Middle Eastern Market Insights: Dubai Investments PJSC And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced a dip, with Gulf markets trending lower amid investor caution surrounding global economic indicators such as Nvidia earnings and U.S. jobs data. In this context, penny stocks, though an older term, continue to represent intriguing opportunities for investors seeking growth at accessible price points. By focusing on companies with strong financial health and potential for expansion, these stocks can offer both stability and upside potential in the evolving market landscape.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.35 | SAR1.34B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.959 | ₪283.84M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.00 | AED2.04B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED377.69M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.25 | AED13.95B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.795 | AED2.26B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.836 | AED501.81M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.70 | ₪211.95M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both within the United Arab Emirates and internationally, with a market cap of AED13.95 billion.

Operations: The company does not report specific revenue segments.

Market Cap: AED13.95B

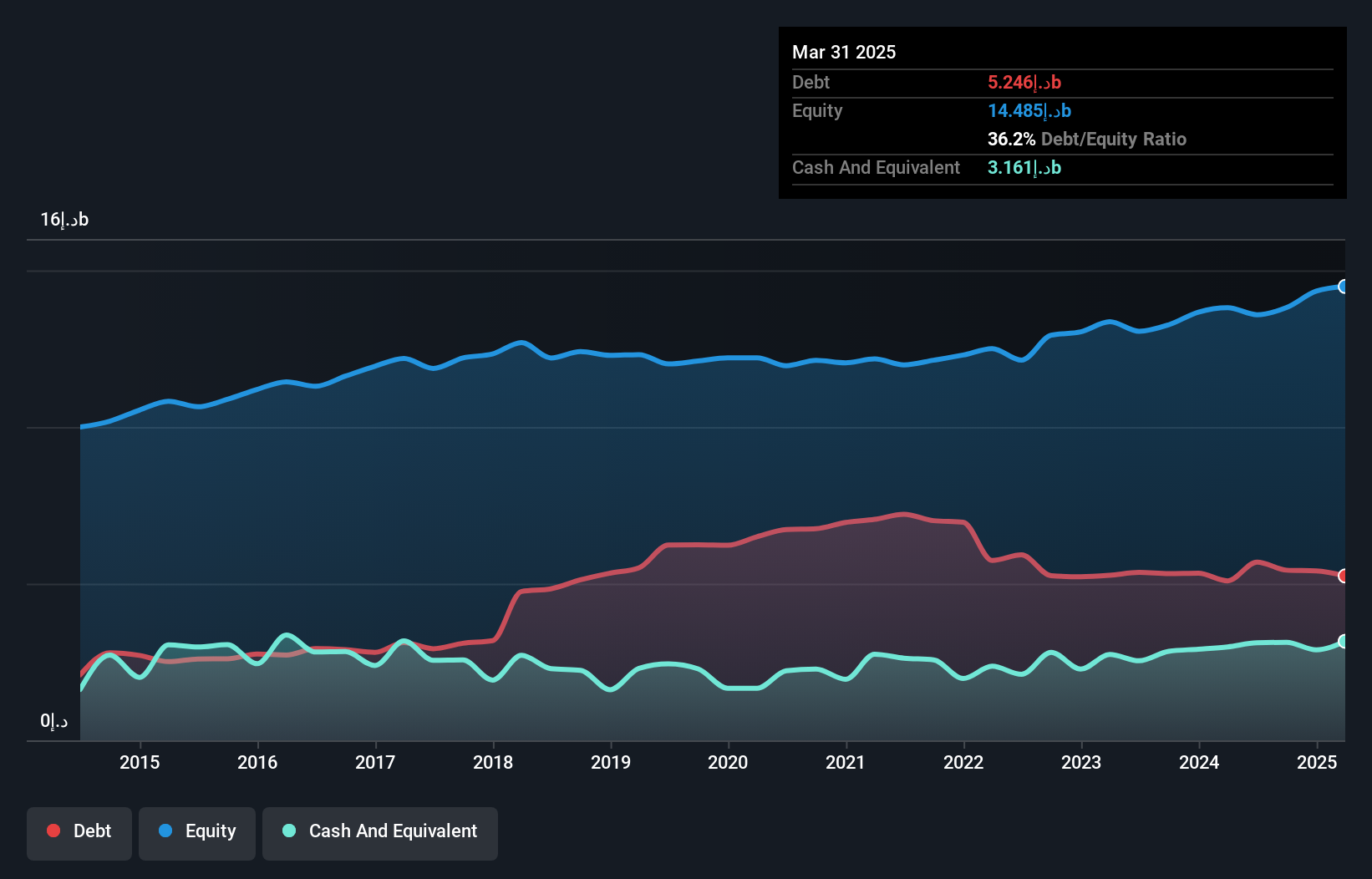

Dubai Investments PJSC has shown robust earnings growth, with a 62.6% increase over the past year, surpassing its five-year average of 18.3% per annum. Recent financial results highlight a net income rise to AED 510.76 million for Q3 2025, up from AED 241.31 million the previous year, reflecting strong operational performance despite low Return on Equity at 10.6%. The company’s debt levels have improved over time, but cash flow coverage remains weak at only 13.5%. While trading at a favorable price-to-earnings ratio of 8.9x compared to the AE market's average of 11.6x, dividend sustainability is questionable due to limited free cash flow coverage.

- Click here and access our complete financial health analysis report to understand the dynamics of Dubai Investments PJSC.

- Learn about Dubai Investments PJSC's future growth trajectory here.

Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi (IBSE:ARSAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi, along with its subsidiaries, produces and sells cotton and synthetic yarn both in Turkey and internationally, with a market cap of TRY5.25 billion.

Operations: Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi has not reported any specific revenue segments.

Market Cap: TRY5.25B

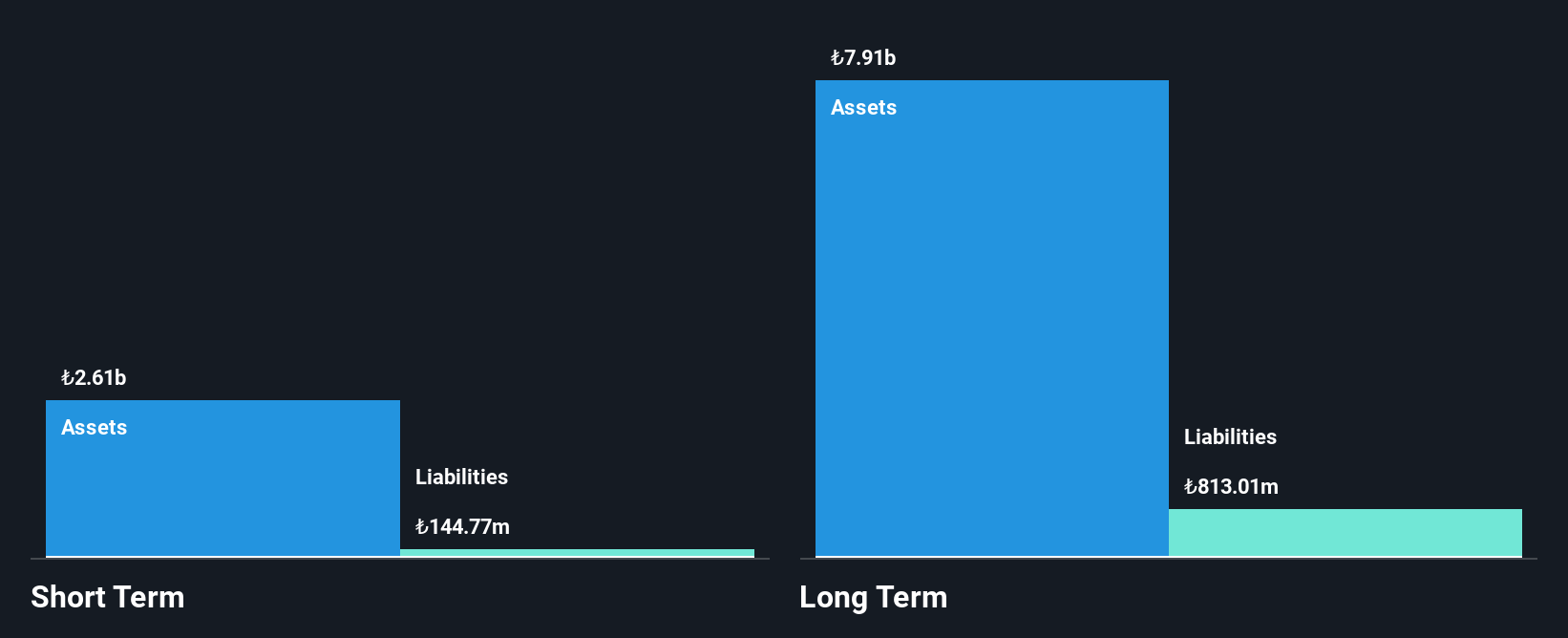

Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi, despite being unprofitable, shows stability in its financial structure. The company reported a significant net loss for the third quarter of 2025, with sales slightly declining to TRY 39.15 million. However, its short-term assets of TRY 2.4 billion comfortably cover both short and long-term liabilities, indicating solid liquidity management. Arsan's debt is well-covered by operating cash flow and has decreased substantially over five years from a debt-to-equity ratio of 23.4% to 0.3%. Trading at nearly half its estimated fair value suggests potential undervaluation in the market.

- Take a closer look at Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi's potential here in our financial health report.

- Explore historical data to track Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi's performance over time in our past results report.

Sonovia (TASE:SONO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sonovia Ltd. is an Israeli company focused on developing and producing anti-bacterial textile products, with a market cap of ₪9.75 million.

Operations: No revenue segments have been reported for Sonovia Ltd.

Market Cap: ₪9.75M

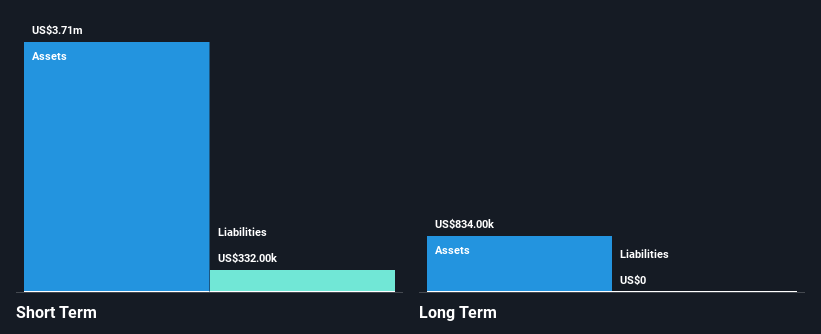

Sonovia Ltd., an Israeli company, is pre-revenue with a market cap of ₪9.75 million and no significant revenue streams reported. Despite being unprofitable, the company maintains a strong financial position with short-term assets of $2.7 million exceeding its short-term liabilities of $237,000 and having no long-term liabilities or debt. The company's experienced board and management team complement its sufficient cash runway for over a year based on current free cash flow levels. However, Sonovia's share price remains highly volatile, reflecting inherent risks associated with penny stocks in this region. Recent earnings show reduced losses compared to the previous year.

- Navigate through the intricacies of Sonovia with our comprehensive balance sheet health report here.

- Gain insights into Sonovia's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Gain an insight into the universe of 80 Middle Eastern Penny Stocks by clicking here.

- Curious About Other Options? These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ARSAN

Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi

Engages in the production and sale of cotton and synthetic yarn in Turkey and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives