- Israel

- /

- Consumer Durables

- /

- TASE:AZRM

Shareholders Are Thrilled That The Azorim-Investment Development & Construction (TLV:AZRM) Share Price Increased 250%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For instance, the price of Azorim-Investment, Development & Construction Co. Ltd (TLV:AZRM) stock is up an impressive 250% over the last five years. Also pleasing for shareholders was the 28% gain in the last three months. But this could be related to the strong market, which is up 12% in the last three months.

See our latest analysis for Azorim-Investment Development & Construction

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

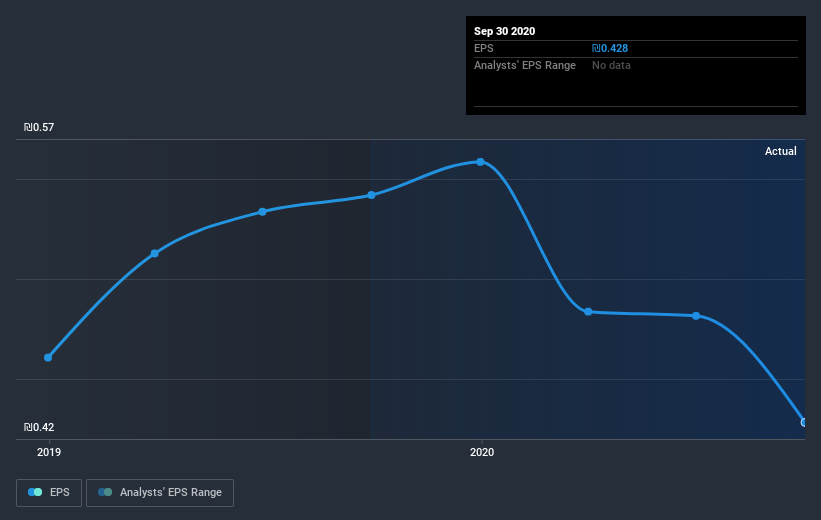

During five years of share price growth, Azorim-Investment Development & Construction achieved compound earnings per share (EPS) growth of 10% per year. This EPS growth is lower than the 28% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

It's good to see that Azorim-Investment Development & Construction has rewarded shareholders with a total shareholder return of 4.2% in the last twelve months. However, the TSR over five years, coming in at 28% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. It's always interesting to track share price performance over the longer term. But to understand Azorim-Investment Development & Construction better, we need to consider many other factors. Even so, be aware that Azorim-Investment Development & Construction is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

But note: Azorim-Investment Development & Construction may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you decide to trade Azorim-Investment Development & Construction, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:AZRM

Azorim-Investment Development & Construction

Azorim-Investment, Development & Construction Co.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives