- Israel

- /

- Capital Markets

- /

- TASE:MTAV

Meitav Investment House (TASE:MTAV): Is the Stock Still Undervalued After Surging Q3 2025 Earnings?

Reviewed by Simply Wall St

Meitav Investment House (TASE:MTAV) just posted its third quarter 2025 earnings, showing a sharp jump in both revenue and net income compared to last year. This has caught investors’ attention across the market.

See our latest analysis for Meitav Investment House.

This blockbuster earnings report follows a year of extraordinary momentum. Meitav’s share price has climbed to ₪114.9, with a 267% gain year-to-date and a notable 353% total shareholder return over twelve months. Investors are clearly responding to the company’s renewed growth story and shifting risk perceptions, with short-term price returns also reflecting fresh optimism.

If strong moves like this have you curious about what else might be taking off, now is the perfect time to broaden your investing search and discover fast growing stocks with high insider ownership

But after such a meteoric surge, is there still value left in Meitav Investment House or has the market already factored in the company’s future earnings growth? Is this a potential buying opportunity, or is everything already priced in?

Price-to-Earnings of 11.1x: Is it justified?

Meitav Investment House is currently trading at a price-to-earnings (P/E) ratio of 11.1x, lower than both the Israel market average (15.2x) and key industry peers (20.6x). This suggests that the stock is valued more cheaply relative to its earnings when compared to its competitors.

The price-to-earnings ratio measures how much investors are willing to pay for a company’s profit, relative to its earnings. For financial services firms, it is a commonly used barometer that helps indicate market sentiment about future growth, profitability, or risk.

With such a sizable gap below industry averages, the market might be underestimating Meitav’s earning power despite its dramatic growth. Investors could be pricing in concerns about sustainability or simply not yet rewarding the company for its turnaround. However, Meitav’s P/E ratio gives it room to be re-rated upward if current growth momentum persists and risks are kept in check.

Compared to both the Israeli market and the Asian Capital Markets industry, Meitav’s lower price-to-earnings multiple stands out. This could become a catalyst if investor confidence builds, especially if the company continues to outpace the sector in terms of earnings growth.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11.1x (UNDERVALUED)

However, investors should note potential risks from fluctuating market conditions or unexpected regulatory changes, as both could quickly shift the outlook for Meitav.

Find out about the key risks to this Meitav Investment House narrative.

Another View: Discounted Cash Flow Model Weighs In

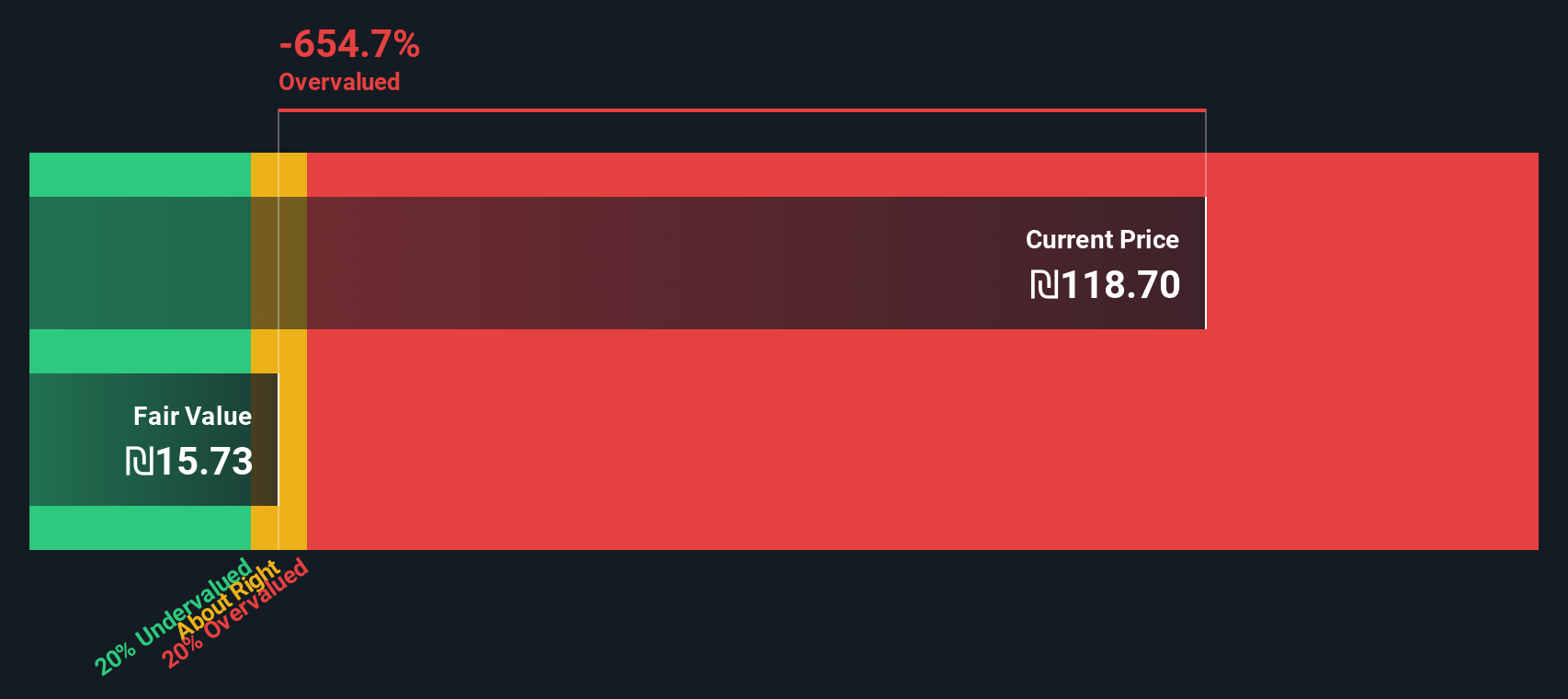

Our SWS DCF model offers a different perspective. It estimates Meitav’s fair value at ₪15.85 a share, which is far below the current market price. This suggests Meitav might be overvalued by a wide margin according to DCF assumptions and raises questions about how sustainable its recent market optimism truly is.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Meitav Investment House for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Meitav Investment House Narrative

If you see the story differently or want to dig deeper on your own terms, you can build a personalized view in just a few minutes. Do it your way

A great starting point for your Meitav Investment House research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing is about staying one step ahead. Don’t let new opportunities slip by. There are breakthrough stocks emerging every day that could supercharge your portfolio.

- Fuel your search for future tech leaders and tap into the potential of these 26 AI penny stocks changing the AI landscape across industries.

- Boost your portfolio’s passive income by scouting these 14 dividend stocks with yields > 3% offering reliable yields for steady cash flow through changing markets.

- Seize timely bargains with these 917 undervalued stocks based on cash flows, making sure you never miss out on stocks the market may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MTAV

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success