- Ireland

- /

- Consumer Durables

- /

- ISE:GVR

December 2024 Penny Stocks To Watch For Potential Growth

Reviewed by Simply Wall St

Global markets have been experiencing a period of robust growth, with major indices like the Dow Jones and S&P 500 reaching record highs, reflecting investor optimism despite geopolitical tensions and tariff concerns. In such a vibrant market landscape, identifying stocks with potential for growth can be particularly rewarding. Penny stocks, often associated with smaller or newer companies, continue to hold appeal due to their affordability and potential for significant returns when underpinned by strong financials. As we explore this investment area, we'll highlight three promising penny stocks that stand out for their financial strength and growth prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$145.87M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.345 | £432.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

Click here to see the full list of 5,688 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Glenveagh Properties (ISE:GVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Glenveagh Properties PLC, along with its subsidiaries, focuses on constructing and selling houses and apartments to private buyers, local authorities, and the private rental sector in Ireland, with a market cap of €893.71 million.

Operations: The company's revenue is primarily derived from its Suburban segment at €463.42 million and Urban segment at €75.88 million.

Market Cap: €893.71M

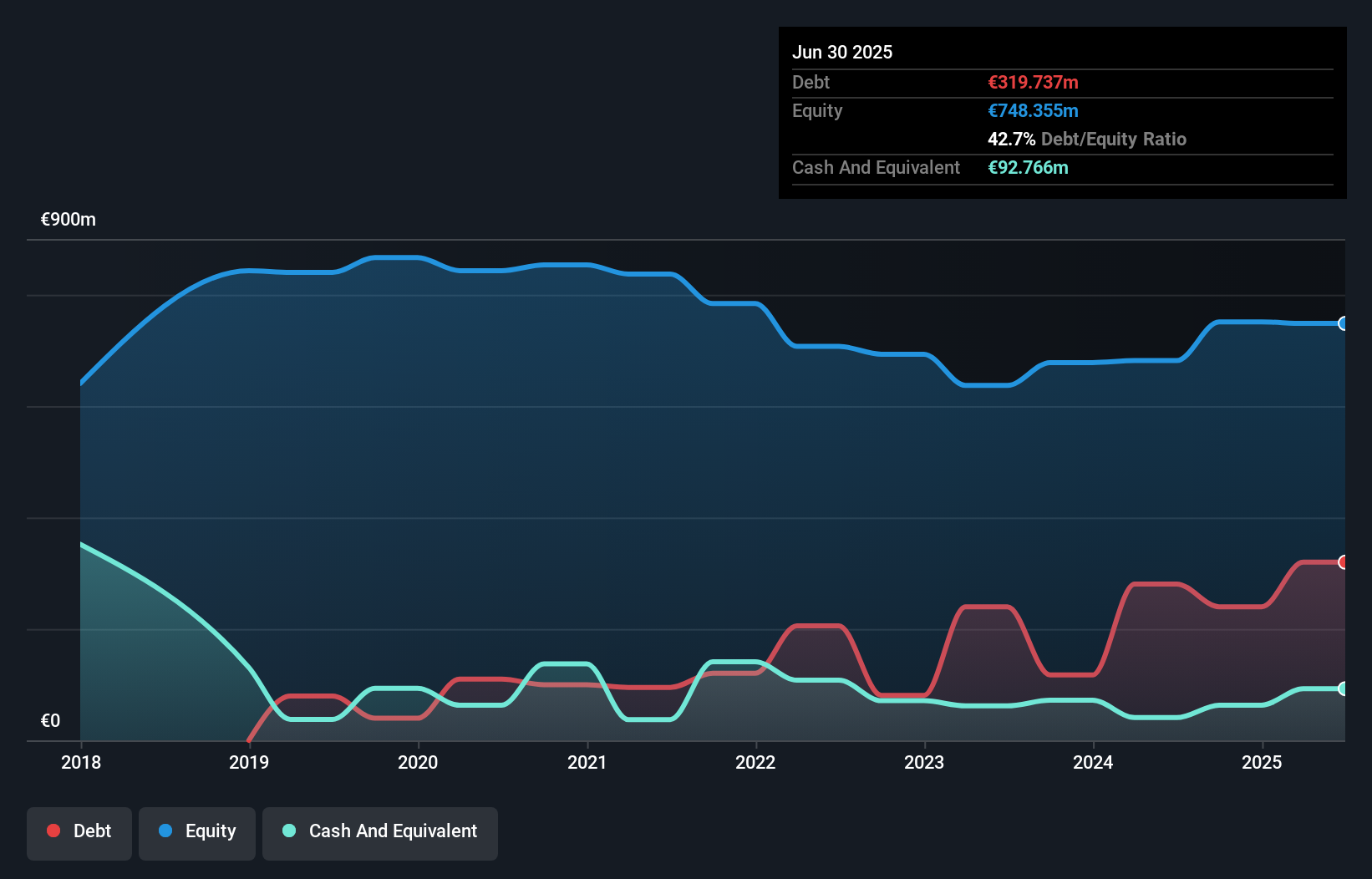

Glenveagh Properties PLC, with a market cap of €893.71 million, has shown stable weekly volatility and experienced management. The company reported half-year sales of €152.19 million and net income of €0.67 million, reflecting some challenges compared to the previous year. Despite this, Glenveagh's earnings have grown over the past five years at 39.8% annually but slowed to 5.1% last year while still outperforming its industry peers' negative growth rates. The company's recent share buyback program aims to return capital by repurchasing up to €50 million in shares, potentially enhancing shareholder value amidst evolving executive leadership changes.

- Jump into the full analysis health report here for a deeper understanding of Glenveagh Properties.

- Learn about Glenveagh Properties' future growth trajectory here.

Guangshen Railway (SEHK:525)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guangshen Railway Company Limited operates in the railway passenger and freight transportation sectors in the People's Republic of China, with a market capitalization of approximately HK$24.22 billion.

Operations: The company's revenue is derived entirely from its operations in China, amounting to CN¥27.05 billion.

Market Cap: HK$24.22B

Guangshen Railway Company Limited, with a market cap of HK$24.22 billion, has demonstrated significant earnings growth over the past year, outpacing both its historical performance and industry averages. The company's revenue for the first nine months of 2024 reached CN¥20.03 billion, with net income increasing to CN¥1.21 billion from the previous year. Despite an unstable dividend track record and a low return on equity of 4.6%, Guangshen's financial health is bolstered by strong cash flow coverage of debt and sufficient short-term assets to cover liabilities. Recent strategic alliances may offer further growth opportunities amidst leadership changes.

- Click to explore a detailed breakdown of our findings in Guangshen Railway's financial health report.

- Examine Guangshen Railway's earnings growth report to understand how analysts expect it to perform.

Greattown Holdings (SHSE:600094)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Greattown Holdings Ltd. operates in the real estate development sector in China with a market capitalization of approximately CN¥8.83 billion.

Operations: The company's revenue is derived entirely from its operations in China, amounting to CN¥5.28 billion.

Market Cap: CN¥8.83B

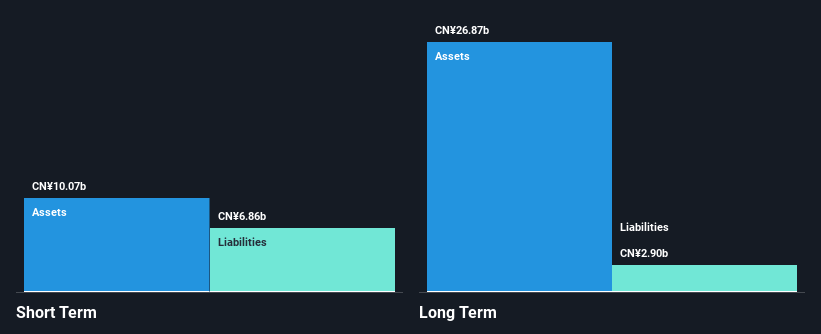

Greattown Holdings Ltd., with a market cap of CN¥8.83 billion, operates in China's real estate sector and faces challenges as it remains unprofitable. Its revenue for the first nine months of 2024 was CN¥3.81 billion, significantly down from CN¥10.23 billion the previous year, with net income dropping to CN¥232.74 million from CN¥645.53 million. Despite reduced debt levels and experienced management and board teams, profitability struggles persist amid declining earnings over five years at an annual rate of 31%. The company's short-term assets comfortably cover both short- and long-term liabilities, providing some financial stability amidst volatility concerns.

- Dive into the specifics of Greattown Holdings here with our thorough balance sheet health report.

- Learn about Greattown Holdings' historical performance here.

Key Takeaways

- Jump into our full catalog of 5,688 Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:GVR

Glenveagh Properties

Glenveagh Properties PLC, together with its subsidiaries, constructs and sells houses and apartments for the private buyers, local authorities, and the private rental sector in Ireland.

Proven track record with adequate balance sheet.