How Investors Are Reacting To Ryanair Holdings (ISE:RYA) Upgraded Passenger Guidance and Jordan Expansion Plans

Reviewed by Sasha Jovanovic

- Ryanair Holdings recently reported strong results for the quarter and six months ended September 2025, highlighting year-on-year growth in both revenue and net income, as well as an increase in passengers and steady load factors.

- Alongside upgrading its fiscal 2026 passenger traffic guidance due to robust travel demand and accelerated Boeing deliveries, Ryanair unveiled ambitious growth plans for its operations in Jordan, aiming to boost connectivity and inbound tourism.

- Next, we’ll examine how Ryanair's revised passenger outlook and earnings performance shape its overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Ryanair Holdings' Investment Narrative?

To feel comfortable as a Ryanair shareholder, you need to believe the airline can sustain its passenger growth and cost discipline, even as competition intensifies and economic conditions fluctuate. The robust half-year results and the recent lift in fiscal 2026 traffic guidance, propelled by earlier Boeing deliveries and high demand, could shift short-term catalysts firmly toward continued route expansion and operational scaling, especially given the ambitious Jordan growth plan. These updates may also temper earlier concerns about supply delays hampering growth or demand softening, though risks remain around fuel price volatility, regulatory actions, and potential overcapacity as the group pushes new markets. While share price gains have been steady, the reaction hasn’t yet signaled a dramatic re-rating, suggesting the new guidance is viewed as incremental rather than transformational. Still, execution risk is now more pronounced given the raised expectations.

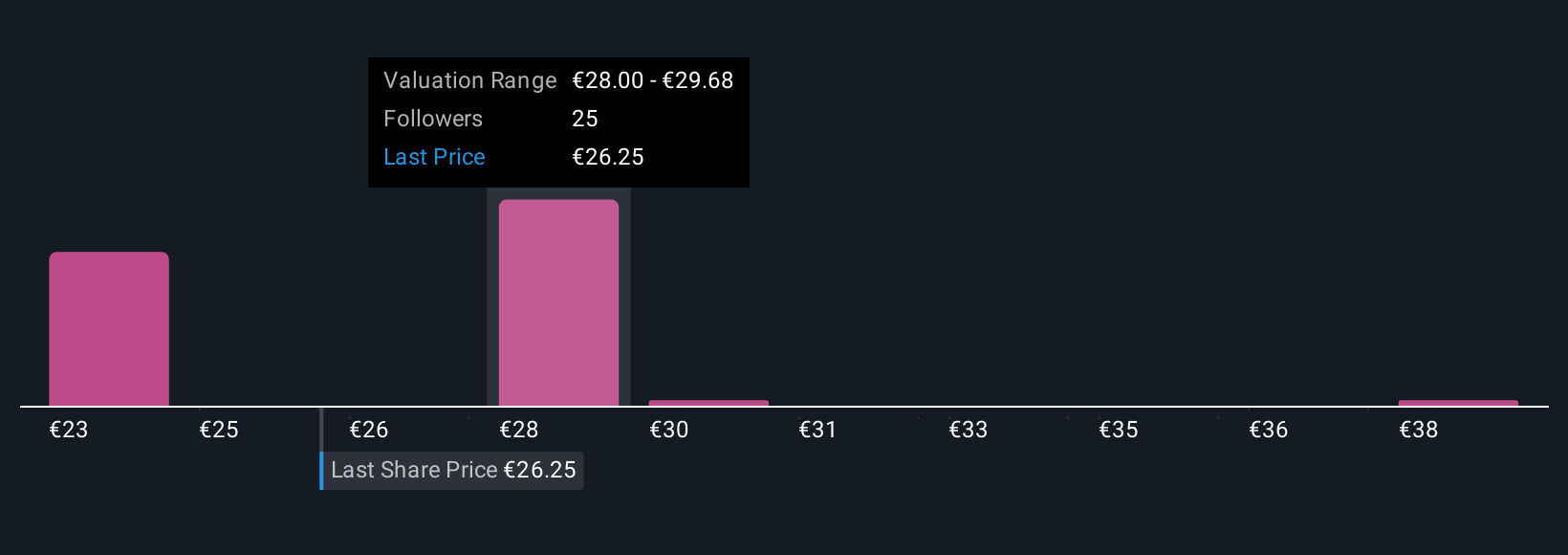

But consider: cost pressures and capacity risks have not disappeared, and investors should keep these in mind. Ryanair Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 8 other fair value estimates on Ryanair Holdings - why the stock might be worth just €25.36!

Build Your Own Ryanair Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ryanair Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Ryanair Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ryanair Holdings' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:RYA

Ryanair Holdings

Provides scheduled-passenger airline services in Ireland, Italy, Spain, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives