- Ireland

- /

- Consumer Durables

- /

- ISE:GVR

3 European Penny Stocks With Market Caps Under €1B

Reviewed by Simply Wall St

The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by 0.90% as inflation slowed and the European Central Bank eased monetary policy. Amidst these developments, investors are increasingly interested in exploring opportunities within smaller companies that offer potential for growth at lower price points. While the term "penny stocks" might seem outdated, it still captures the essence of investing in smaller or newer companies that can provide value and growth potential when backed by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.66 | SEK274.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.23 | €68.13M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.65 | €17.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.385 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.66 | SEK222.67M | ✅ 2 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.26 | €9.49M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.205 | €304.43M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.964 | €32.28M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 445 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Enapter (DB:H2O)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Enapter AG designs, manufactures, and sells hydrogen generators with a market cap of €79.66 million.

Operations: The company generates €24.82 million in revenue from designing and producing hydrogen generators.

Market Cap: €79.66M

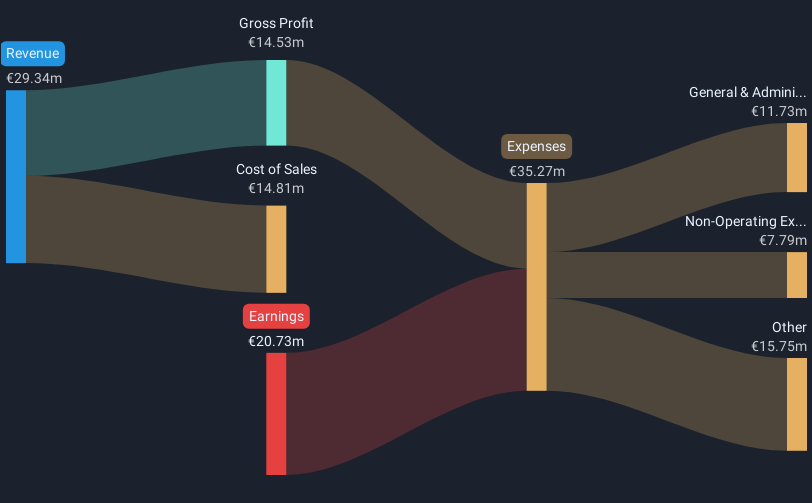

Enapter AG, with a market cap of €79.66 million, is navigating the penny stock landscape by leveraging its advancements in hydrogen production technology. Recent announcements highlight significant efficiency improvements in their AEM megawatt electrolyzers and robust demand, evidenced by a substantial order from Greece. Despite these technological strides, Enapter faces financial challenges, including an increased net loss of €20.73 million for 2024 and auditor concerns about its viability as a going concern. The company's strategic initiatives include AI-driven optimizations and partnerships to enhance product offerings but are counterbalanced by high debt levels and short cash runway forecasts.

- Navigate through the intricacies of Enapter with our comprehensive balance sheet health report here.

- Explore Enapter's analyst forecasts in our growth report.

Glenveagh Properties (ISE:GVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Glenveagh Properties PLC, along with its subsidiaries, focuses on constructing and selling houses and apartments for private buyers, local authorities, and the private rental sector in Ireland, with a market cap of approximately €989.50 million.

