The Market Doesn't Like What It Sees From Granolio d.d.'s (ZGSE:GRNL) Earnings Yet

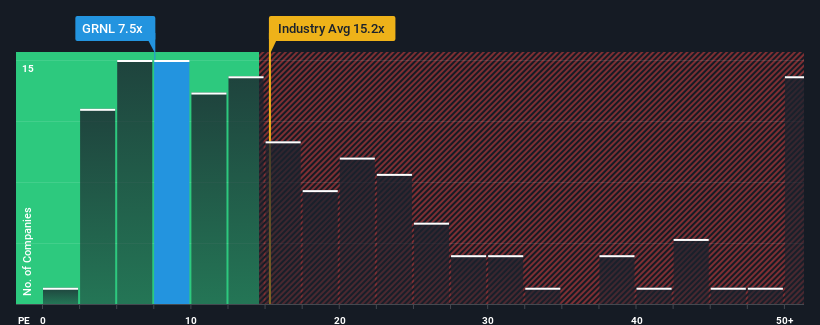

Granolio d.d.'s (ZGSE:GRNL) price-to-earnings (or "P/E") ratio of 7.5x might make it look like a buy right now compared to the market in Croatia, where around half of the companies have P/E ratios above 15x and even P/E's above 24x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For instance, Granolio d.d's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Granolio d.d

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Granolio d.d would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 56%. The last three years don't look nice either as the company has shrunk EPS by 65% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to decline by 9.2% over the next year, or less than the company's recent medium-term annualised earnings decline.

With this information, it's not too hard to see why Granolio d.d is trading at a lower P/E in comparison. However, when earnings shrink rapidly P/E often shrinks too, which could set up shareholders for future disappointment regardless. Even just maintaining these prices will be difficult to achieve as recent earnings trends are already weighing down the shares heavily.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Granolio d.d maintains its low P/E on the weakness of its recent three-year earnings being even worse than the forecasts for a struggling market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Although, we would be concerned whether the company can even maintain its medium-term level of performance under these tough market conditions. In the meantime, unless the company's relative performance improves, the share price will hit a barrier around these levels.

Having said that, be aware Granolio d.d is showing 4 warning signs in our investment analysis, and 1 of those can't be ignored.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:GRNL

Granolio d.d

Engages in the production and sale of food, milk, agricultural products, and dairy products in Croatia and internationally.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives