- Israel

- /

- Electrical

- /

- TASE:ELWS

Electreon Wireless (TLV:ELWS) rises 7.9% this week, taking one-year gains to 265%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Electreon Wireless Ltd (TLV:ELWS) share price had more than doubled in just one year - up 265%. It's also good to see the share price up 117% over the last quarter. On the other hand, longer term shareholders have had a tougher run, with the stock falling 12% in three years.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Electreon Wireless

Given that Electreon Wireless didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Electreon Wireless saw its revenue grow by 167%. That's a head and shoulders above most loss-making companies. Meanwhile, the market has paid attention, sending the share price soaring 265% in response. It's great to see strong revenue growth, but the question is whether it can be sustained. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

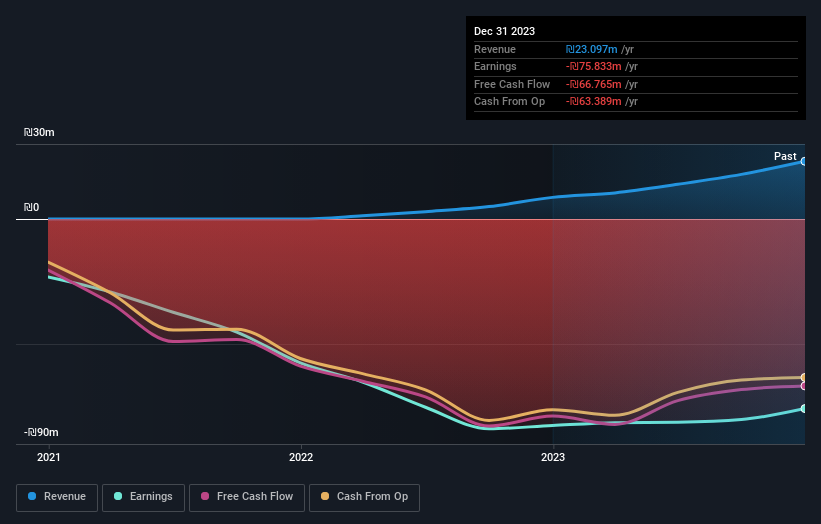

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that Electreon Wireless shareholders have received a total shareholder return of 265% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 20% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Electreon Wireless better, we need to consider many other factors. For example, we've discovered 4 warning signs for Electreon Wireless (3 are concerning!) that you should be aware of before investing here.

But note: Electreon Wireless may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Electreon Wireless might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ELWS

Electreon Wireless

Engages in the research, development, and implementation of the wireless electric road system in Israel.

Adequate balance sheet with low risk.

Market Insights

Community Narratives