- Israel

- /

- Consumer Durables

- /

- TASE:MTRN

Maytronics (TASE:MTRN) Net Loss Widens, Challenging High Dividend Sustainability Narrative

Reviewed by Simply Wall St

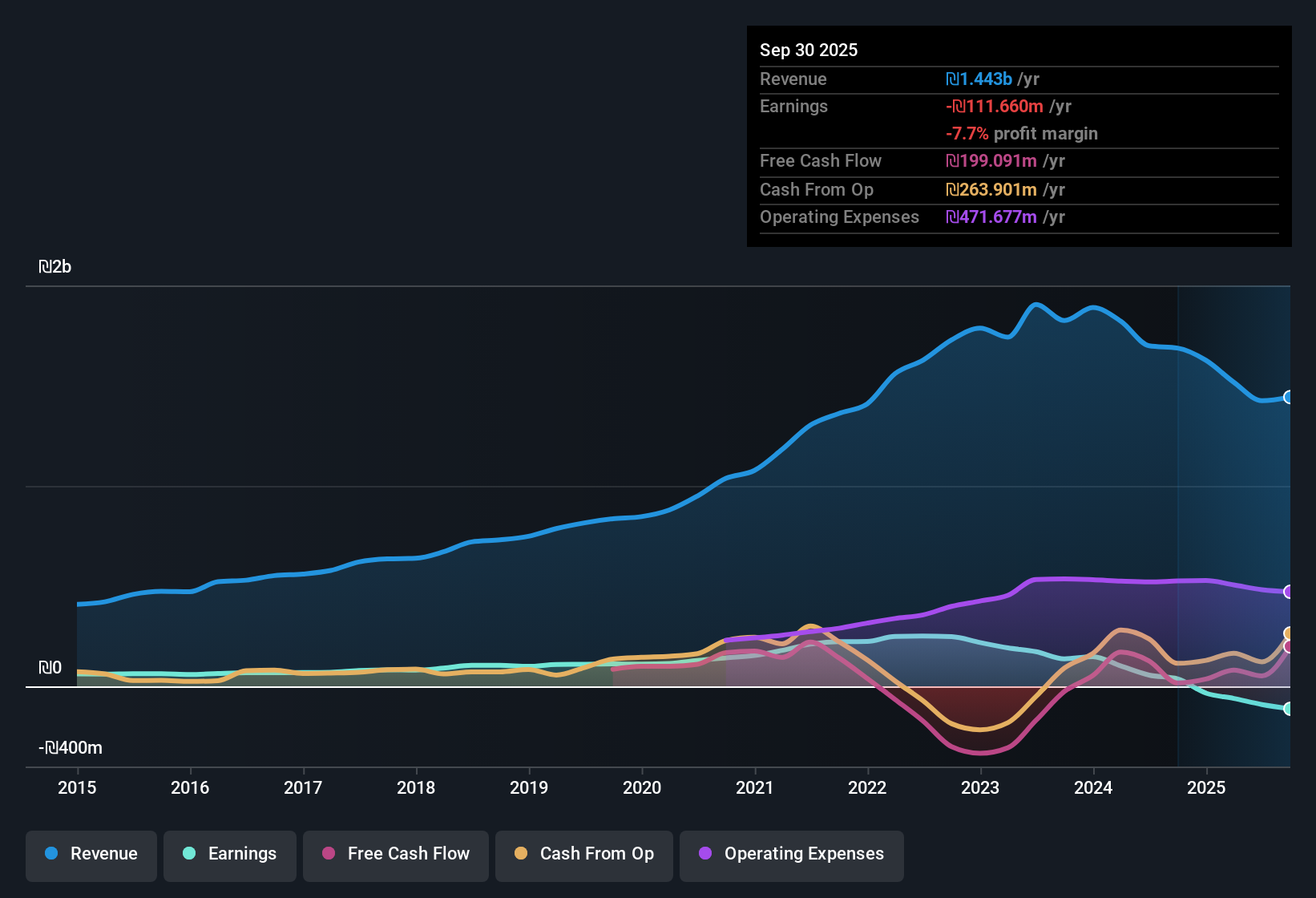

Maytronics (TASE:MTRN) just posted its Q3 2025 results, reporting revenue of 339.1 million ILS and a basic EPS of -0.37 ILS, alongside a net loss of 40.3 million ILS. Looking at recent quarters, the company’s revenue has fluctuated between 242.6 million ILS and 607.2 million ILS, and EPS has swung from a high of 0.38 ILS to deeper losses in other periods. Margins took a hit yet again this quarter, adding to the pressure on profitability and leaving investors watching for any sign of a turnaround.

See our full analysis for Maytronics.Now, let’s dig into how these fresh numbers measure up against the main narratives driving market sentiment, and see where expectations might need a reset.

Curious how numbers become stories that shape markets? Explore Community Narratives

Dividend Coverage at Risk Despite 9.11% Yield

- Maytronics’ dividend yield stands at 9.11%, but financial data shows that these payouts are not covered by earnings. The company reported a net loss of 111.66 million ILS over the last twelve months.

- What stands out in the prevailing market view is that such a high yield is typically seen as attractive. However,

- the trend of rising losses, highlighted by the sequential decline in Basic EPS from 0.11 ILS in Q2 to -0.37 ILS in Q3 2025, significantly undermines dividend sustainability,

- and insufficient operating cash flow coverage of debt raises the risk that future payouts may face reductions or suspension.

Net Losses Deepen and Unprofitability Spreads

- Trailing twelve-month net income has slipped to -111.66 million ILS, with the net loss worsening by more than 70 million ILS since Q2 2025, when it stood at -90.78 million ILS.

- Digging into the prevailing analysis reveals that:

- earnings are in a persistent decline, falling at a rate of 29.8% per year over five years, which heavily challenges any notion of rapid turnaround,

- and, with no improvement in net margins shown over recent quarters, market observers point to deepening unprofitability as the central risk for potential investors.

Valuation Looks Cheap on Sales, Not on Profits

- The company’s price-to-sales ratio of 0.3x is well below both the Asian Consumer Durables industry average (1.2x) and its peer average (2.1x). However, the share price of 4.51 ILS still trades well above the DCF fair value of 97.03 ILS, indicating conflicting signals depending on the lens used.

- Despite appearing undervalued from a revenue perspective,

- the ongoing earnings losses directly challenge the view that a low price-to-sales ratio alone makes Maytronics a bargain,

- and the market view cautions that without a clear path to profits or margin recovery, investors could be tempted by the relative value while missing real risks flagged by persistent unprofitability and weak dividend coverage.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Maytronics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With Maytronics facing ongoing net losses, shrinking earnings, and dividend coverage risks, investors are left searching for more stable, cash-generating opportunities. If dependable income and safer payouts matter to you, check out these 1942 dividend stocks with yields > 3% for alternatives offering stronger dividends backed by solid financials and sustainability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MTRN

Maytronics

Engages in the development, production, marketing, distribution, and technical support of swimming pool equipment in Israel, North America, Europe, Oceania, and internationally.

Average dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026