- Israel

- /

- Professional Services

- /

- TASE:TIGBUR

Tigbur (TASE:TIGBUR) Net Margin Drops to 2.1%, Challenging Profitability Narrative

Reviewed by Simply Wall St

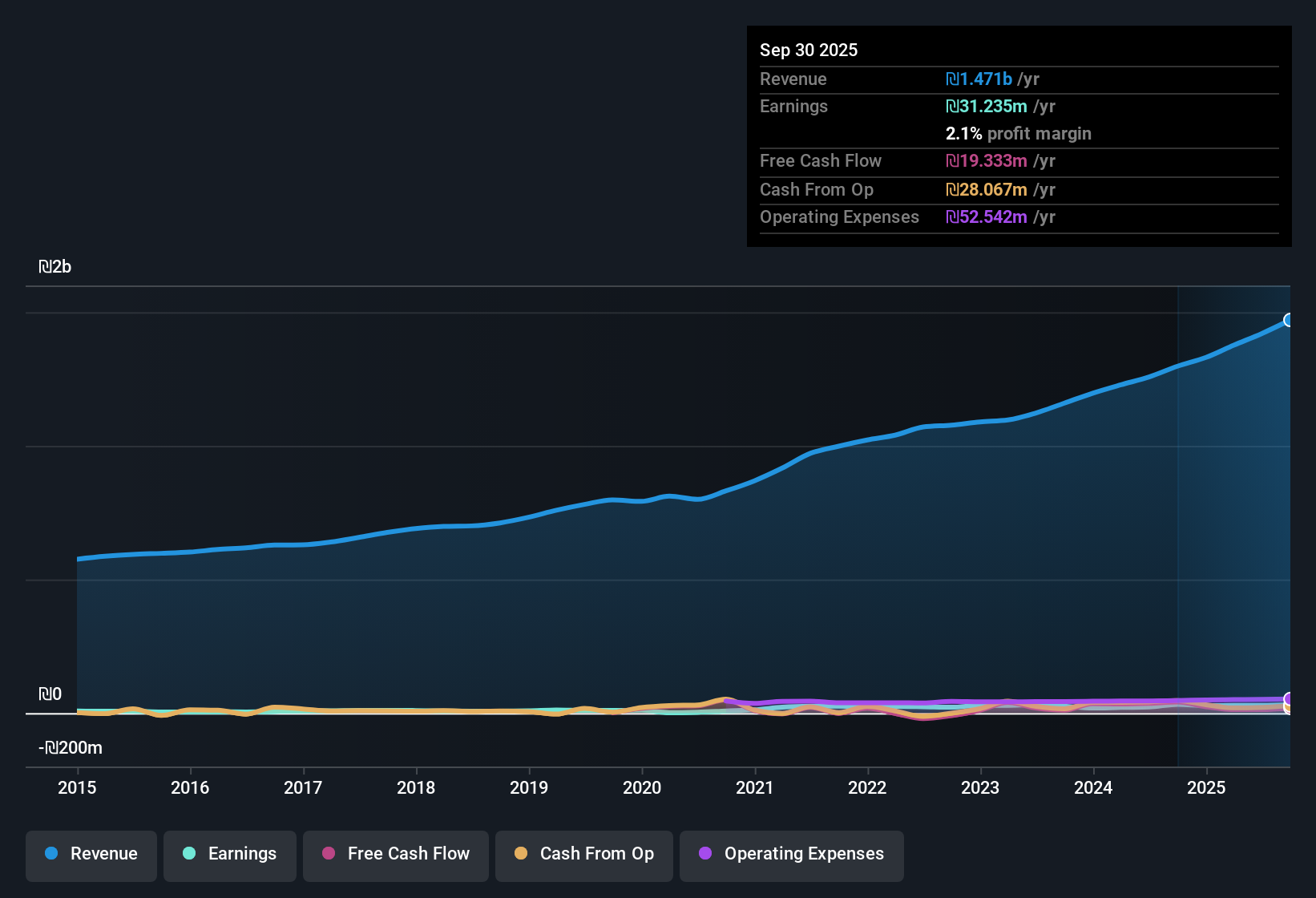

Tigbur Temporary Professional Personnel (TASE:TIGBUR) released its Q3 2025 financial results, reporting revenue of ₪391.4 million and net income of ₪10.5 million, which translated to basic EPS of ₪1.04. Over the last year, the company has seen total revenue rise from ₪1.26 billion to ₪1.47 billion, while net income increased from ₪22.5 million to ₪31.2 million on a trailing twelve month basis. Margins remained compressed, presenting a mixed picture for investors considering short-term profitability momentum compared to past growth.

See our full analysis for Tigbur - Temporary Professional Personnel.Next, we will see how these latest numbers compare to the broader market narratives and what they could mean for Tigbur’s future story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Slides To 2.1%

- Tigbur’s net profit margin dropped to 2.1% over the past year, down from 2.5% the year before, meaning less was kept as profit from each shekel earned.

- The market narrative weighs this margin slide against the company’s history of 9.8% average annual earnings growth across five years.

- Steady multi-year gains did not prevent profitability from compressing lately. This suggests that current business pressures outweigh past growth trends.

- Consensus analysis points out that despite the margin dip, Tigbur’s diversified service mix and track record continue to support a stable outlook. However, recent profit rates now lag peer averages.

Curious how the company’s defensive business model balances out these margin trends? 📊 Read the full Tigbur - Temporary Professional Personnel Consensus Narrative.

Share Price Far Exceeds DCF Fair Value

- Tigbur’s share price stands at ₪56.04, vastly above its DCF fair value estimate of ₪9.02, indicating the market is pricing in either future growth or scarcity of similar investment options.

- Analysis highlights this premium valuation as a key friction point.

- Compared to the Asian Professional Services industry average price-to-earnings (P/E) ratio of 16.4x, Tigbur trades close by at 16.6x but looks inexpensive versus direct peers averaging 47.4x.

- This above-fair-value pricing challenges consensus expectations, since compressed margins and muted current growth do not offer a clear near-term catalyst to justify the gap.

Dividend Stability Remains A Concern

- The company’s unstable dividend track record is highlighted as a minor risk, especially for investors seeking steady income, since there’s no pattern of reliable payouts in the results or commentary.

- Consensus narrative calls out that weak dividend signals combine with shrinking net margins.

- Income-focused investors could find this combination discouraging given current profitability trends and patchy dividend history.

- In the broader industry context, dividend consistency is often a draw for staffing and care companies. This gap stands out in peer comparisons.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tigbur - Temporary Professional Personnel's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Tigbur currently faces challenges with compressed profit margins and a share price that significantly exceeds its fair value, raising immediate valuation concerns.

If you want to avoid premium-priced stocks with similar risks, discover these 932 undervalued stocks based on cash flows offering stronger upside potential based on actual cash flows and intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tigbur - Temporary Professional Personnel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TIGBUR

Tigbur - Temporary Professional Personnel

Tigbur - Temporary Professional Personnel Ltd.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026