- Israel

- /

- Aerospace & Defense

- /

- TASE:ESLT

Assessing Elbit Systems After 64% Rally and Major Defense Contract News

Reviewed by Bailey Pemberton

- Ever wondered if Elbit Systems is truly worth its current price, or if there could be untapped value hidden beneath the surface?

- The stock has rocketed upward this year, gaining an impressive 64.3% year-to-date and surging 83.4% over the past twelve months. However, it has taken a minor dip of 0.5% in the past week.

- Elbit has recently attracted attention after securing significant defense contracts and forming new alliances in the aerospace sector, fueling both excitement and speculation. These headlines help explain some of the momentum behind the sharp price increases and have led investors to reconsider the company's long-term growth story.

- On pure numbers, Elbit Systems scores just 1 out of 6 on our valuation checks, which may surprise those following its rapid climb. Next, we will break down what this means for potential investors using classic valuation approaches, but be sure to stick around as there is an even smarter way to look at value coming up at the end.

Elbit Systems scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

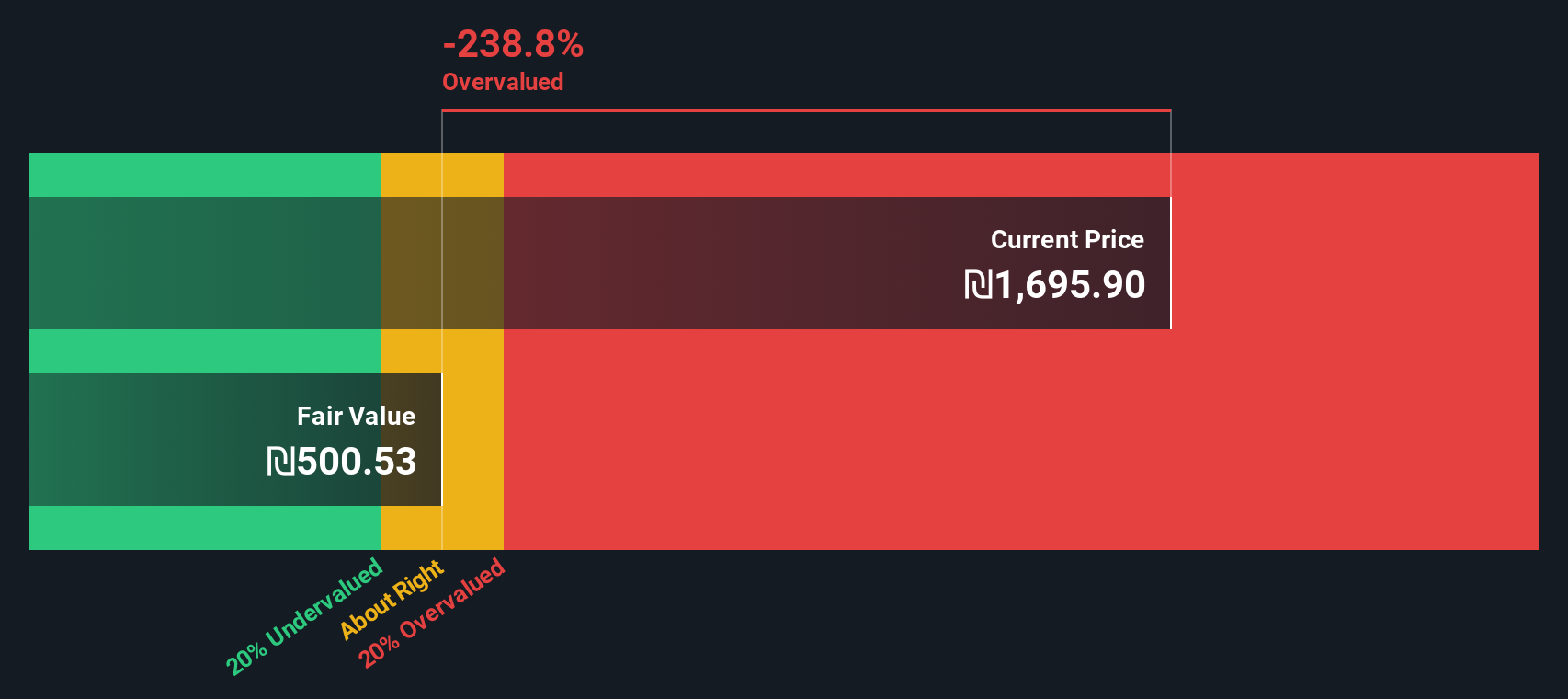

Approach 1: Elbit Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future cash flows and discounting them back to their value today. This approach aims to determine what the business is worth based on its ability to generate cash, rather than just short-term profits.

For Elbit Systems, the latest reported Free Cash Flow stands at $592 million. Analyst estimates project Free Cash Flow to reach $917 million by 2029, with the next decade’s projections relying on analyst input for the early years and extrapolations for the later years. These forecasts reflect moderate annual growth and suggest the company’s underlying business is expected to steadily expand its cash generation over time.

According to the DCF analysis, Elbit Systems' estimated intrinsic value is $957.89 per share. However, this is significantly below the current trading price, which suggests the stock is approximately 64.1% overvalued by this method. For investors seeking value, this indicates the stock’s current price is well ahead of what future cash flows can justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Elbit Systems may be overvalued by 64.1%. Discover 839 undervalued stocks or create your own screener to find better value opportunities.

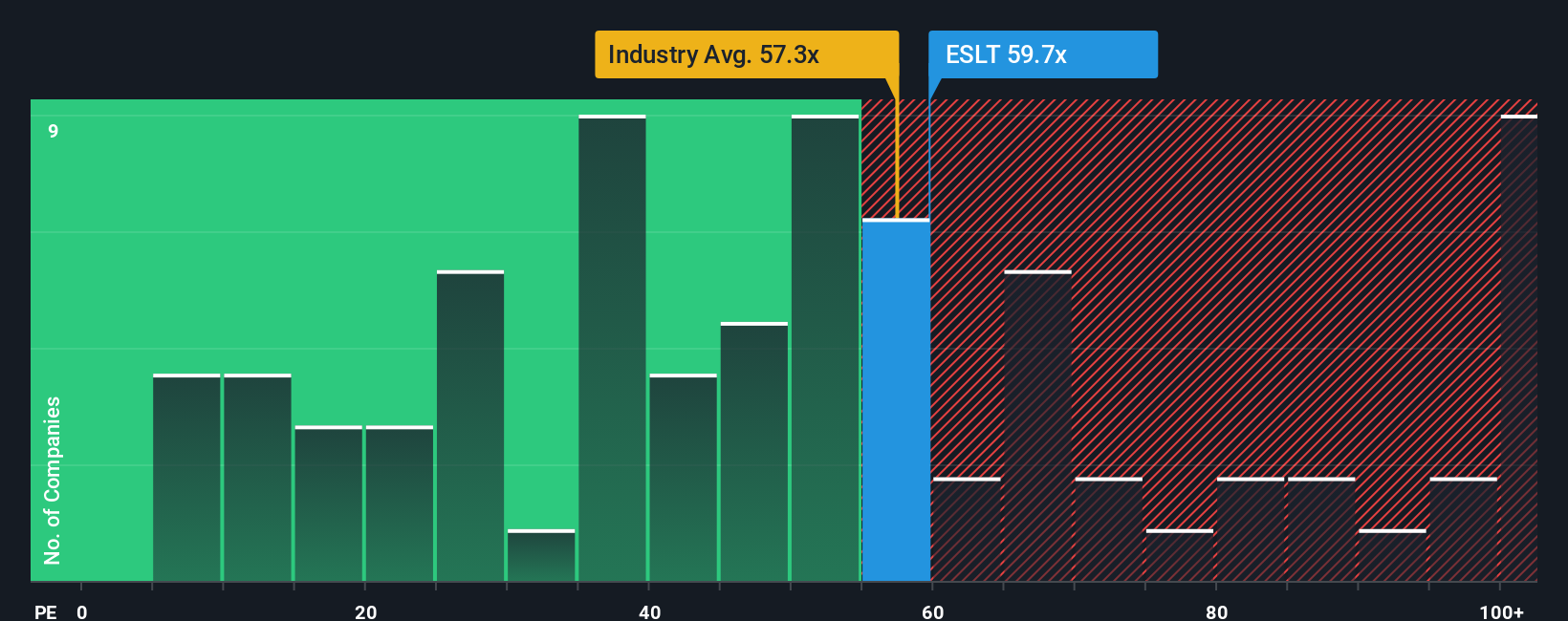

Approach 2: Elbit Systems Price vs Earnings

The Price-to-Earnings (PE) ratio is widely accepted as a valuable valuation tool for profitable companies like Elbit Systems because it directly relates a company's stock price to its net earnings. This gives investors an intuitive measure of how much they are paying for each unit of earnings generated.

It is important to recognize that the "normal" or "fair" PE ratio for any company is not a static figure. Growth expectations and perceived risks play a major role. Companies with faster earnings growth or lower risk profiles typically justify higher PE ratios, while slower-growing or riskier businesses tend to trade at lower multiples.

Currently, Elbit Systems is trading at a PE ratio of 55.7x. For context, the average for its aerospace and defense industry peers is 42.98x, and the broader industry average sits at 48.24x. At first glance, this suggests that Elbit is being valued at a premium compared to both its direct peers and its sector as a whole.

Simply Wall St has developed a proprietary "Fair Ratio" metric as a more precise benchmark. Unlike simple industry or peer comparisons, the Fair Ratio takes into account Elbit Systems’ specific earnings growth, risk profile, profit margins, industry classification, and market capitalization. This approach offers a fuller, more relevant picture for investors assessing if a stock is truly overvalued or undervalued.

In comparing Elbit Systems’ current PE ratio to its Fair Ratio, the data shows a significant gap, suggesting that at today’s price, the stock is likely trading above what fundamentals alone would warrant.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Elbit Systems Narrative

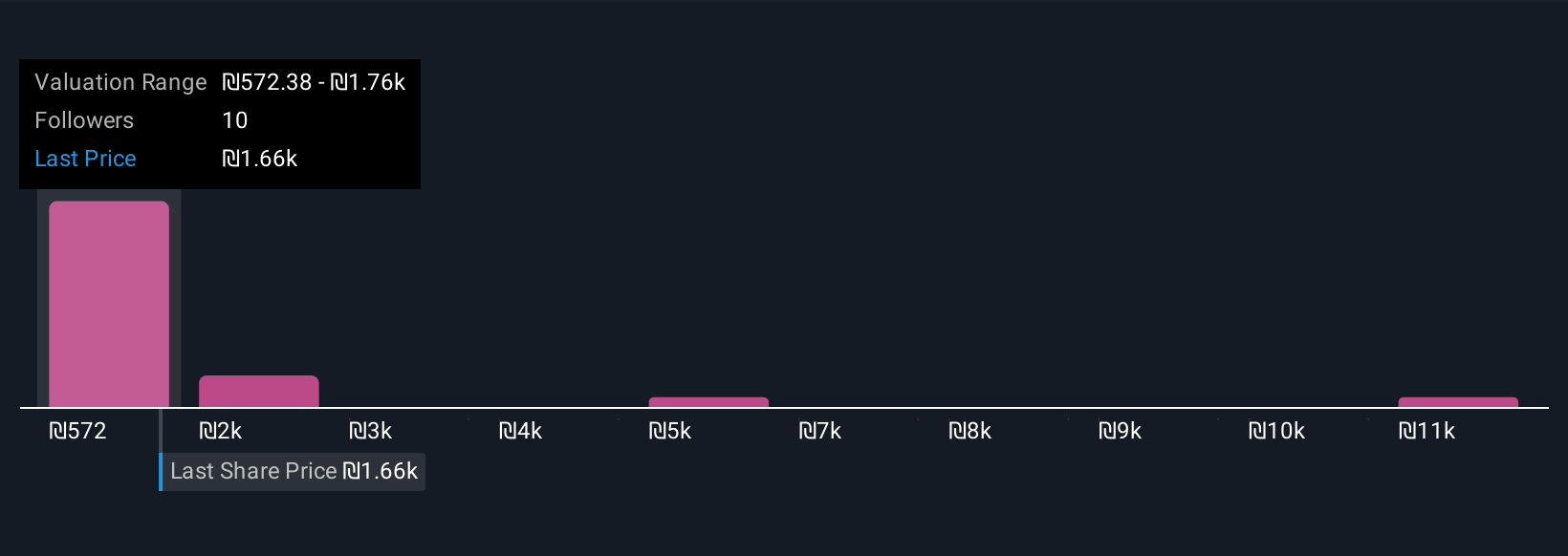

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is an investor's story behind the numbers. It links your personal perspective on a company to forecasts for future revenue, earnings, margins, and ultimately to your own fair value estimation. Narratives bring together the qualitative and quantitative, allowing you to map out how different scenarios could play out for Elbit Systems and see the resulting fair value compared to today's share price.

This approach is accessible to everyone and is used by millions on Simply Wall St’s platform within the Community page, making it easy to explore, create, and share perspectives with other investors. Narratives are dynamic and update automatically as new data, such as news or earnings releases, come in. This empowers you to confidently decide when to buy or sell by seeing how your fair value stacks up against the live market price.

For example, some investors may see Elbit’s contracts as justifying a fair value well above $900 per share. Others take a more conservative approach and value it below $700, reflecting different expectations for growth and profitability.

Do you think there's more to the story for Elbit Systems? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elbit Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ESLT

Elbit Systems

Develops and supplies a portfolio of airborne, land, and naval systems and products for the defense, homeland security, and commercial aviation applications in Israel, North America, Europe, the Asia-Pacific, Latin America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives