- Israel

- /

- Aerospace & Defense

- /

- TASE:ESLT

A Look at Elbit Systems (TASE:ESLT) Valuation After Securing a $2.3 Billion Global Defense Contract

Reviewed by Simply Wall St

Elbit Systems (TASE:ESLT) just announced a $2.3 billion international contract for a strategic defense solution, which will be delivered over eight years. This agreement provides solid long-term revenue and strengthens Elbit's global reach.

See our latest analysis for Elbit Systems.

Momentum around Elbit Systems has been building, with its share price up an impressive 73.8% year-to-date and a total shareholder return of 80.4% over the past year. Recent events, such as robust third-quarter earnings, affirmed dividends, and several new contracts (including the Merkava tank upgrade in Israel and talk of further U.S. acquisitions) suggest investors see long-term value beyond the latest $2.3 billion deal.

With defense stocks in the spotlight, it’s worth exploring other players making moves in the global sector. Check out See the full list for free..

With so much good news already reflected in a soaring share price, is Elbit Systems undervalued and offering more upside, or is the market now fully pricing in its growth potential?

Price-to-Earnings of 58.5x: Is it justified?

Elbit Systems is currently trading at a price-to-earnings ratio of 58.5x, which places it above both its industry and peer averages. The last close was ₪1,663, suggesting investors are already factoring in significant future growth.

The price-to-earnings (P/E) ratio captures how much investors are paying for every unit of earnings. It is often used as a confidence measure for future profit potential, especially in sectors like Aerospace and Defense.

Elbit’s premium P/E implies the market is optimistic about continued profit acceleration, but compared to the Asian Aerospace & Defense industry average of 56.7x and the peer average of 42.7x, this valuation looks expensive. If the market’s growth expectations falter or sector multiples revert lower, Elbit’s high P/E could face pressure.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 58.5x (OVERVALUED)

However, any slowdown in defense spending or weaker-than-expected contract wins could challenge the lofty growth assumptions that are built into Elbit’s current valuation.

Find out about the key risks to this Elbit Systems narrative.

Another View: What Does the SWS DCF Model Suggest?

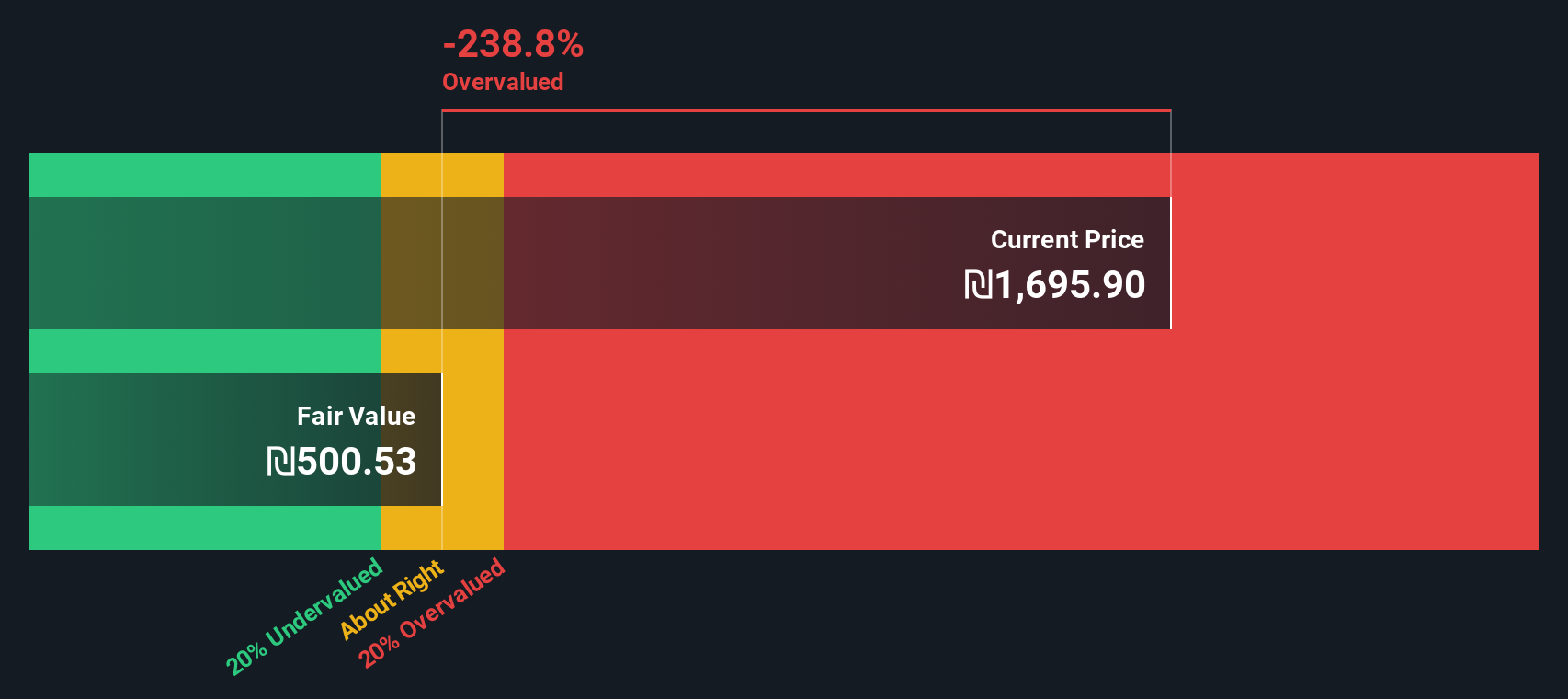

Taking a different approach, our DCF model indicates Elbit Systems’ fair value is ₪1,048.97, which is noticeably below the current market price of ₪1,663. This suggests the shares may be overvalued if cash flow growth does not accelerate. So, should investors trust the multiples or the cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elbit Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elbit Systems Narrative

If you see things differently or want to dig into the numbers yourself, you can develop your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Elbit Systems.

Looking for More Smart Investment Opportunities?

Expand your investing toolkit and spark new ideas by checking out these handpicked stock lists. Don’t let these potential winners slip by. Your next big move could be just a click away.

- Start earning steady income with market leaders by tapping into these 18 dividend stocks with yields > 3% offering attractive yields above 3%.

- Spot overlooked value plays primed for growth by reviewing these 905 undervalued stocks based on cash flows identified through strong cash flow analysis.

- Ride the front lines of innovation in healthcare by browsing these 31 healthcare AI stocks and see which companies are reshaping the industry using artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elbit Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ESLT

Elbit Systems

Develops and supplies a portfolio of airborne, land, and naval systems and products for the defense, homeland security, and commercial aviation applications in Israel, North America, Europe, the Asia-Pacific, Latin America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives