- Croatia

- /

- Communications

- /

- ZGSE:ERNT

Ericsson Nikola Tesla d.d's (ZGSE:ERNT) Dividend Will Be Increased To €15.00

Ericsson Nikola Tesla d.d.'s (ZGSE:ERNT) dividend will be increasing from last year's payment of the same period to €15.00 on 17th of July. This will take the dividend yield to an attractive 4.8%, providing a nice boost to shareholder returns.

View our latest analysis for Ericsson Nikola Tesla d.d

Ericsson Nikola Tesla d.d Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, Ericsson Nikola Tesla d.d's dividend was comfortably covered by both cash flow and earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

EPS is set to grow by 14.2% over the next year if recent trends continue. If the dividend continues on its recent course, the payout ratio in 12 months could be 96%, which is a bit high and could start applying pressure to the balance sheet.

Dividend Volatility

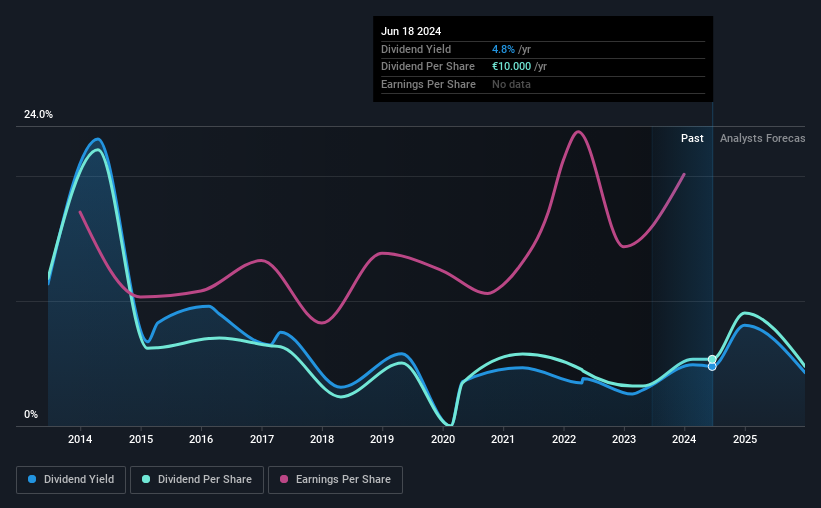

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2014, the annual payment back then was €22.13, compared to the most recent full-year payment of €10.00. This works out to be a decline of approximately 7.6% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. We are encouraged to see that Ericsson Nikola Tesla d.d has grown earnings per share at 14% per year over the past three years. Shareholders are getting plenty of the earnings returned to them, which combined with strong growth makes this quite appealing.

Ericsson Nikola Tesla d.d Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All of these factors considered, we think this has solid potential as a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Ericsson Nikola Tesla d.d that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Ericsson Nikola Tesla d.d might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ZGSE:ERNT

Ericsson Nikola Tesla d.d

Provides communication products, solutions, and software in the Republic of Croatia, Bosnia and Herzegovina, and Central and Eastern Europe.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives