- Israel

- /

- Capital Markets

- /

- TASE:TASE

Tel-Aviv Stock Exchange (TASE:TASE) Enhances Derivatives Market With Bank Leumi Market-Making Program

Reviewed by Simply Wall St

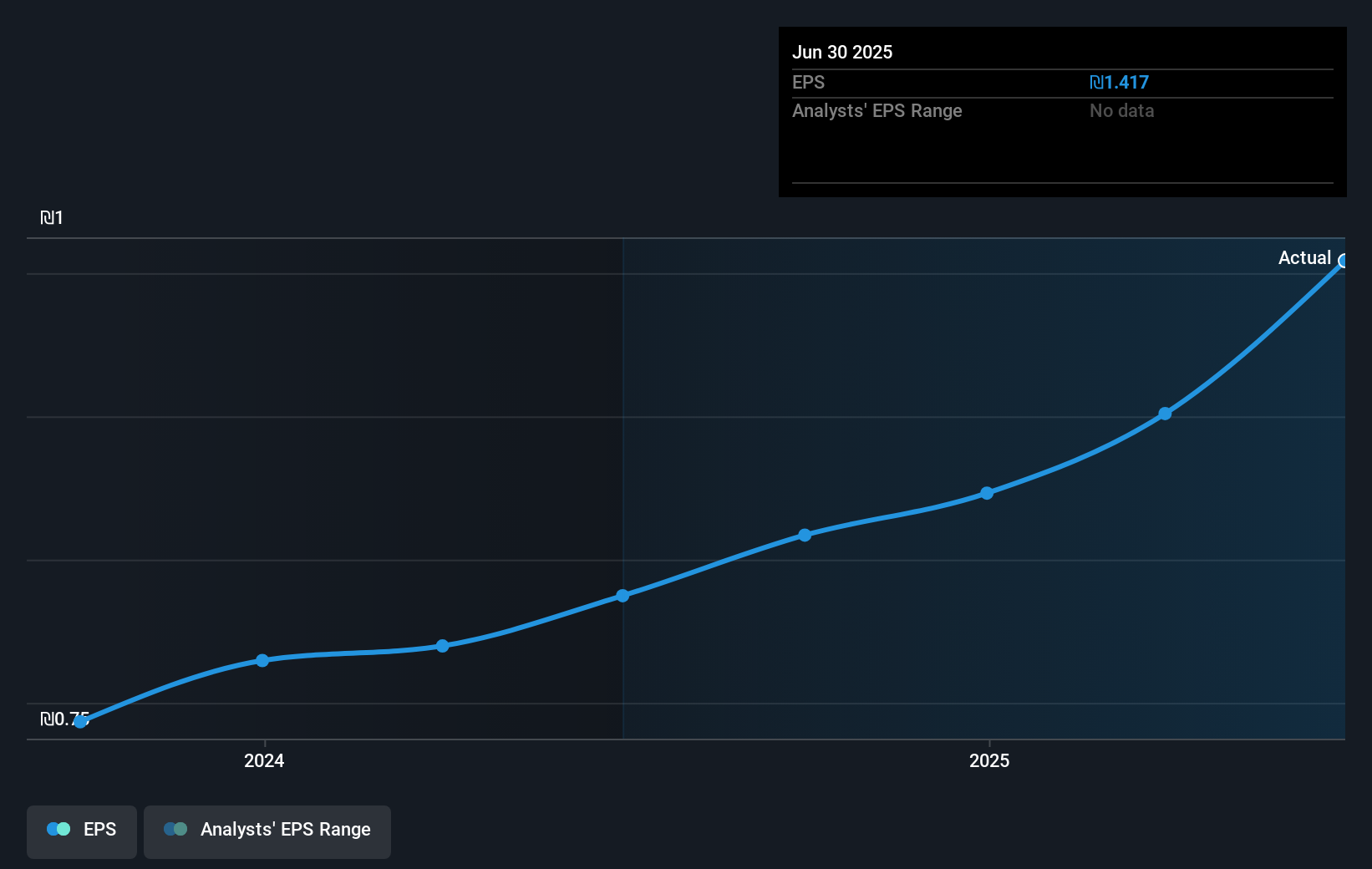

The Tel-Aviv Stock Exchange (TASE:TASE) announced Bank Leumi's participation in its tailor-made market-making program on September 15, aimed at developing Israel's derivatives market. Over the last quarter, TASE's stock price surged by 30%, a performance partly reinforced by strong Q2 earnings. Revenues grew to ILS 136 million from ILS 105 million year-over-year, with net income rising to ILS 44 million. This robust financial performance, alongside strategic client collaborations, complemented broader market trends such as rising tech stocks and expectations of Fed interest rate cuts, aligning TASE's price movements with the positive sentiment across global markets.

Over the past five years, the Tel-Aviv Stock Exchange (TASE) has delivered a very large total return of 517.62%, which illustrates significant appreciation in shareholder value. However, when considering performance over the past year, TASE's returns did not match the IL Capital Markets industry, which achieved much higher returns. This indicates that while TASE has seen strong long-term performance, recent returns have been more restrained compared to its peers.

The recent announcement regarding Bank Leumi's participation in TASE's market-making program could enhance derivatives market activity, possibly affecting future revenue streams positively. With solid earnings growth observed in both year-over-year comparisons and historical averages, these initiatives may drive further revenue and earnings improvements. Notably, although TASE's current share price of ₪77.85 is slightly above the consensus price target of ₪75.00, reflecting its perceived overvaluation, it aligns closely with analysts' expectations, suggesting that the market sentiment towards TASE remains cautiously optimistic in the near term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tel-Aviv Stock Exchange might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TASE

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success