As most Gulf bourses remain muted due to lower oil prices and uncertainty surrounding U.S. Federal Reserve rate decisions, the Middle East market is navigating a complex landscape influenced by global economic shifts. Despite these challenges, opportunities exist for discerning investors who can identify stocks with strong fundamentals and resilience in the face of broader market pressures. In this article, we will explore three undiscovered gems in the region that may offer potential growth amid current conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 9.71% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.46% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.57% | -36.80% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Emlak Konut Gayrimenkul Yatirim Ortakligi (IBSE:EKGYO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emlak Konut Gayrimenkul Yatirim Ortakligi, established in 1953, focuses on urbanization and improving living standards through real estate development, with a market cap of TRY72.96 billion.

Operations: Emlak Konut Gayrimenkul Yatirim Ortakligi generates revenue primarily through real estate development projects. The company's net profit margin has shown variability, reflecting fluctuations in project costs and market conditions.

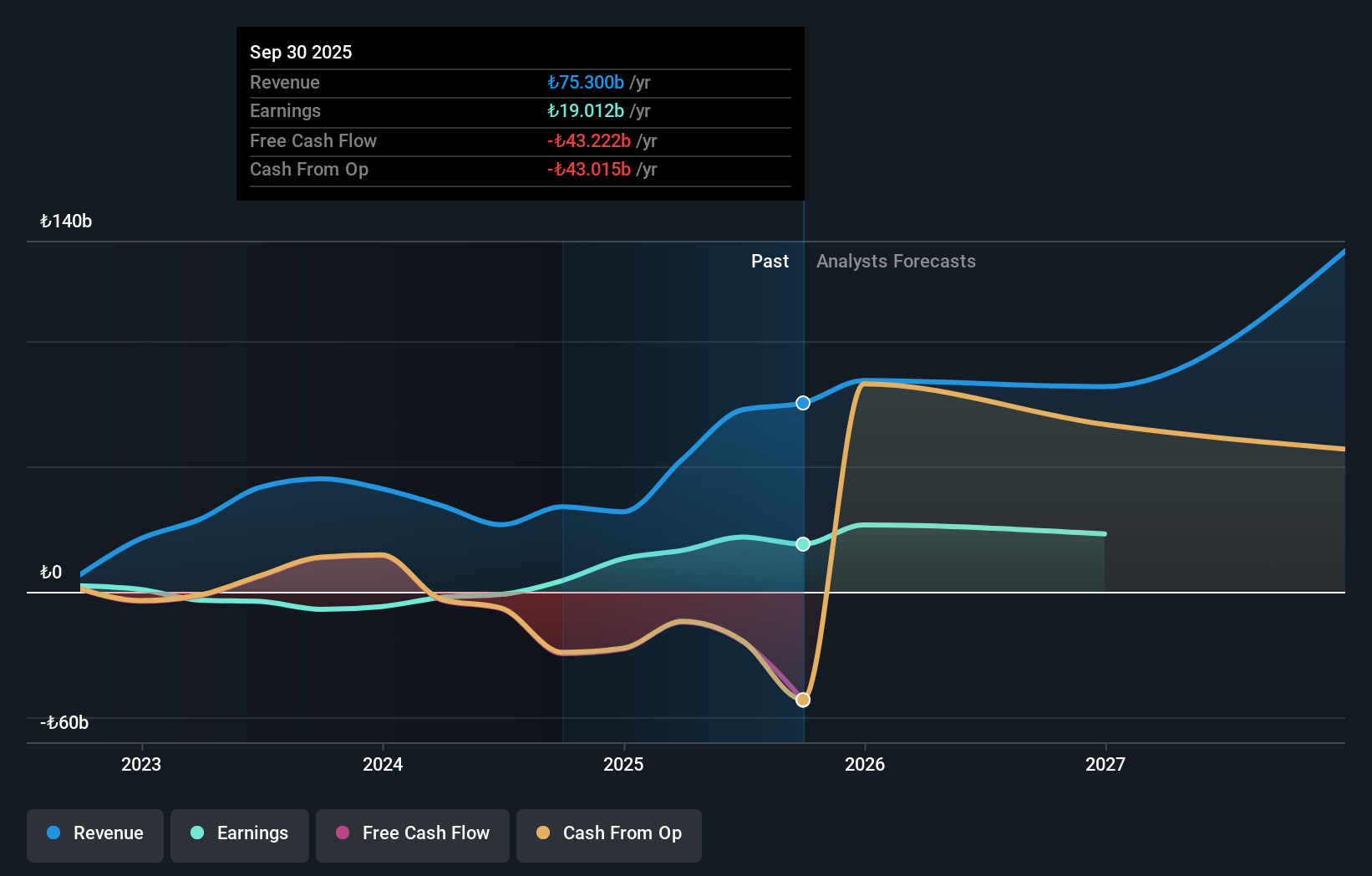

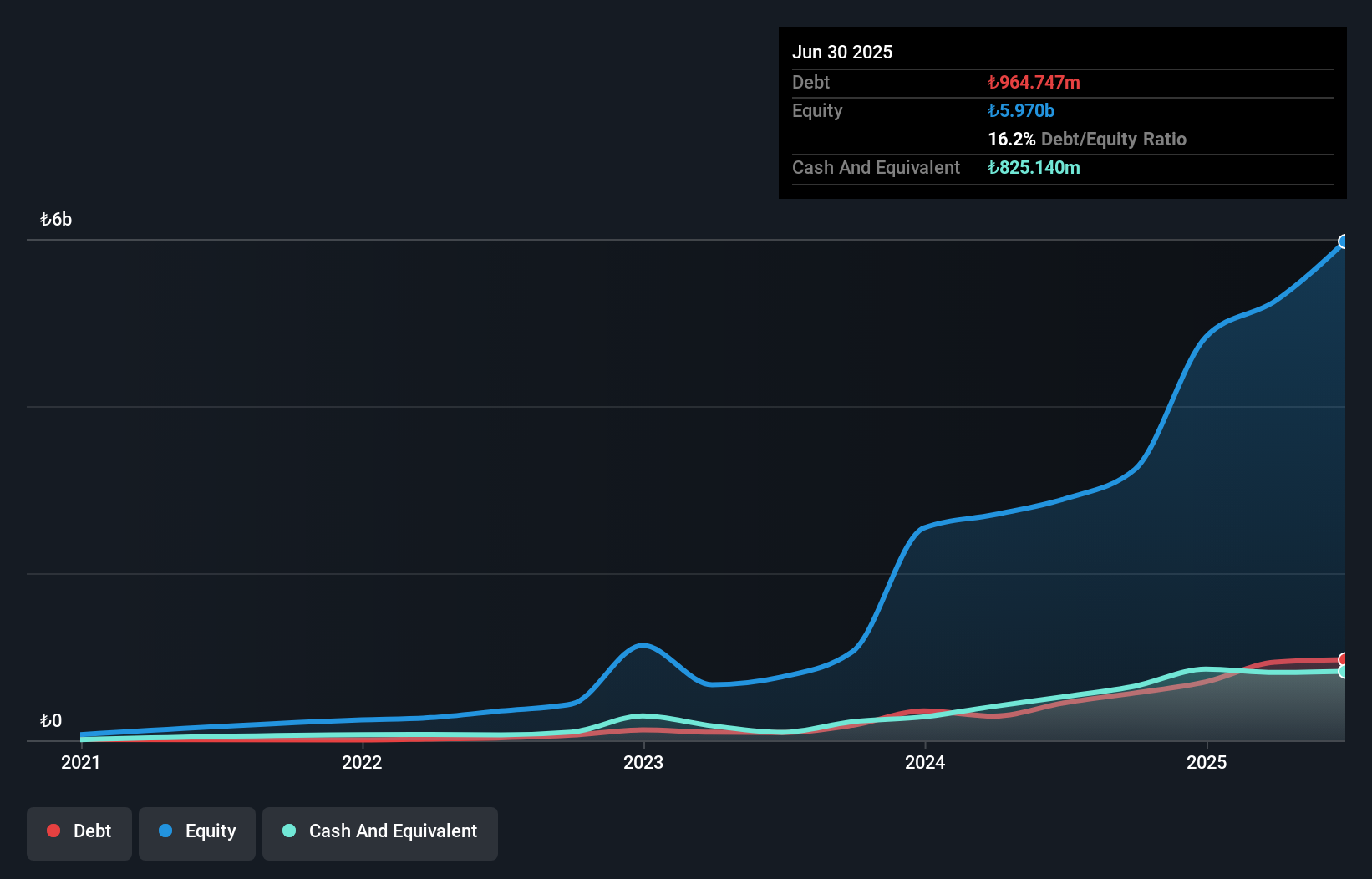

Emlak Konut, a notable player in the Middle Eastern real estate sector, has demonstrated remarkable financial performance. Over the past year, earnings surged by 324%, significantly outpacing the industry average of 14.8%. The company's debt to equity ratio improved from 37.5% to 30.3% over five years, reflecting prudent financial management with a satisfactory net debt to equity ratio of 21%. Despite not being free cash flow positive, Emlak Konut trades at a compelling value—40% below its estimated fair value—suggesting potential upside for investors seeking undervalued opportunities in emerging markets.

- Delve into the full analysis health report here for a deeper understanding of Emlak Konut Gayrimenkul Yatirim Ortakligi.

Learn about Emlak Konut Gayrimenkul Yatirim Ortakligi's historical performance.

MIA Teknoloji Anonim Sirketi (IBSE:MIATK)

Simply Wall St Value Rating: ★★★★★☆

Overview: MIA Teknoloji Anonim Sirketi offers software development services to both public and private sectors in Turkey, with a market capitalization of TRY19.99 billion.

Operations: The company's primary revenue stream is derived from its software and programming services, generating TRY1.89 billion.

MIA Teknoloji, a small player in the tech scene, has shown robust earnings growth of 61.2% annually over five years, though recent annual growth of 21.8% trails the broader software industry. The company reported a significant turnaround with Q2 net income at TRY 404.57 million from a previous loss of TRY 39.18 million, despite sales dipping to TRY 1,105.98 million for six months compared to last year’s TRY 1,796.39 million. Their price-to-earnings ratio stands attractively at 11x against the TR market's average of nearly double that figure (18x), suggesting potential value for investors seeking opportunities in emerging markets.

Y.D. More Investments (TASE:MRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Y.D. More Investments Ltd is a privately owned investment manager with a market capitalization of ₪3.58 billion, focusing on various financial services including mutual fund and portfolio management.

Operations: Y.D. More Investments generates revenue primarily from managing provident and pension funds (₪571.38 million) and mutual fund management (₪275.57 million). The company also earns from investment portfolio management, contributing ₪36.73 million to its revenue streams.

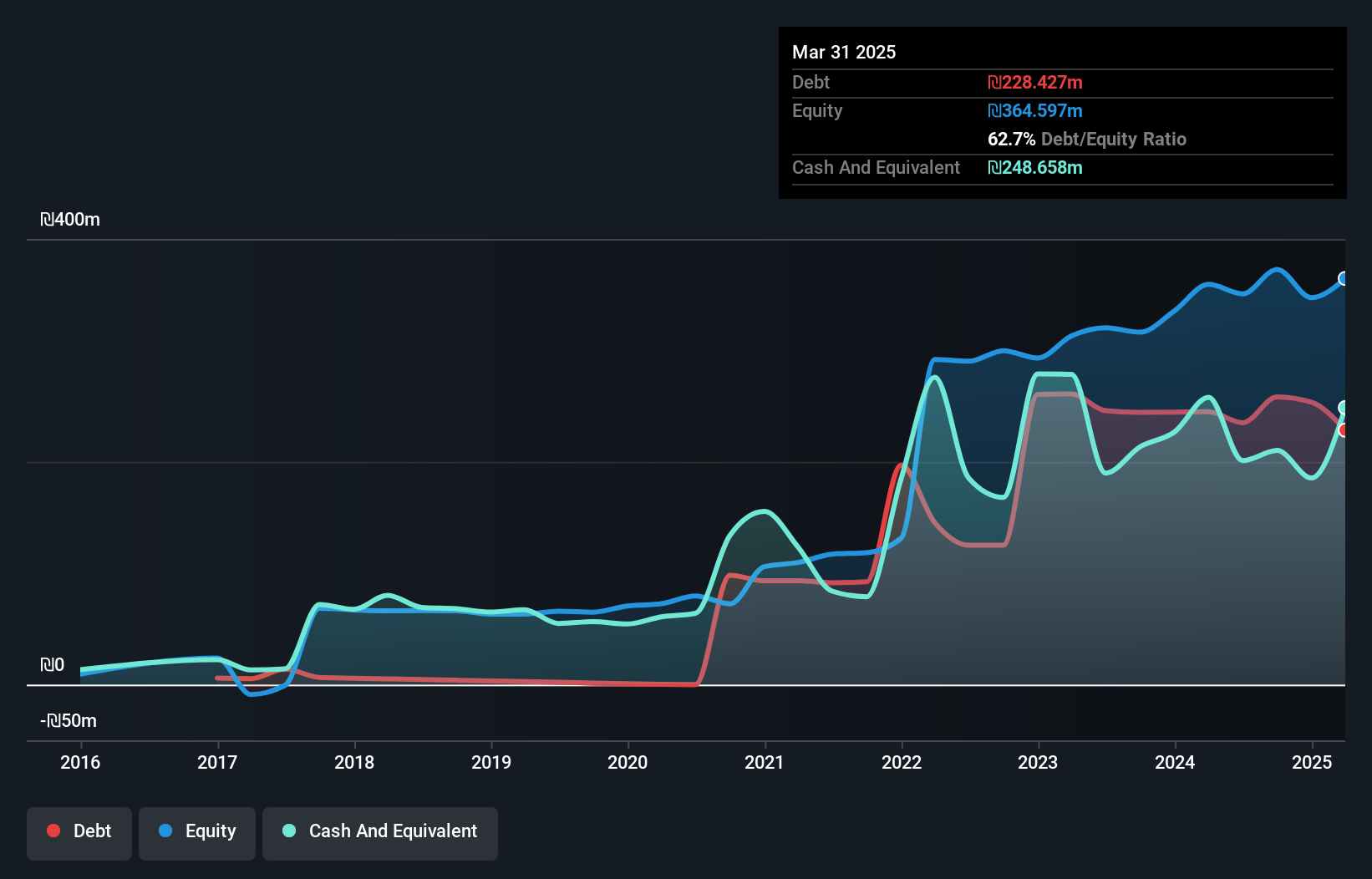

Y.D. More Investments, a notable player in the Middle East financial landscape, has shown impressive growth. Their earnings surged by 75% over the past year, outpacing the Capital Markets industry average of 42.3%. The company's net income for Q2 reached ILS 37.97 million, up from ILS 15.09 million a year ago, with revenue climbing to ILS 250.97 million from ILS 176.15 million in the same period last year. Recently added to both TA-125 and S&P Global BMI indices, Y.D.'s robust performance is further highlighted by its share repurchase program worth NIS 20 million, financed internally till September next year.

- Dive into the specifics of Y.D. More Investments here with our thorough health report.

Evaluate Y.D. More Investments' historical performance by accessing our past performance report.

Where To Now?

- Dive into all 199 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:MIATK

MIA Teknoloji Anonim Sirketi

Provides software development services to public and private organizations in Turkey.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives