- Israel

- /

- Oil and Gas

- /

- TASE:DLEKG

Top Middle Eastern Dividend Stocks To Watch In June 2025

Reviewed by Simply Wall St

As geopolitical tensions between Israel and Iran weigh heavily on Gulf markets, many investors are turning their attention to the resilience of dividend stocks in the region. In such uncertain times, a strong dividend yield can provide a measure of stability and income, making these stocks particularly appealing for those looking to navigate volatility.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.81% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.80% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.28% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.65% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.41% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.76% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.97% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.89% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.28% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 8.04% | ★★★★★☆ |

Click here to see the full list of 77 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

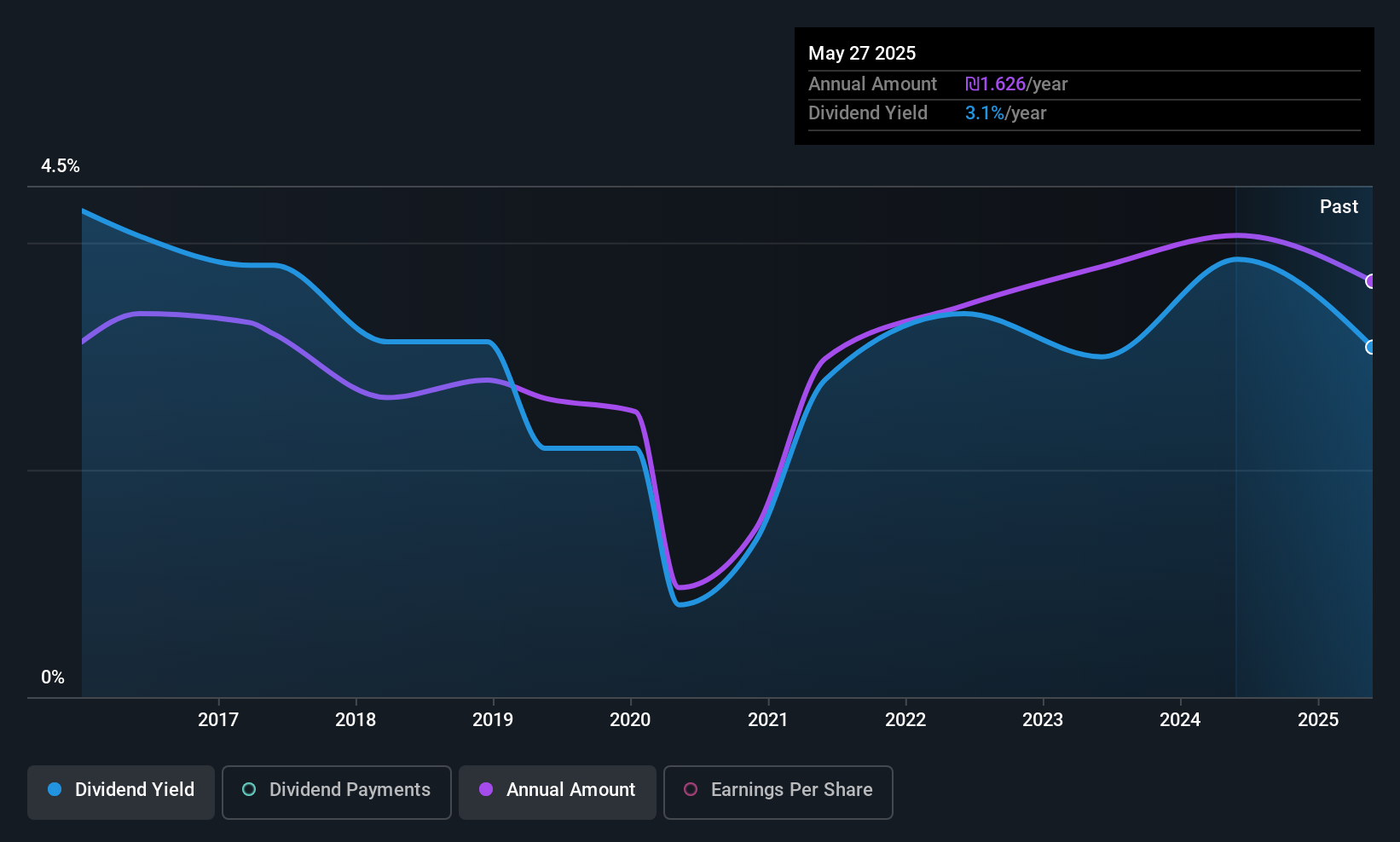

Arad (TASE:ARD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arad Ltd. designs, develops, manufactures, and sells water systems both in Israel and internationally with a market cap of ₪1.32 billion.

Operations: Arad Ltd.'s revenue primarily comes from its Electronic Test & Measurement Instruments segment, generating $399.46 million.

Dividend Yield: 3%

Arad Ltd.'s dividend payments, although covered by earnings and cash flows with payout ratios of 46.6% and 31.3% respectively, have been historically volatile over the past decade. The recent announcement of a US$0.465 cash dividend reflects a continued commitment to shareholder returns despite these fluctuations. While its dividend yield of 3.04% is lower than top-tier payers in the region, Arad's financial performance shows modest growth with Q1 sales at US$103.62 million and net income at US$7.2 million.

- Navigate through the intricacies of Arad with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Arad is priced lower than what may be justified by its financials.

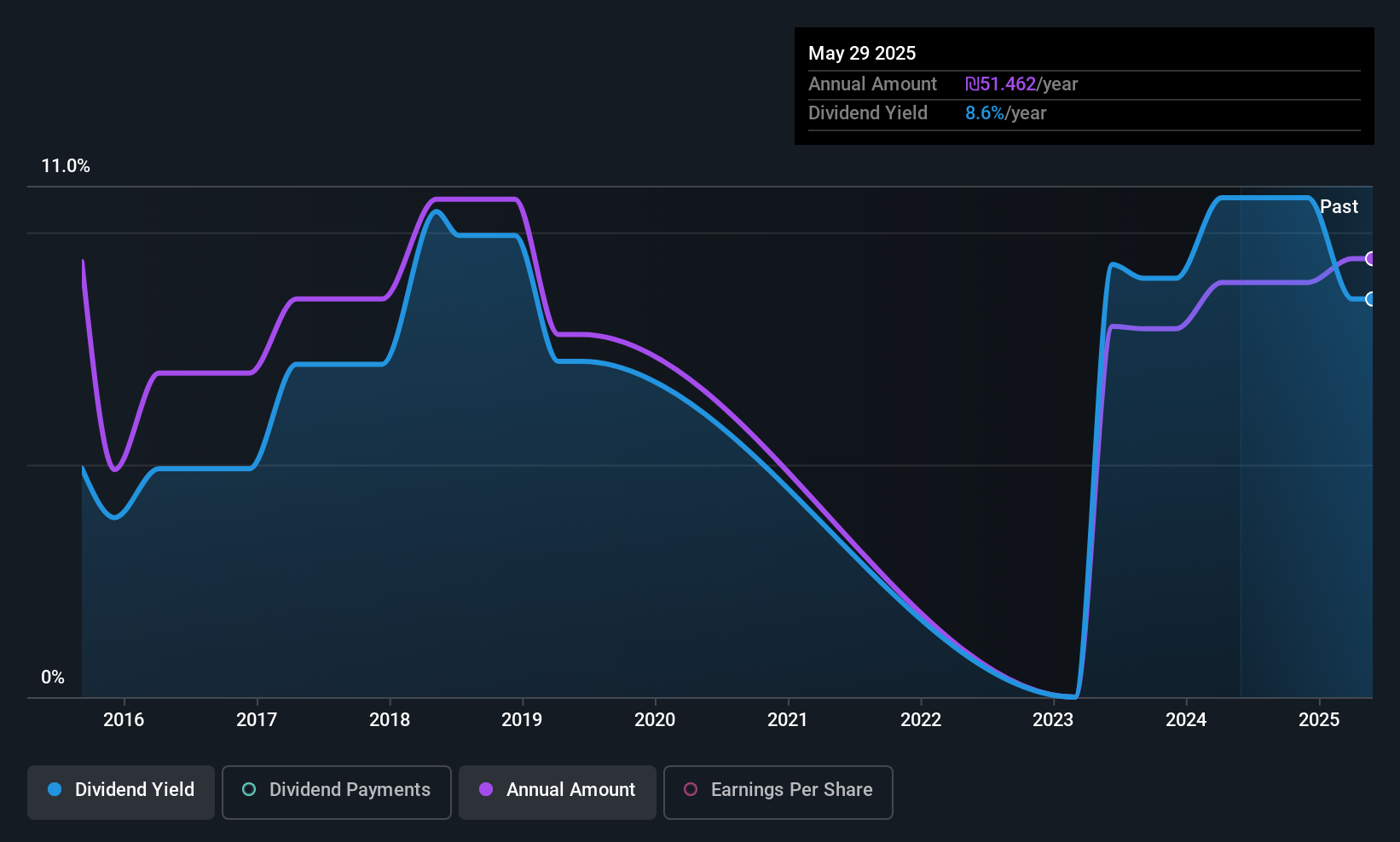

Delek Group (TASE:DLEKG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delek Group Ltd. is an energy company involved in the exploration, development, production, and marketing of oil and gas both in Israel and internationally, with a market cap of ₪12.07 billion.

Operations: Delek Group Ltd.'s revenue segments include the development and production of oil and gas assets in the North Sea, generating ₪8.12 billion, and oil and gas exploration and production in Israel and its surroundings, contributing ₪3.72 billion.

Dividend Yield: 7.8%

Delek Group's dividend yield of 7.8% places it in the top 25% of IL market payers, yet its high payout ratio of 91.6% indicates dividends are not well covered by earnings. Despite a history of volatility and unreliability in dividend payments, cash flows seem supportive with a low cash payout ratio of 31.8%. Recent financials show Q1 sales at ILS 3.85 billion, but net income fell sharply to ILS 10 million from ILS 269 million year-over-year.

- Delve into the full analysis dividend report here for a deeper understanding of Delek Group.

- Our expertly prepared valuation report Delek Group implies its share price may be lower than expected.

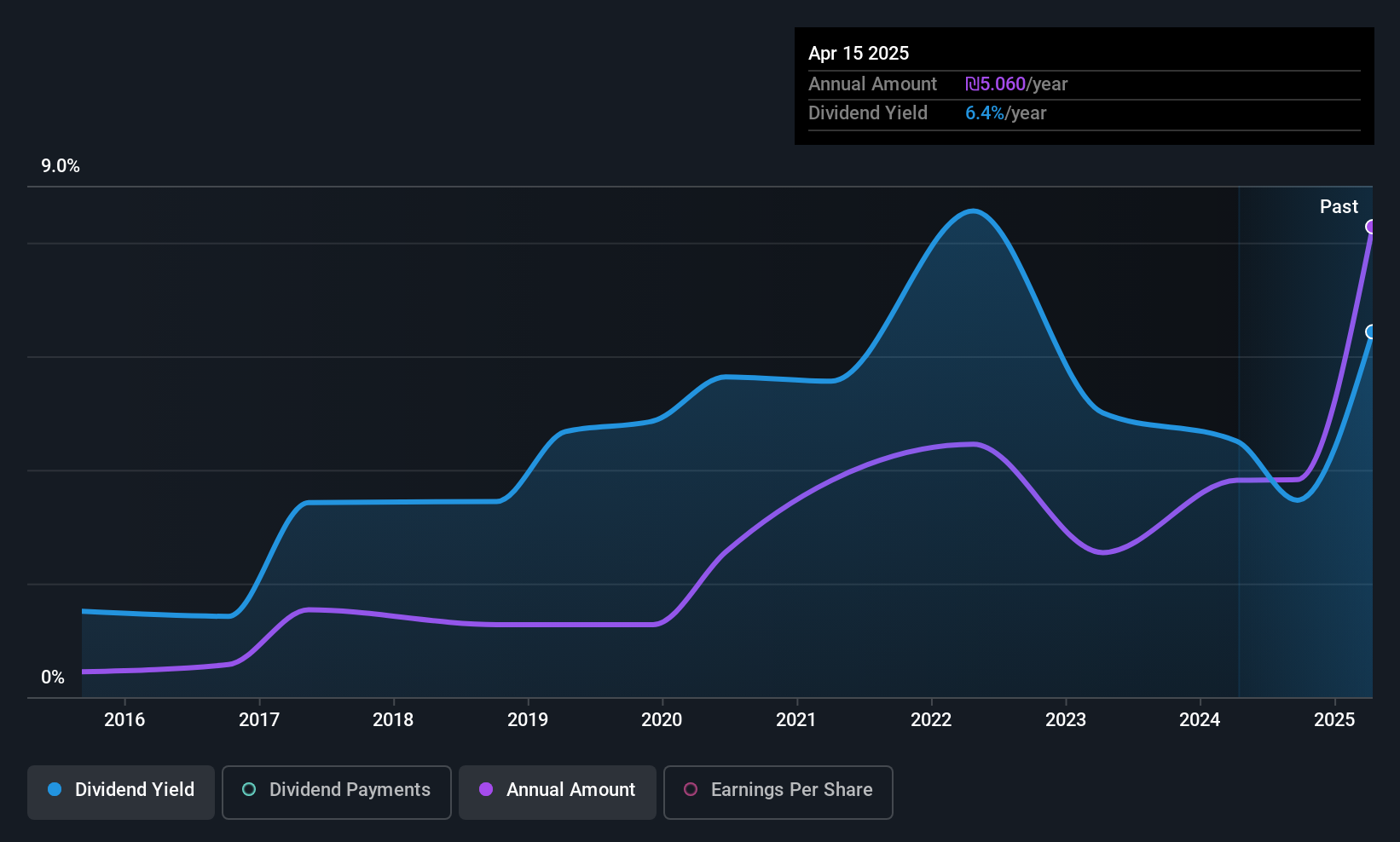

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Palram Industries (1990) Ltd, with a market cap of ₪2.04 billion, manufactures and sells thermoplastic sheets, panel systems, and finished products both in Israel and internationally.

Operations: Palram Industries' revenue is derived from several segments, including the Polycarbonate Sector at ₪966.35 million, the PVC Sector at ₪445.42 million, the Home Finished Products Sector at ₪254.45 million, and the Sales and Display Stands Sector at ₪222.65 million.

Dividend Yield: 6.4%

Palram Industries offers a dividend yield of 6.38%, ranking in the top 25% of IL market payers, with dividends covered by both earnings and cash flows due to payout ratios of 57.4% and 53.6%, respectively. However, its dividend history is marked by volatility and unreliability over the past decade. Recent Q1 results show sales at ILS 438.73 million, with net income slightly down to ILS 51.86 million from ILS 56.76 million year-over-year.

- Take a closer look at Palram Industries (1990)'s potential here in our dividend report.

- According our valuation report, there's an indication that Palram Industries (1990)'s share price might be on the cheaper side.

Next Steps

- Navigate through the entire inventory of 77 Top Middle Eastern Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DLEKG

Delek Group

An energy company, engages in the exploration, development, production, and marketing of oil and gas in Israel and internationally.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives