- Israel

- /

- Food and Staples Retail

- /

- TASE:TTAM

Undiscovered Gems in the Middle East to Explore This June 2025

Reviewed by Simply Wall St

The Middle East markets have recently experienced a rebound, driven by improved investor sentiment despite ongoing geopolitical tensions between Israel and Iran. As regional indices recover from previous losses, the current environment presents an opportune moment to explore stocks that demonstrate resilience and growth potential in these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

I.E.S Holdings (TASE:IES)

Simply Wall St Value Rating: ★★★★★★

Overview: I.E.S Holdings Ltd focuses on real estate investment activities in Israel with a market capitalization of ₪1.30 billion.

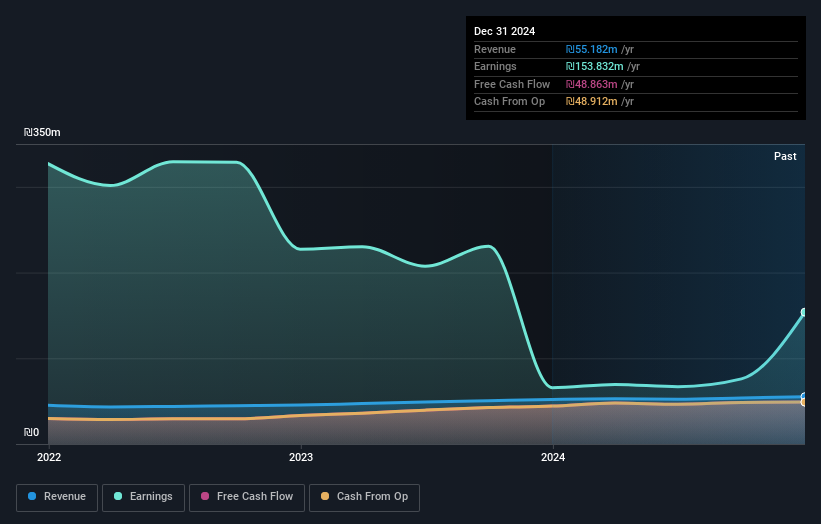

Operations: The company generates revenue primarily from investment real estate, amounting to ₪57.17 million.

I.E.S Holdings, a small player in the real estate sector, has seen its earnings soar by 119.5% over the past year, outpacing industry growth of 32.4%. Despite a one-off gain of ₪140.7M impacting recent results, its price-to-earnings ratio remains attractive at 8.5x compared to the IL market's 13.8x. The company’s debt-to-equity ratio improved from 0.4% to 0.1% over five years, indicating prudent financial management and more cash than total debt suggests solid fiscal health. Recent earnings showed sales rising to ILS15.18 million from ILS13.2 million last year, though net income dipped slightly to ILS15.04 million from ILS16.28 million.

- Get an in-depth perspective on I.E.S Holdings' performance by reading our health report here.

Gain insights into I.E.S Holdings' past trends and performance with our Past report.

Rami Levi Chain Stores Hashikma Marketing 2006 (TASE:RMLI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd operates a chain of discount retail stores in Israel and has a market capitalization of ₪4.26 billion.

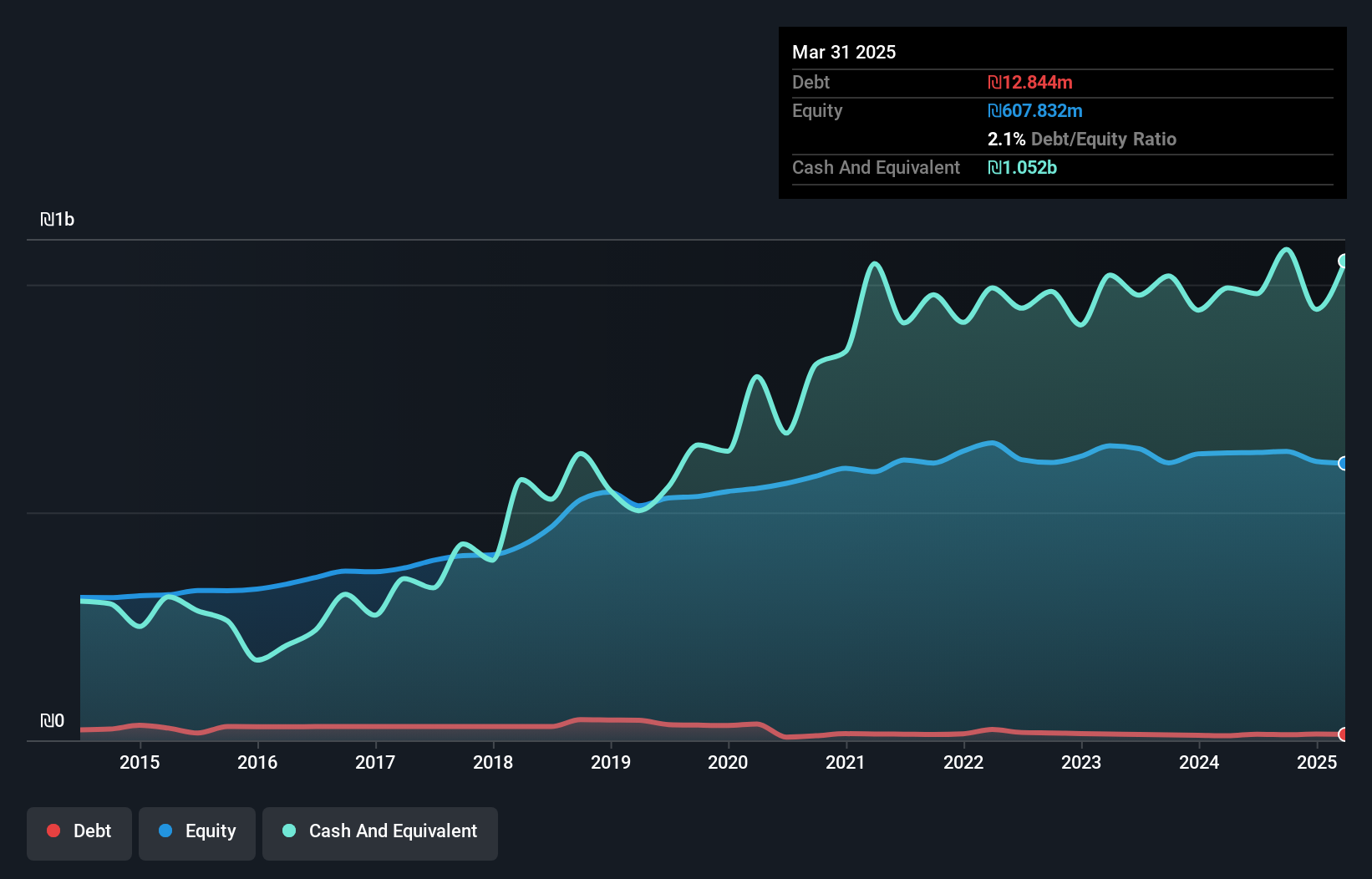

Operations: The primary revenue stream for Rami Levi Chain Stores comes from its retail chains, contributing ₪6.64 billion. The Good Pharm Wholesale segment adds another ₪455.07 million to the company's revenue.

Rami Levi, a prominent player in Israel's retail sector, has seen its debt to equity ratio improve significantly from 6.5% to 2.1% over five years, showcasing effective financial management. Despite recent earnings growth challenges at -0.6%, the company continues to trade at an attractive valuation, approximately 60% below fair value estimates. Its high-quality past earnings and robust free cash flow position it well financially, with interest payments comfortably covered by EBIT (6.9x). Recent quarterly results highlighted sales of ILS 1,846M and net income of ILS 50.96M; however, EPS dipped slightly from ILS 4.23 to ILS 3.7 year-over-year.

Tiv Taam Holdings 1 (TASE:TTAM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tiv Taam Holdings 1 Ltd. is involved in the production, marketing, and importation of food products in Israel, with a market cap of ₪883.81 million.

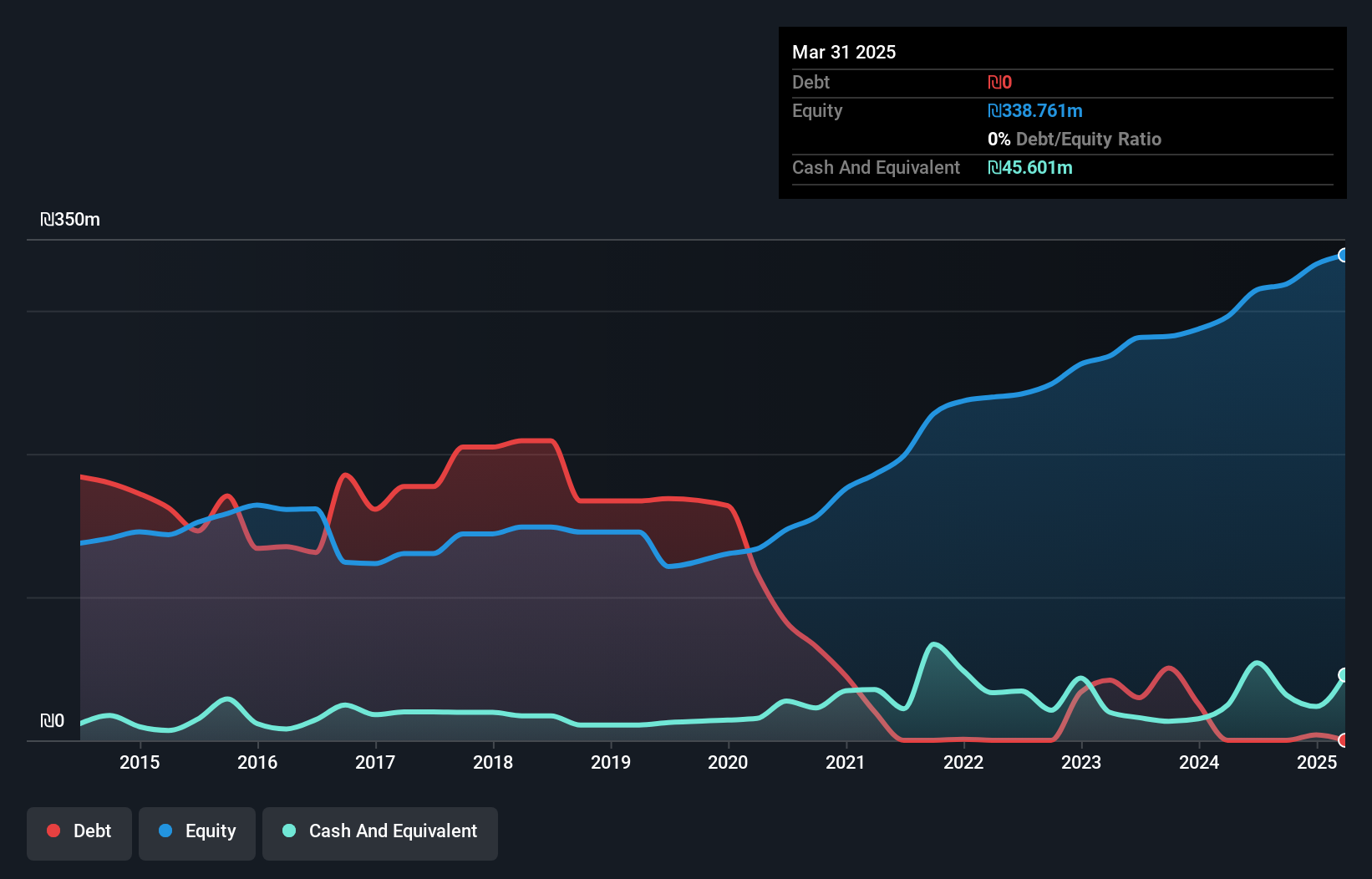

Operations: Tiv Taam generates revenue primarily through its retail segment, contributing ₪1.59 billion, and the manufacture, import, and marketing of food products, which adds ₪390.17 million.

Tiv Taam Holdings 1, a nimble player in the Middle East market, showcases robust financial health with no debt compared to five years ago when its debt to equity ratio was 87.3%. Despite a modest annual earnings decline of 0.9% over the past five years, recent performance tells a different story. Earnings surged by 55.1% last year, surpassing industry growth of 44.7%. The company's latest quarterly results reported sales of ILS 426 million and net income of ILS 11 million, up from ILS 10.41 million previously. With high-quality earnings and profitability intact, Tiv Taam remains an intriguing prospect for investors seeking growth potential in this region.

Turning Ideas Into Actions

- Navigate through the entire inventory of 219 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tiv Taam Holdings 1 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TTAM

Tiv Taam Holdings 1

Produces, markets, and imports of food products in Israel.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives