- Israel

- /

- Aerospace & Defense

- /

- TASE:ESLT

Elbit Systems (TASE:ESLT): Evaluating Valuation After a Recent Cool-Off in Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Elbit Systems.

After a remarkable run this year, Elbit Systems has seen its recent momentum ease as the 1-month share price return slipped nearly 7%. Despite this short-term pullback, total shareholder return over the past year remains impressive. This highlights the stock’s strong long-term trajectory and continued investor confidence.

If you’re keeping an eye on defense and aerospace trends, now’s a great time to discover See the full list for free.

With the recent cool-off, investors are left to wonder if Elbit Systems still holds hidden value for the future or if markets have already factored in all the upcoming growth prospects.

Price-to-Earnings of 55.2x: Is it justified?

Elbit Systems is trading at a price-to-earnings (P/E) ratio of 55.2x, just slightly below the Asian Aerospace & Defense industry average of 58.4x. However, this multiple is significantly higher than the peer group average, raising important questions about whether the market is pricing in exceptional future growth or paying a premium for quality.

The price-to-earnings multiple represents the value investors place on each unit of earnings. For defense and aerospace companies, a higher P/E can signal market optimism about sustained profit growth or resilience in volatile times. In Elbit's case, the elevated P/E suggests investors expect robust growth ahead, possibly reflecting the recent earnings surge and the company’s reputation for high-quality profits.

Compared to its peers in the industry, Elbit’s P/E is considered reasonable alongside the Asian industry average. At the same time, it appears expensive when compared to the peer group. Investors should consider if these market expectations are justified or if sentiment is inflating the valuation beyond fundamentals. If the fair ratio analysis were available, it could clarify whether the current multiple truly matches Elbit’s risk and growth profile.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 55.2x (ABOUT RIGHT)

However, if revenue growth slows or if profitability trends reverse, this could quickly challenge the bullish sentiment around Elbit Systems and impact future returns.

Find out about the key risks to this Elbit Systems narrative.

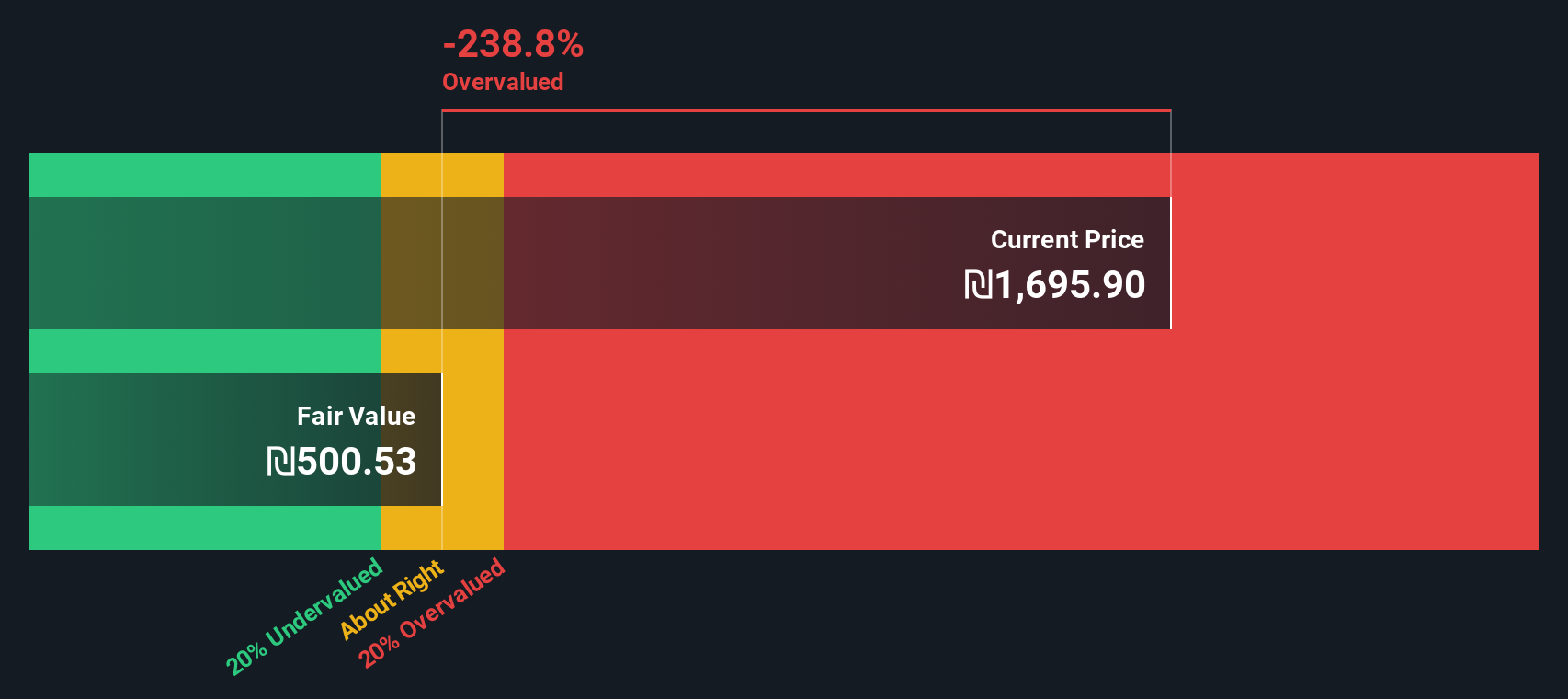

Another View: Discounted Cash Flow Model Suggests Overvaluation

While the market’s optimism is reflected in Elbit Systems’ price-to-earnings ratio, our DCF model tells a different story. Based on this approach, the current share price of ₪1,560 stands well above the estimated fair value of ₪957.14. This suggests the stock could be overvalued according to future cash flow projections. Does this mean growth expectations are too high, or could positive surprises still emerge?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elbit Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 838 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elbit Systems Narrative

If you’d rather dive into the data and draw your own conclusions, it’s quick and easy to build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Elbit Systems.

Looking for more investment ideas?

Don’t let your next big opportunity pass you by. Give yourself an investing edge with these unique stock ideas picked by the Simply Wall Street Screener:

- Spot high rewards by jumping on these 838 undervalued stocks based on cash flows, which have strong cash flow potential and market mispricing, before the crowd catches on.

- Spotlight your portfolio's future by checking out these 28 quantum computing stocks, which are shaping tomorrow’s tech landscape right now.

- Bolster your steady income streams by taking a look at these 23 dividend stocks with yields > 3%, which deliver robust yields above 3% and reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elbit Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ESLT

Elbit Systems

Develops and supplies a portfolio of airborne, land, and naval systems and products for the defense, homeland security, and commercial aviation applications in Israel, North America, Europe, the Asia-Pacific, Latin America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives