Insufficient Growth At Highcon Systems Ltd. (TLV:HICN) Hampers Share Price

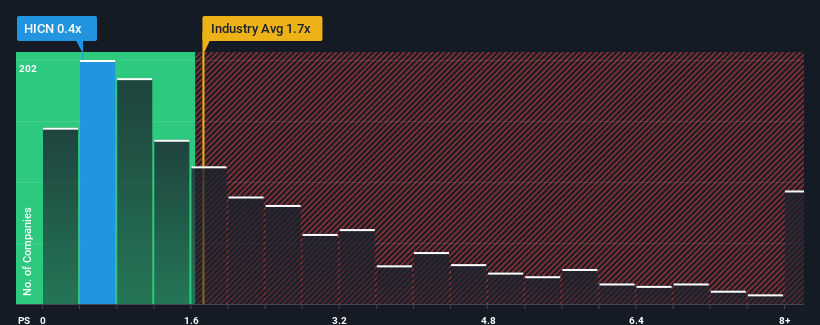

When you see that almost half of the companies in the Machinery industry in Israel have price-to-sales ratios (or "P/S") above 1.1x, Highcon Systems Ltd. (TLV:HICN) looks to be giving off some buy signals with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Highcon Systems

What Does Highcon Systems' Recent Performance Look Like?

Recent times have been quite advantageous for Highcon Systems as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. Those who are bullish on Highcon Systems will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Highcon Systems' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Highcon Systems?

Highcon Systems' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 36% gain to the company's top line. As a result, it also grew revenue by 10% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 17% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Highcon Systems is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Highcon Systems' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, Highcon Systems maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

You should always think about risks. Case in point, we've spotted 5 warning signs for Highcon Systems you should be aware of, and 4 of them are a bit unpleasant.

If these risks are making you reconsider your opinion on Highcon Systems, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Highcon Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:HICN

Highcon Systems

Engages in the provision of a proprietary technology for digital cutting and creasing solutions for post print processes in the folding carton and corrugated carton industry.

Moderate and slightly overvalued.

Market Insights

Community Narratives