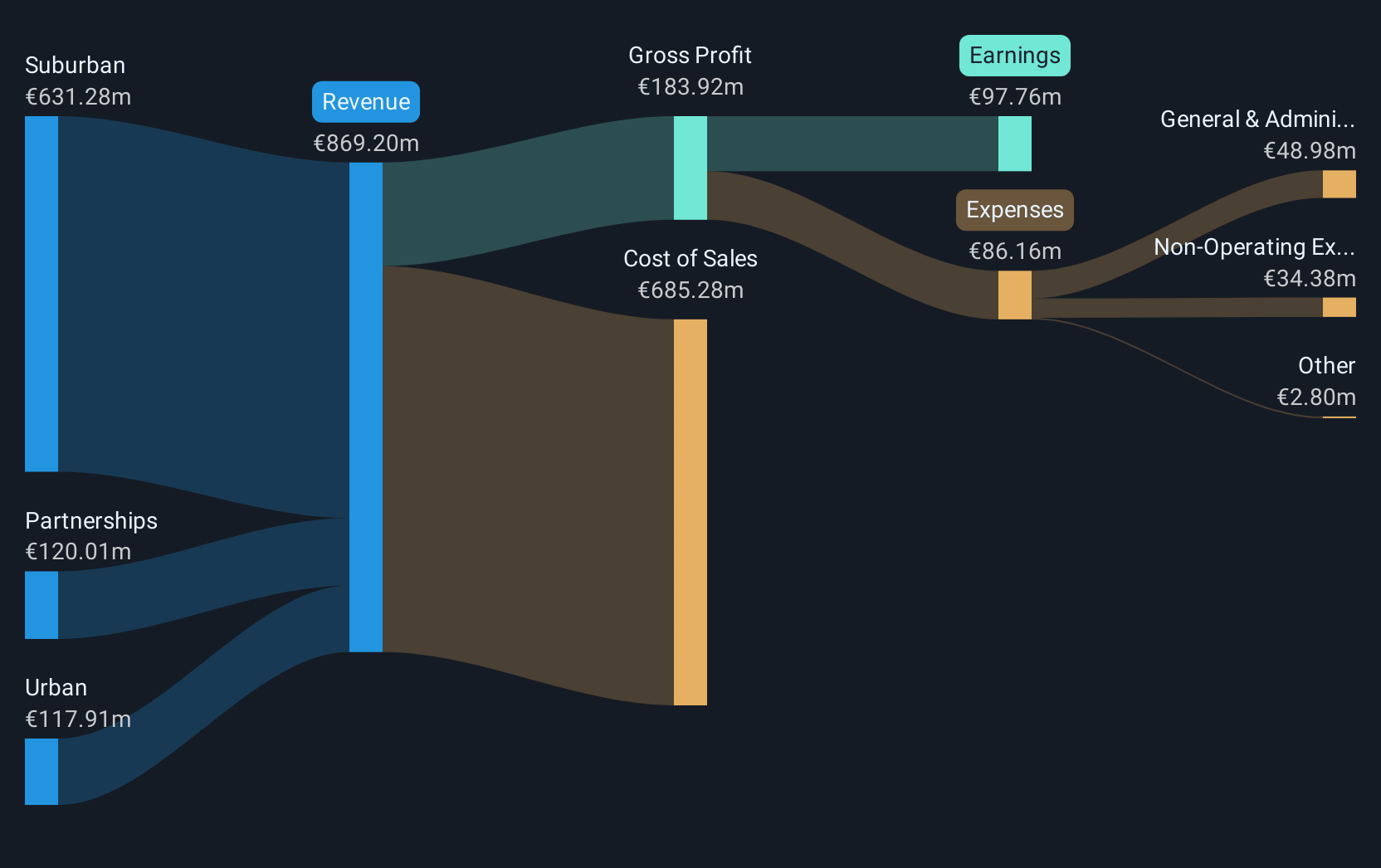

Operations: The company generates revenue through three main segments: Suburban (€631.28 million), Partnerships (€120.01 million), and Urban (€117.91 million).

Market Cap: €989.5M

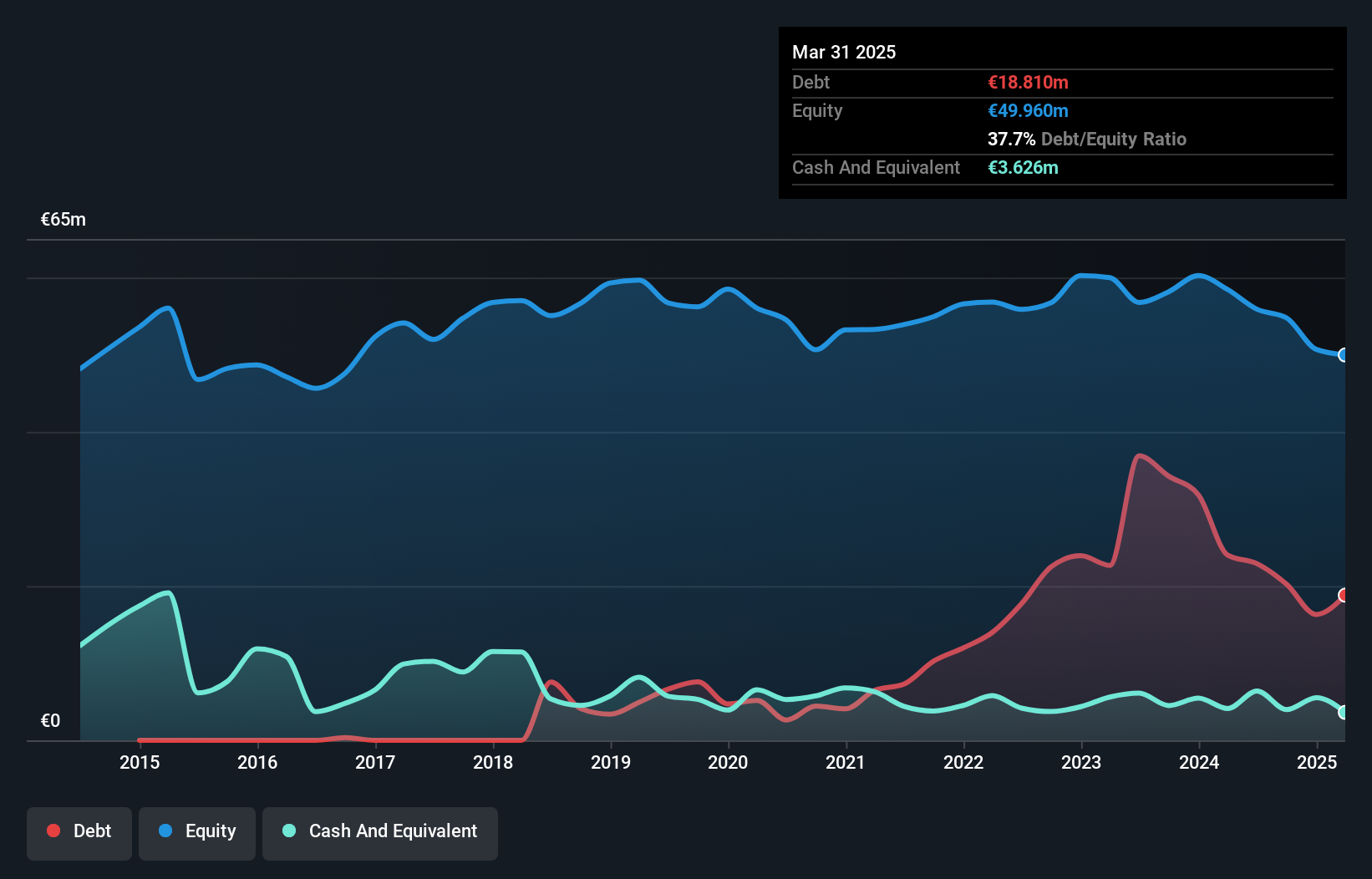

Glenveagh Properties, with a market cap of €989.50 million, is actively expanding its housing and apartment construction business in Ireland. The company has demonstrated strong revenue growth across its Suburban, Partnerships, and Urban segments, with total sales reaching €869.2 million for 2024. Earnings have improved significantly over the past year by 107.5%, supported by stable weekly volatility and satisfactory debt levels with interest well covered by EBIT (6.9x). Recent guidance confirms confidence in delivering 1,500 home units and achieving significant revenue from partnerships in 2025 while maintaining a robust land portfolio strategy and completing share buybacks worth €44.3 million.

- Get an in-depth perspective on Glenveagh Properties' performance by reading our balance sheet health report here.

- Understand Glenveagh Properties' earnings outlook by examining our growth report.

Viscom (XTRA:V6C)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viscom SE develops, manufactures, and sells inspection systems for industrial production applications across Europe, the Americas, and Asia with a market cap of €42.65 million.

Operations: The company's revenue segments include Asia with €28.91 million and the Americas with €12.26 million.

Market Cap: €42.65M

Viscom SE, with a market cap of €42.65 million, has shown resilience despite recent challenges in its financial performance. The company reported first-quarter 2025 revenue of €20.25 million, an increase from the previous year, while reducing its net loss to €0.266 million from €1.96 million a year ago. Viscom's debt is well-covered by operating cash flow (72.6%), and it trades at good value compared to peers and industry standards, though its share price remains highly volatile. Despite being unprofitable with increasing losses over five years, Viscom maintains satisfactory debt levels and strong asset coverage for liabilities.

- Click here and access our complete financial health analysis report to understand the dynamics of Viscom.

- Assess Viscom's future earnings estimates with our detailed growth reports.

Make It Happen

- Gain an insight into the universe of 445 European Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:GVR

Glenveagh Properties

Glenveagh Properties PLC, together with its subsidiaries, constructs and sells houses and apartments for the private buyers, local authorities, and the private rental sector in Ireland.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives