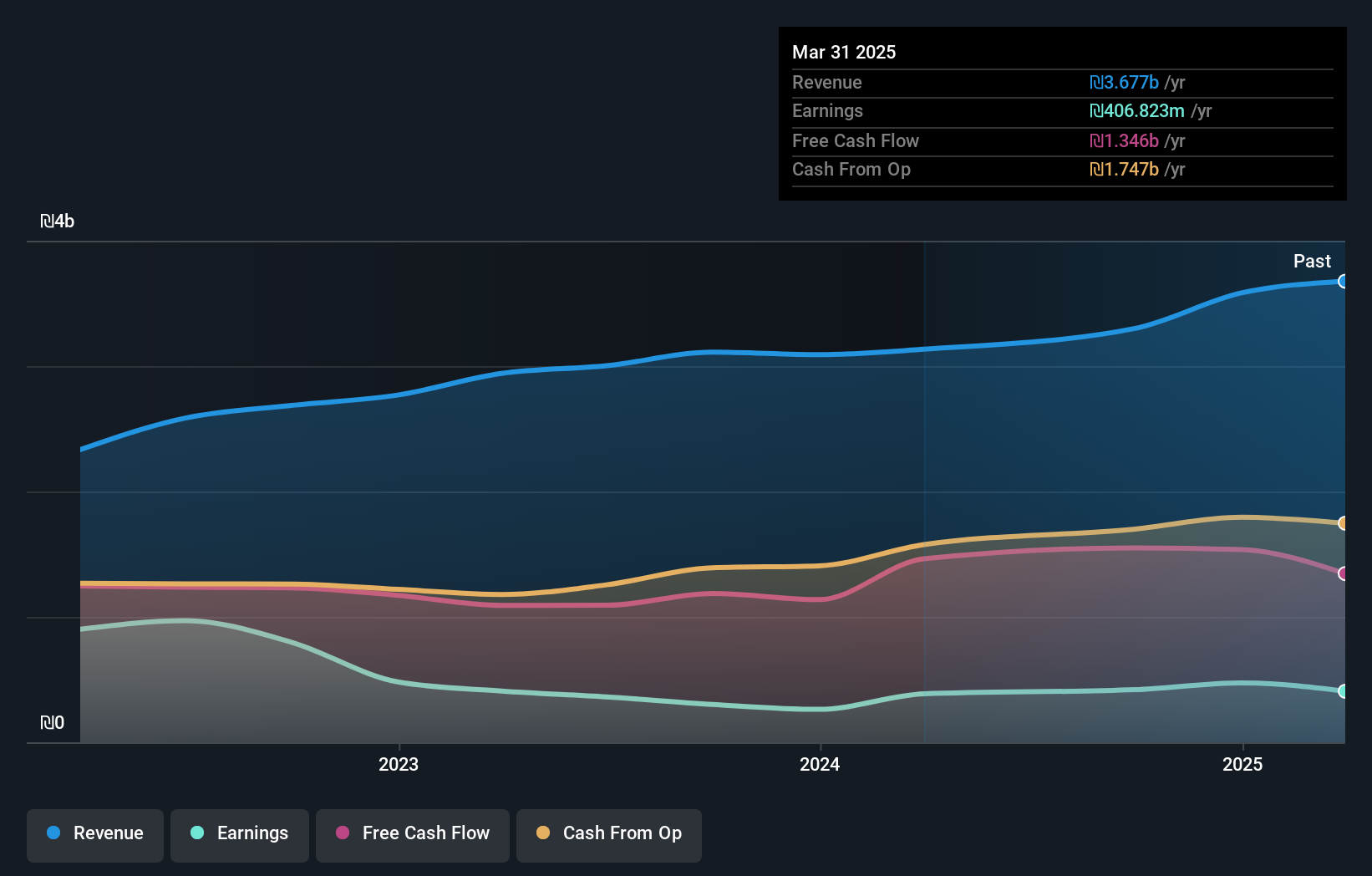

Overview: Equital Ltd. operates in real estate, oil and gas, and residential construction sectors both in Israel and internationally, with a market capitalization of ₪5.76 billion.

Operations: Equital generates revenue primarily from oil and gas operations in Israel (₪1.79 billion) and property rental and management in Israel (₪945.25 million). The company's net profit margin shows significant variation, reflecting the diverse nature of its business segments.

Equital, a dynamic player in the Middle East, recently joined the S&P Global BMI Index, highlighting its growing recognition. The company reported a net income of ILS 136 million for Q2 2025, up from ILS 81.74 million the previous year, reflecting strong performance despite earnings declining by an average of 8.4% annually over five years. Trading at approximately 71% below estimated fair value offers potential upside for investors. With interest payments well covered by EBIT at nearly nine times and free cash flow positivity evident, Equital's financial maneuvers seem strategically sound despite a high net debt to equity ratio of 43%.

- Dive into the specifics of Equital here with our thorough health report.

Gain insights into Equital's past trends and performance with our Past report.

Key Takeaways

- Embark on your investment journey to our 210 Middle Eastern Undiscovered Gems With Strong Fundamentals selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DRC

Dubai Refreshment (P.J.S.C.)

Engages in bottling and selling Pepsi Cola International products in the United Arab Emirates and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives