- Croatia

- /

- Construction

- /

- ZGSE:DLKV

Revenues Tell The Story For Dalekovod d.d. (ZGSE:DLKV) As Its Stock Soars 25%

Despite an already strong run, Dalekovod d.d. (ZGSE:DLKV) shares have been powering on, with a gain of 25% in the last thirty days. The annual gain comes to 157% following the latest surge, making investors sit up and take notice.

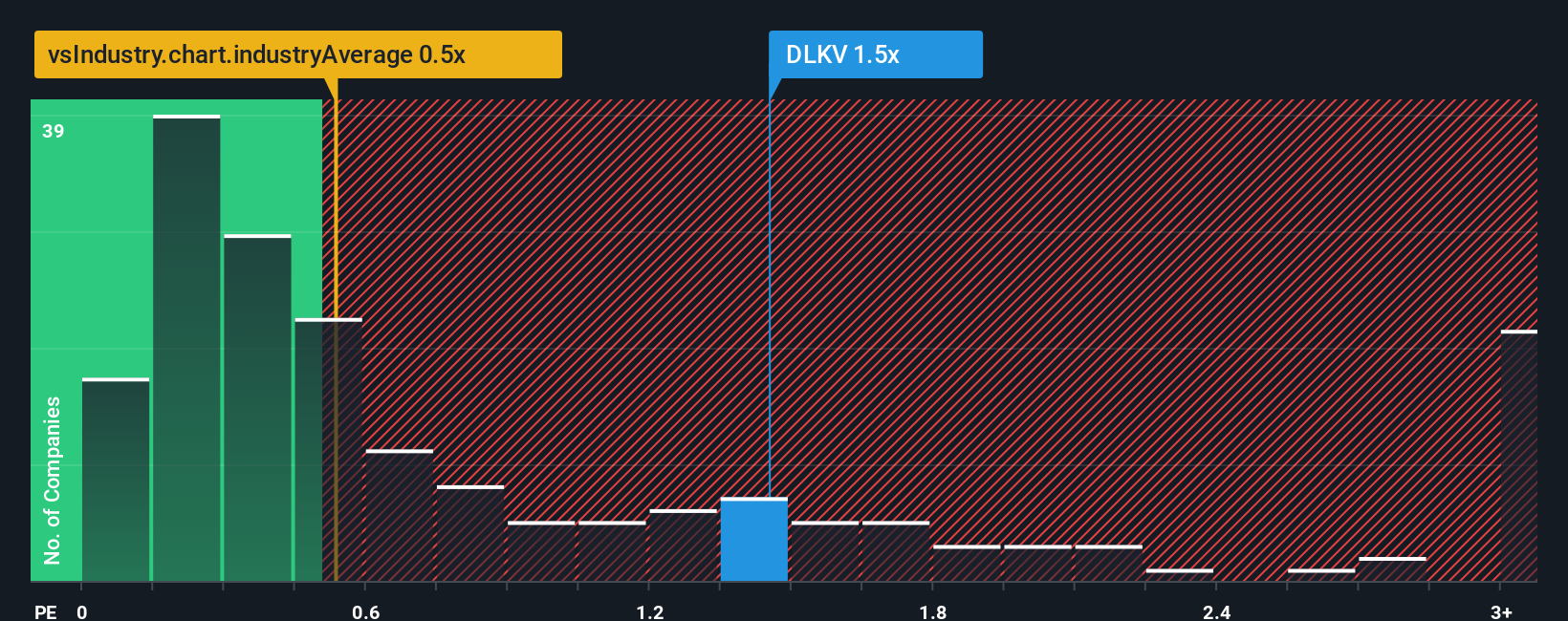

Following the firm bounce in price, given close to half the companies operating in Croatia's Construction industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Dalekovod d.d as a stock to potentially avoid with its 1.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Dalekovod d.d

What Does Dalekovod d.d's P/S Mean For Shareholders?

Revenue has risen firmly for Dalekovod d.d recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Dalekovod d.d's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Dalekovod d.d?

The only time you'd be truly comfortable seeing a P/S as high as Dalekovod d.d's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. As a result, it also grew revenue by 28% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 5.3% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why Dalekovod d.d's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Dalekovod d.d's P/S?

The large bounce in Dalekovod d.d's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Dalekovod d.d revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Dalekovod d.d you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:DLKV

Dalekovod d.d

Engages in the design, engineering, production, construction, and installation of electric power facilities, facilities for road, railroad and mass transit, and telecommunication infrastructure in Croatia, Sweden, Norway, Slovenia, Germany, Ukraine, the United Kingdom, Northern Macedonia, Bosnia and Herzegovina, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success