- Israel

- /

- Consumer Durables

- /

- TASE:ECP

Electra Consumer Products (1970) Ltd (TLV:ECP) Is About To Go Ex-Dividend, And It Pays A 2.1% Yield

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Electra Consumer Products (1970) Ltd (TLV:ECP) is about to go ex-dividend in just two days. If you purchase the stock on or after the 7th of March, you won't be eligible to receive this dividend, when it is paid on the 4th of April.

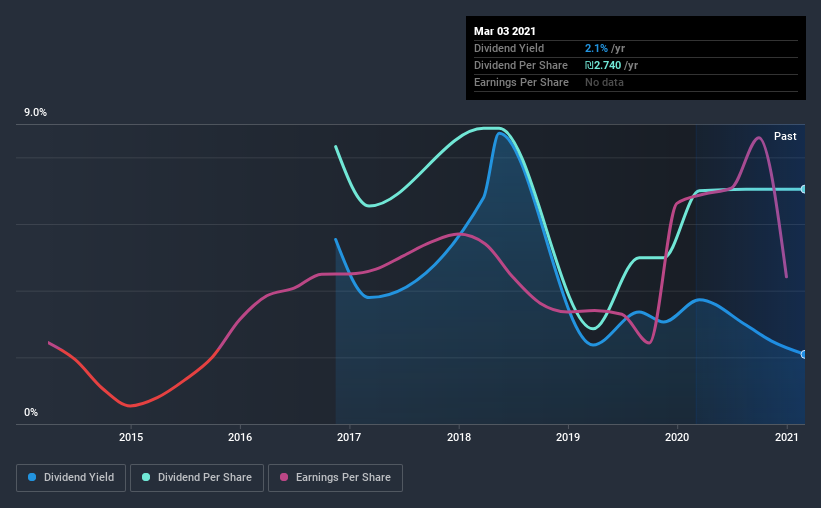

Electra Consumer Products (1970)'s next dividend payment will be ₪1.82 per share, and in the last 12 months, the company paid a total of ₪2.74 per share. Based on the last year's worth of payments, Electra Consumer Products (1970) stock has a trailing yield of around 2.1% on the current share price of ₪131.1. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether Electra Consumer Products (1970) has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for Electra Consumer Products (1970)

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Electra Consumer Products (1970) is paying out an acceptable 71% of its profit, a common payout level among most companies. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Electra Consumer Products (1970) paid out more free cash flow than it generated - 149%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

Electra Consumer Products (1970) does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

While Electra Consumer Products (1970)'s dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were Electra Consumer Products (1970) to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. For this reason, we're glad to see Electra Consumer Products (1970)'s earnings per share have risen 20% per annum over the last five years. Earnings have been growing at a decent rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Electra Consumer Products (1970)'s dividend payments per share have declined at 4.1% per year on average over the past four years, which is uninspiring. Electra Consumer Products (1970) is a rare case where dividends have been decreasing at the same time as earnings per share have been improving. It's unusual to see, and could point to unstable conditions in the core business, or more rarely an intensified focus on reinvesting profits.

The Bottom Line

Should investors buy Electra Consumer Products (1970) for the upcoming dividend? It's good to see that earnings per share are growing and that the company's payout ratio is within a normal range for most businesses. However we're somewhat concerned that it paid out 149% of its cashflow, which is uncomfortably high. All things considered, we are not particularly enthused about Electra Consumer Products (1970) from a dividend perspective.

So if you want to do more digging on Electra Consumer Products (1970), you'll find it worthwhile knowing the risks that this stock faces. To help with this, we've discovered 3 warning signs for Electra Consumer Products (1970) that you should be aware of before investing in their shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Electra Consumer Products (1970), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Electra Consumer Products (1970) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:ECP

Electra Consumer Products (1970)

Manufactures, imports, exports, distributes, sells, and services for various consumer electrical products in Israel.

Acceptable track record with low risk.

Market Insights

Community Narratives