- Israel

- /

- Food and Staples Retail

- /

- TASE:RTMD-M

Middle Eastern Penny Stocks With Market Caps Over US$3M

Reviewed by Simply Wall St

Most Gulf markets have recently experienced declines, influenced by weak oil prices and concerns over global economic conditions. Despite these challenges, the potential for growth in certain sectors remains, particularly among smaller companies often categorized as penny stocks. Although the term "penny stocks" might seem outdated, these investments can offer unique opportunities for value and growth when backed by strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.394 | ₪14.79M | ✅ 0 ⚠️ 5 View Analysis > |

| Maharah for Human Resources (SASE:1831) | SAR4.79 | SAR2.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.64 | SAR1.46B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.13 | AED2.26B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.97 | AED392.7M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.84 | AED12.08B | ✅ 3 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.859 | AED526.14M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.817 | ₪209.42M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 76 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Aerodrome Group (TASE:ARDM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aerodrome Group Ltd specializes in offering solutions for data collection, processing, and analysis using UAVs, advanced software, and AI applications across civil and security sectors with a market cap of ₪30.74 million.

Operations: The company's revenue is primarily derived from Air Intelligence, contributing ₪11.61 million, and Know-How Sharing, which accounts for ₪2.84 million.

Market Cap: ₪30.74M

Aerodrome Group Ltd, with a market cap of ₪30.74 million, focuses on UAV-based data solutions and AI applications. Despite generating revenue from Air Intelligence (₪11.61 million) and Know-How Sharing (₪2.84 million), the company remains unprofitable with a negative Return on Equity of -79.3%. Aerodrome's short-term assets exceed both its short-term and long-term liabilities, indicating some financial stability, yet it faces challenges with less than a year of cash runway if current cash flow trends persist. The board is experienced, but earnings have declined by 20.2% annually over the past five years.

- Unlock comprehensive insights into our analysis of Aerodrome Group stock in this financial health report.

- Understand Aerodrome Group's track record by examining our performance history report.

Retailminds Technologies (TASE:RTMD-M)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Retailminds Technologies Ltd, with a market cap of ₪10.43 million, offers online shopping services in Israel.

Operations: The company generates revenue from online retailers, amounting to ₪0.72 million.

Market Cap: ₪10.43M

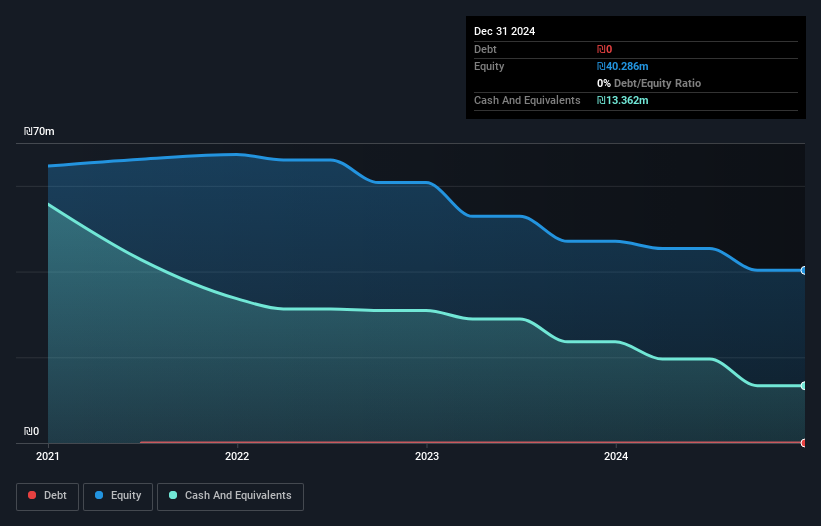

Retailminds Technologies Ltd, with a market cap of ₪10.43 million, operates in the online shopping sector in Israel but remains pre-revenue with earnings below US$1 million (₪717K). Despite revenue growth of 19.5% over the past year and no debt on its books for five years, the company faces challenges due to its unprofitability and negative Return on Equity (-29.41%). The management team and board are experienced, yet Retailminds has less than a year of cash runway based on current free cash flow trends. Its share price has been highly volatile recently, reflecting investor uncertainty.

- Jump into the full analysis health report here for a deeper understanding of Retailminds Technologies.

- Gain insights into Retailminds Technologies' historical outcomes by reviewing our past performance report.

Unicorn Technologies - Limited Partnership (TASE:UNCT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Unicorn Technologies - Limited Partnership, based in Tel Aviv, Israel, operates as a principal investment firm with a market cap of ₪12.53 million.

Operations: Unicorn Technologies - Limited Partnership has not reported any revenue segments.

Market Cap: ₪12.53M

Unicorn Technologies - Limited Partnership, based in Tel Aviv with a market cap of ₪12.53 million, is pre-revenue and debt-free, highlighting its financial prudence despite unprofitability. The company reported improved earnings for the first half of 2025 with a net income of ₪0.811 million compared to a loss last year, suggesting potential operational improvements. Its short-term assets far exceed liabilities (₪9M vs ₪341K), providing liquidity assurance. While the stock's volatility remains high and weekly fluctuations are above most IL stocks, Unicorn has over two years of cash runway if current free cash flow trends persist.

- Navigate through the intricacies of Unicorn Technologies - Limited Partnership with our comprehensive balance sheet health report here.

- Evaluate Unicorn Technologies - Limited Partnership's historical performance by accessing our past performance report.

Where To Now?

- Reveal the 76 hidden gems among our Middle Eastern Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:RTMD-M

Adequate balance sheet with slight risk.

Market Insights

Community Narratives