Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Shapir Engineering and Industry Ltd (TLV:SPEN) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Shapir Engineering and Industry

How Much Debt Does Shapir Engineering and Industry Carry?

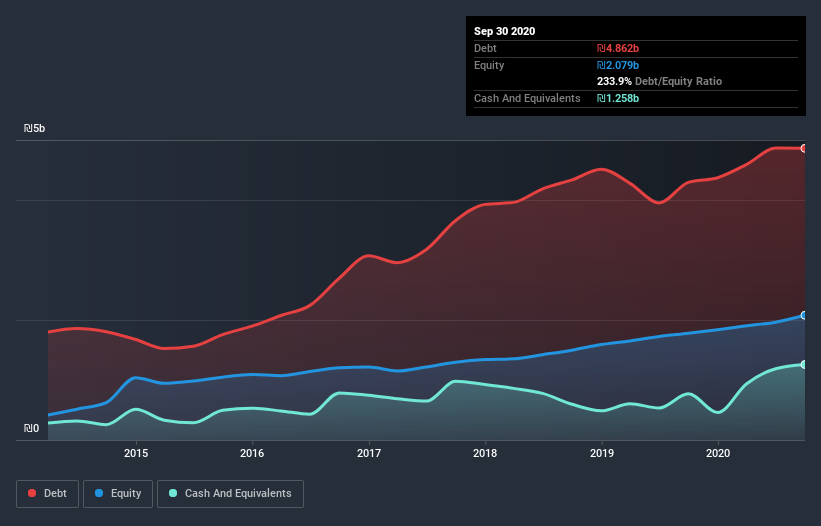

As you can see below, at the end of September 2020, Shapir Engineering and Industry had ₪4.85b of debt, up from ₪4.29b a year ago. Click the image for more detail. However, it does have ₪1.26b in cash offsetting this, leading to net debt of about ₪3.59b.

A Look At Shapir Engineering and Industry's Liabilities

According to the last reported balance sheet, Shapir Engineering and Industry had liabilities of ₪2.31b due within 12 months, and liabilities of ₪3.68b due beyond 12 months. On the other hand, it had cash of ₪1.26b and ₪1.55b worth of receivables due within a year. So its liabilities total ₪3.19b more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Shapir Engineering and Industry has a market capitalization of ₪8.24b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 2.2 times and a disturbingly high net debt to EBITDA ratio of 6.0 hit our confidence in Shapir Engineering and Industry like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Fortunately, Shapir Engineering and Industry grew its EBIT by 2.3% in the last year, slowly shrinking its debt relative to earnings. There's no doubt that we learn most about debt from the balance sheet. But it is Shapir Engineering and Industry's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Shapir Engineering and Industry created free cash flow amounting to 8.7% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

On the face of it, Shapir Engineering and Industry's interest cover left us tentative about the stock, and its net debt to EBITDA was no more enticing than the one empty restaurant on the busiest night of the year. But at least its EBIT growth rate is not so bad. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Shapir Engineering and Industry stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Shapir Engineering and Industry is showing 1 warning sign in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Shapir Engineering and Industry, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:SPEN

Shapir Engineering and Industry

Engages in the construction, engineering, and infrastructure businesses in Israel.

Acceptable track record with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success