Assessing AIB Group (ISE:A5G) Valuation Following a 77% Share Price Climb

Reviewed by Kshitija Bhandaru

AIB Group (ISE:A5G) shares have shown a steady upward trajectory over the past year, with the stock gaining 77% during that time. Investors are taking notice as the bank continues to post solid long-term returns.

See our latest analysis for AIB Group.

AIB Group’s share price has benefited from positive momentum in recent months, reflecting a mix of consistent results and renewed investor optimism. Supported by a 1-year total shareholder return of 77%, the stock’s performance suggests growing confidence in its outlook.

If you want to see what other financials are catching attention, this is a great opportunity to discover fast growing stocks with high insider ownership

With such impressive gains already on the table, the question now is whether AIB Group is trading at a bargain, or if the market has already factored in its growth prospects and left little room for upside.

Most Popular Narrative: 3.8% Overvalued

With AIB Group now trading above its consensus fair value estimate of €7.61, the narrative suggests shares have run ahead of analyst expectations based on current assumptions. The last close price stands at €7.90, reflecting market optimism that goes beyond what analysts currently project.

The rapid acceleration of digital transformation and branch rationalization presents heightened operational and competitive risk from fintech and big tech challengers. If AIB cannot keep pace with technology change, it risks customer attrition and margin pressure, affecting future revenue and net margin growth.

Curious why analysts think investors might be pricing in tech leadership that could be hard to deliver? There is one major future trend the narrative highlights that could shift the numbers dramatically, but it is not what you’d expect. Could AIB’s digital bets really be worth more than headline financials? Peel back the layers and see what’s driving the math behind this call.

Result: Fair Value of €7.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained economic growth and AIB’s strong digital adoption could drive higher loan demand and profitability. This could potentially challenge the current cautious outlook.

Find out about the key risks to this AIB Group narrative.

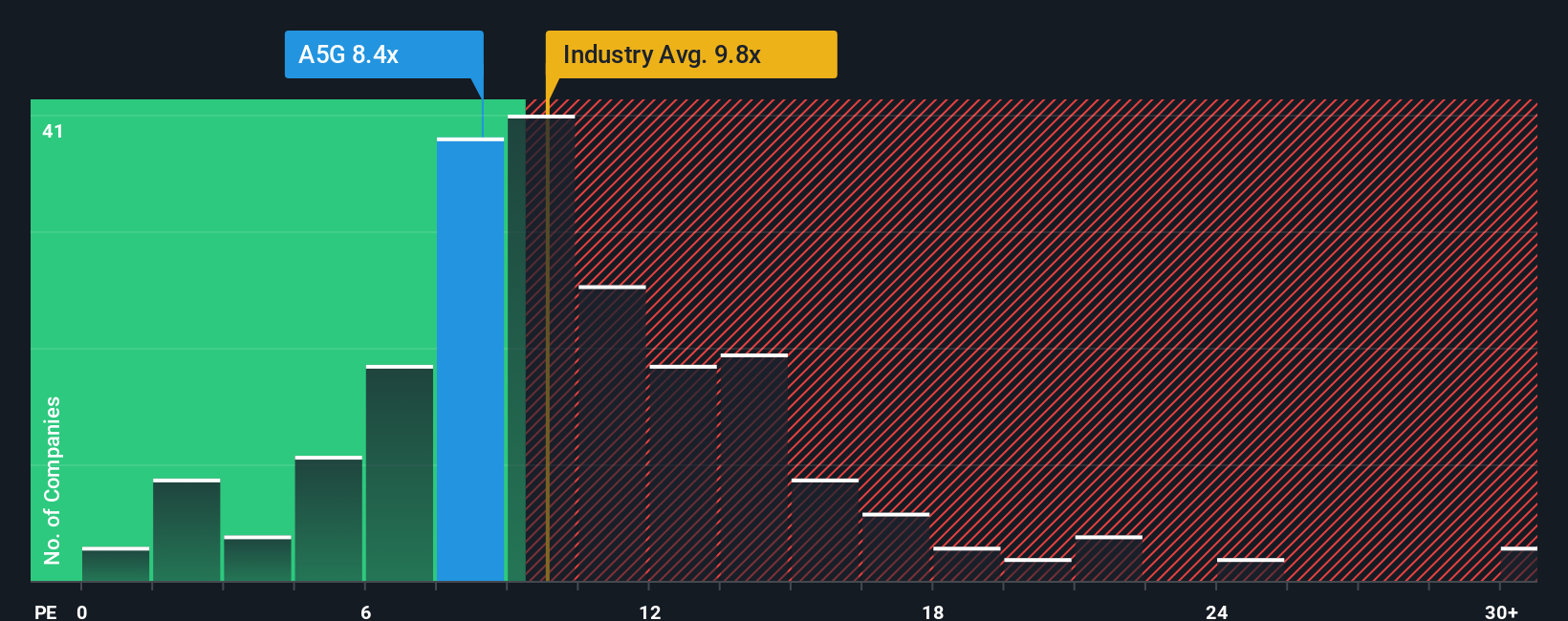

Another View: The Multiples Approach

Looking through another lens, AIB Group trades at a price-to-earnings ratio of 8.1x. This is lower than both the peer average of 12.2x and the European banks industry average of 9.9x. Market pricing also comes in below the company’s fair ratio of 9.6x, which may indicate potential undervaluation if conditions change.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AIB Group Narrative

If you think there is a different story to tell or want to dive deeper into the data, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your AIB Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop searching for their next opportunity, and fresh possibilities are always within reach. Make sure you stay ahead by seizing the trends others might miss.

- Spot high-growth potential and see which companies are redefining financial fundamentals by checking out these 3568 penny stocks with strong financials.

- Tap into the AI revolution and power up your portfolio with businesses at the forefront by investigating these 24 AI penny stocks.

- Catch value opportunities before they are widely recognized by seeking out these 909 undervalued stocks based on cash flows that the market hasn’t fully appreciated yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:A5G

AIB Group

Provides banking and financial products and services to retail, business, and corporate customers in the Republic of Ireland, the United Kingdom, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives