- Israel

- /

- Trade Distributors

- /

- TASE:AMRK

Amir Marketing (TASE:AMRK) Margins Improve to 3.5%, Reinforcing Bullish Community Narrative

Reviewed by Simply Wall St

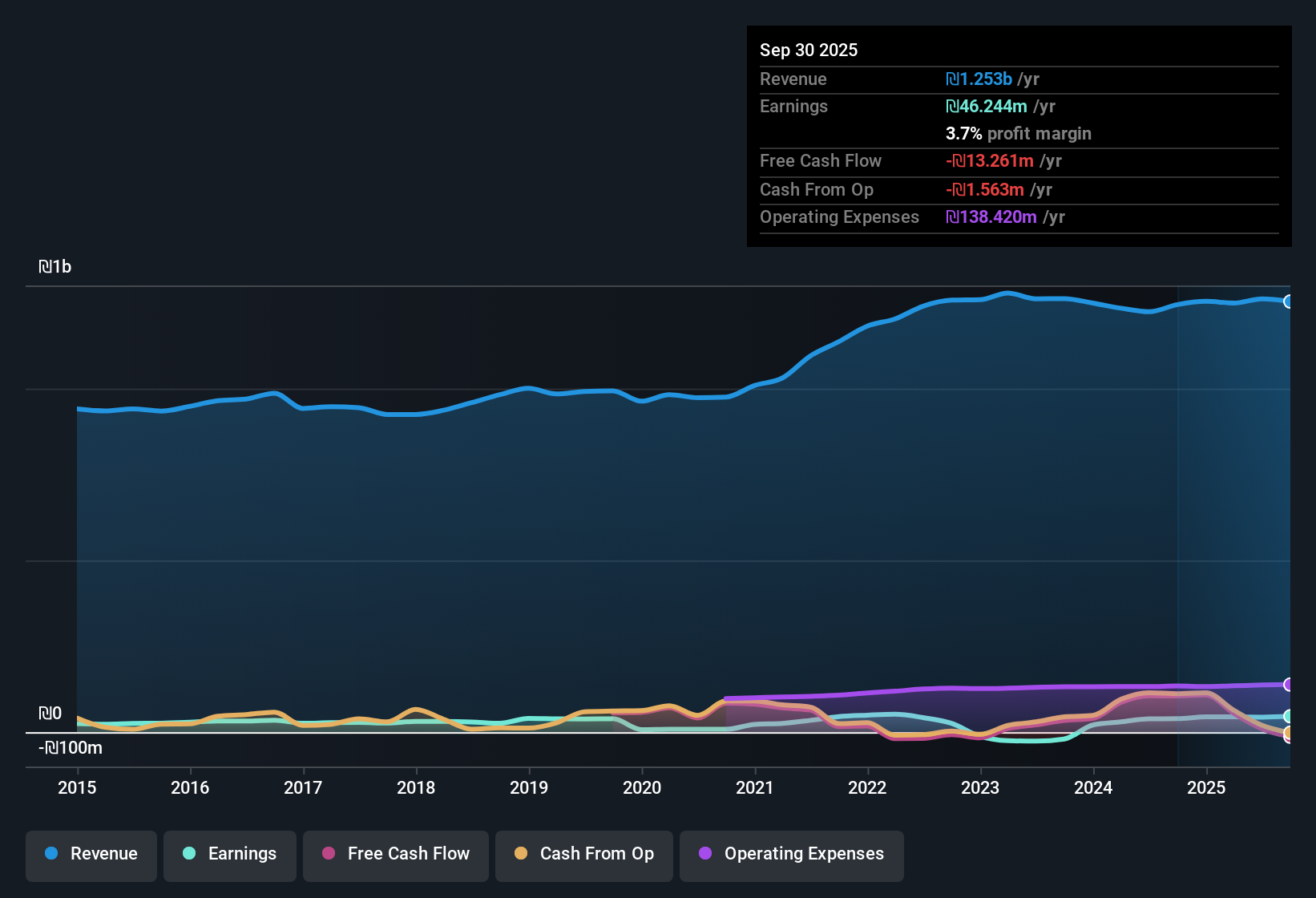

Amir Marketing and Investments in Agriculture (TASE:AMRK) just released its Q3 2025 results, reporting revenue of 317.1 million ILS and basic EPS of 0.66 ILS as net income reached 8.3 million ILS. Looking back, the company has seen revenue fluctuate between 274.2 million ILS and 357.9 million ILS over the three most recent quarters, with EPS ranging from 0.66 ILS to 1.02 ILS. Margins remained steady, providing a solid base for investors to evaluate how operational discipline is influencing bottom-line performance.

See our full analysis for Amir Marketing and Investments in Agriculture.Next, we will see how these headline figures compare to the prominent narratives about AMRK, setting the financial reality alongside investor expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Edge Higher at 3.5%

- Net profit margin improved to 3.5% for the trailing twelve months, up from 3.2% last year. This shows a meaningful lift in how efficiently each shekel of revenue is turning into profit.

- What stands out in the prevailing market perspective is that stability in margins is not just a sign of control. It also highlights AMRK’s ability to navigate input costs and competition without showing the volatility seen in many peers.

- This margin lift goes hand in hand with operating discipline, keeping profit growth above the company’s historic trend.

- It also suggests recent improvements are not entirely cyclical and may reflect real efficiency gains.

Price-To-Earnings Sits at 9.9x

- AMRK’s price-to-earnings ratio is 9.9 times, lower than both the Israeli market (15.6x) and peer group averages (14.3x). This points to a discount valuation despite above-average earnings growth.

- Prevailing analysis emphasizes that this low multiple gives fundamental investors a wider margin of safety:

- Profit has grown by 12.8% in the past year, almost double the five-year annual average of 6.4%.

- This valuation gap is seen as an opportunity for those willing to bet on reliable performers over high-flying growth stocks.

Dividend Coverage Remains a Watch Point

- The 3.52% dividend yield is attractive, but is not well covered by free cash flows. This flags payout sustainability for those looking at the stock for income.

- Market watchers view this as a minor yellow flag even as profit and margins trend well:

- Payouts outpacing free cash flow can become a problem if not addressed, especially if cash generation does not accelerate to match distributions.

- This risk stands out more in an otherwise robust set of numbers and acts as a signal to income-focused investors to monitor future updates closely.

To see how the broader community weighs these themes in their outlooks, read the latest consensus narrative and see how your perspective compares. 📊 Read the full Amir Marketing and Investments in Agriculture Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Amir Marketing and Investments in Agriculture's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While AMRK’s profits and margins are steady, its dividend payouts are not well covered by free cash flows. This raises long-term sustainability concerns for income investors.

For those seeking more reliable income, check out these 1941 dividend stocks with yields > 3% to find companies offering attractive yields supported by stronger cash flows and payout ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:AMRK

Amir Marketing and Investments in Agriculture

Supplies and markets agricultural inputs in Israel.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026