Stock Analysis

- Israel

- /

- Consumer Durables

- /

- TASE:AZRM

Azorim-Investment Development & Construction's (TLV:AZRM) five-year earnings growth trails the 24% YoY shareholder returns

Azorim-Investment, Development & Construction Co. Ltd (TLV:AZRM) shareholders might be concerned after seeing the share price drop 20% in the last quarter. But that doesn't change the fact that shareholders have received really good returns over the last five years. We think most investors would be happy with the 186% return, over that period. We think it's more important to dwell on the long term returns than the short term returns. Only time will tell if there is still too much optimism currently reflected in the share price.

Since the stock has added ₪224m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Azorim-Investment Development & Construction

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

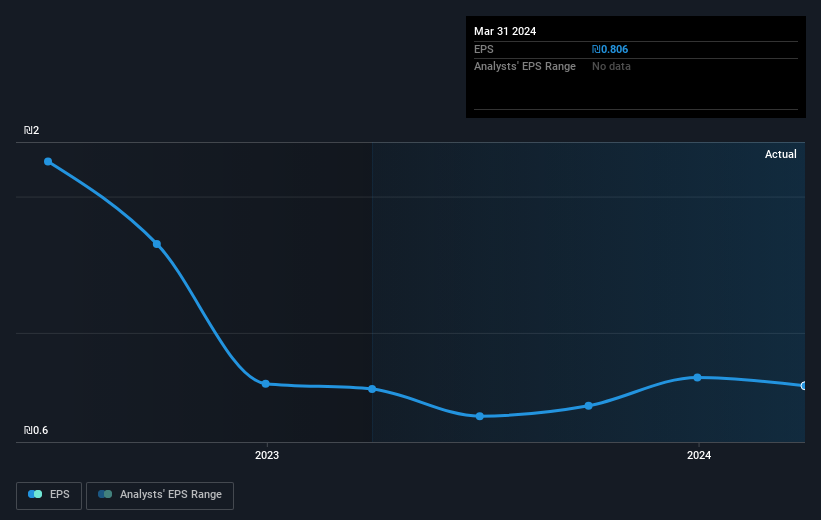

During five years of share price growth, Azorim-Investment Development & Construction achieved compound earnings per share (EPS) growth of 9.6% per year. This EPS growth is slower than the share price growth of 23% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Azorim-Investment Development & Construction's key metrics by checking this interactive graph of Azorim-Investment Development & Construction's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We've already covered Azorim-Investment Development & Construction's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Azorim-Investment Development & Construction's TSR of 189% over the last 5 years is better than the share price return.

A Different Perspective

It's nice to see that Azorim-Investment Development & Construction shareholders have received a total shareholder return of 33% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 24% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Azorim-Investment Development & Construction (1 shouldn't be ignored) that you should be aware of.

But note: Azorim-Investment Development & Construction may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Azorim-Investment Development & Construction is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Azorim-Investment Development & Construction is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:AZRM

Azorim-Investment Development & Construction

Azorim-Investment, Development & Construction Co.

Adequate balance sheet with questionable track record.