The Middle Eastern stock markets have recently experienced a rebound, driven by strong corporate earnings and positive developments such as the U.S.-Japan trade deal. In this context, penny stocks—though an older term—remain relevant for investors seeking growth opportunities at lower price points. These smaller or newer companies can offer significant potential when backed by robust financials, making them intriguing prospects for those looking to uncover hidden gems in the market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.565 | ₪11.79M | ✅ 1 ⚠️ 3 View Analysis > |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.437 | ₪15.25M | ✅ 0 ⚠️ 5 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.02 | SAR1.61B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.164 | ₪294.16M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.57 | AED3.16B | ✅ 3 ⚠️ 3 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY2.45 | TRY2.64B | ✅ 2 ⚠️ 1 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.17 | AED392.7M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.83 | AED12.08B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.771 | AED468.96M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.594 | ₪192.84M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 76 stocks from our Middle Eastern Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Al Seer Marine Supplies and Equipment Company PJSC (ADX:ASM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Seer Marine Supplies and Equipment Company PJSC specializes in the management, maintenance, crewing, and operation of yachts in the United Arab Emirates with a market cap of AED3.79 billion.

Operations: The company generates revenue from three main segments: IDT with AED64.18 million, Yachting contributing AED916.18 million, and Commercial Shipping at AED301.05 million.

Market Cap: AED3.79B

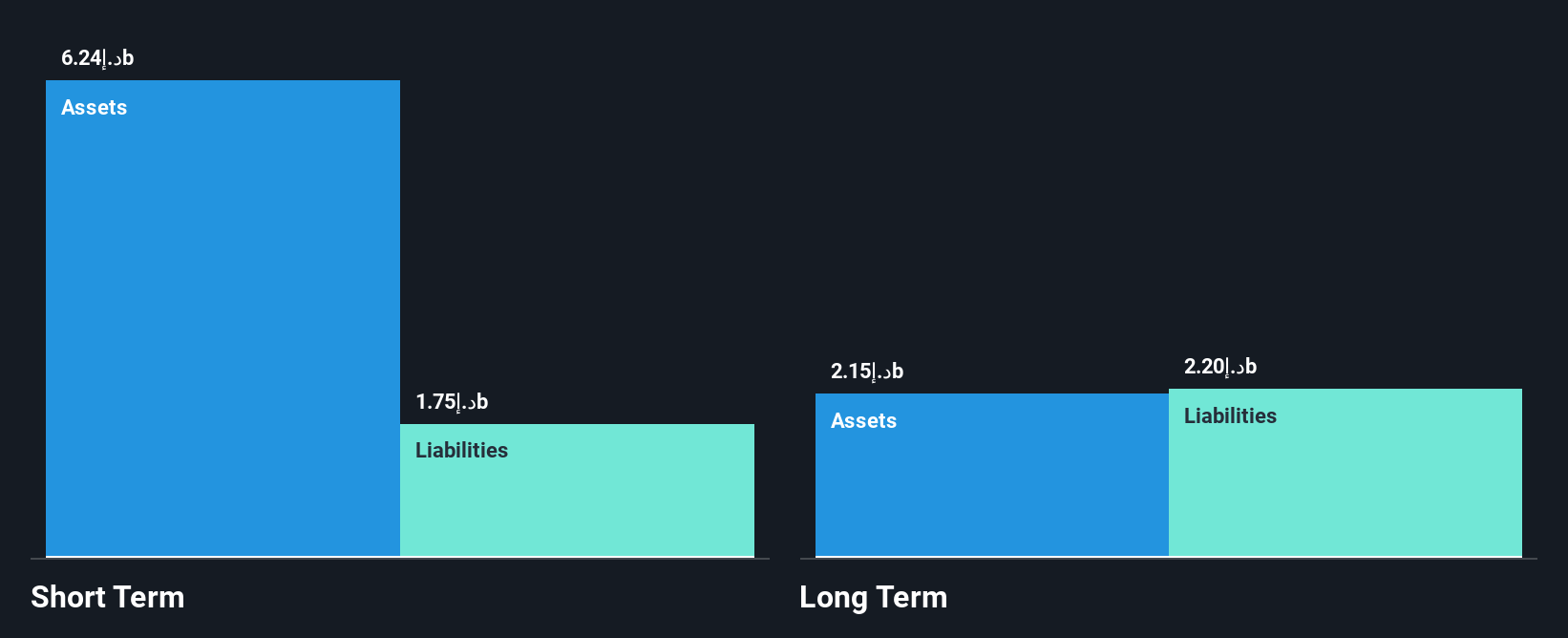

Al Seer Marine Supplies and Equipment Company PJSC has secured significant financing, including an AED 760 million facility from Abu Dhabi Commercial Bank, to bolster its asset-backed growth strategy. The company is unprofitable with a negative return on equity but maintains a satisfactory net debt to equity ratio of 36.4%. Despite high volatility and increased debt over five years, Al Seer's strategic ventures like ASBI Shipping FZCO aim to capture market share in the maritime sector. Short-term assets cover liabilities comfortably, reflecting financial resilience amid challenging profitability metrics.

- Jump into the full analysis health report here for a deeper understanding of Al Seer Marine Supplies and Equipment Company PJSC.

- Gain insights into Al Seer Marine Supplies and Equipment Company PJSC's historical outcomes by reviewing our past performance report.

Ihlas Gazetecilik (IBSE:IHGZT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ihlas Gazetecilik A.S. is involved in the publishing, selling, distributing, and marketing of newspapers, books, encyclopedias, brochures, and magazines both in Turkey and internationally with a market cap of TRY1.40 billion.

Operations: The company generates revenue of TRY1.76 billion from its publishing segment focused on newspapers.

Market Cap: TRY1.4B

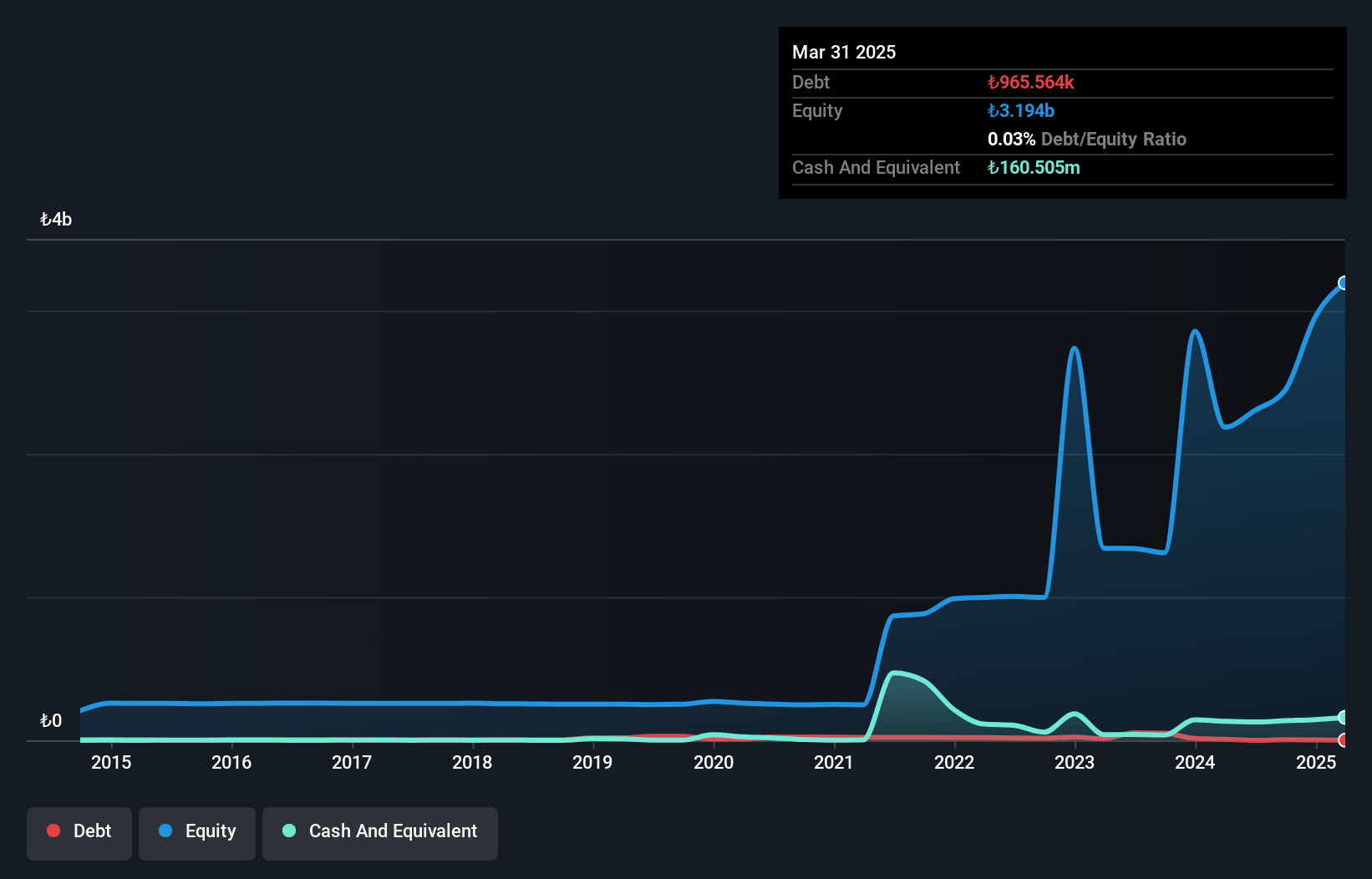

Ihlas Gazetecilik A.S. has demonstrated financial resilience despite recent challenges, with short-term assets of TRY1 billion comfortably exceeding both its short and long-term liabilities. The company reported a net loss of TRY62 million for Q1 2025, an improvement from the previous year's larger loss. While profitability remains a challenge due to large one-off losses, the company's price-to-earnings ratio suggests it may be undervalued compared to the broader Turkish market. Additionally, Ihlas Gazetecilik's debt level is well-managed with more cash on hand than total debt, and its board boasts considerable experience with an average tenure of 8.1 years.

- Unlock comprehensive insights into our analysis of Ihlas Gazetecilik stock in this financial health report.

- Examine Ihlas Gazetecilik's past performance report to understand how it has performed in prior years.

Tgi Infrastructures (TASE:TGI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tgi Infrastructures Ltd, along with its subsidiary, specializes in producing, processing, assembling, and marketing mechanical assemblies made of magnesium for the automotive industry in Israel with a market cap of ₪192.84 million.

Operations: Tgi Infrastructures generates revenue through its Infrastructure and Energy segment, contributing ₪82.70 million, and The Metal and Electrical Industries segment, adding ₪81.87 million.

Market Cap: ₪192.84M

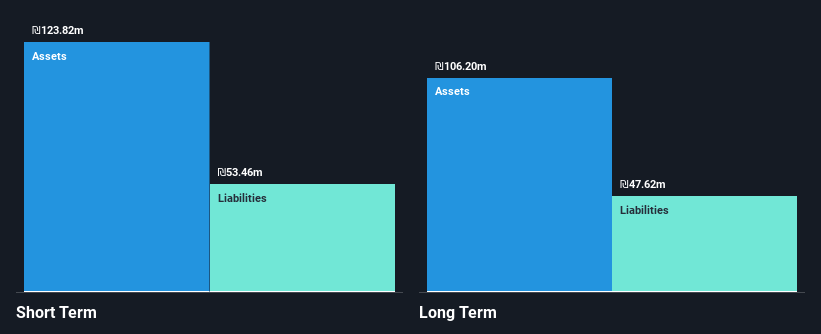

Tgi Infrastructures Ltd has shown robust financial performance, with recent earnings growth of 37.7% surpassing the Auto Components industry average. The company reported a net income increase for Q1 2025, reaching ₪5.49 million from ₪3.36 million the previous year, indicating improved profitability and higher profit margins at 11.1%. TGI's short-term assets significantly cover both short and long-term liabilities, reflecting strong liquidity management. Despite high share price volatility recently, the company's debt levels have been effectively reduced over five years, supported by satisfactory cash flow coverage of its debt obligations and well-covered interest payments by EBIT.

- Get an in-depth perspective on Tgi Infrastructures' performance by reading our balance sheet health report here.

- Learn about Tgi Infrastructures' historical performance here.

Seize The Opportunity

- Unlock more gems! Our Middle Eastern Penny Stocks screener has unearthed 73 more companies for you to explore.Click here to unveil our expertly curated list of 76 Middle Eastern Penny Stocks.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:ASM

Al Seer Marine Supplies and Equipment Company PJSC

Engages in the management, maintenance, crewing, and operation of yachts in the United Arab Emirates.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives