- Croatia

- /

- Auto Components

- /

- ZGSE:ADPL

The 10% return this week takes AD Plastik d.d's (ZGSE:ADPL) shareholders one-year gains to 94%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. For example, the AD Plastik d.d. (ZGSE:ADPL) share price is up 94% in the last 1 year, clearly besting the market return of around 25% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! And shareholders have also done well over the long term, with an increase of 80% in the last three years.

The past week has proven to be lucrative for AD Plastik d.d investors, so let's see if fundamentals drove the company's one-year performance.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

AD Plastik d.d went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

We think that the revenue growth of 4.3% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

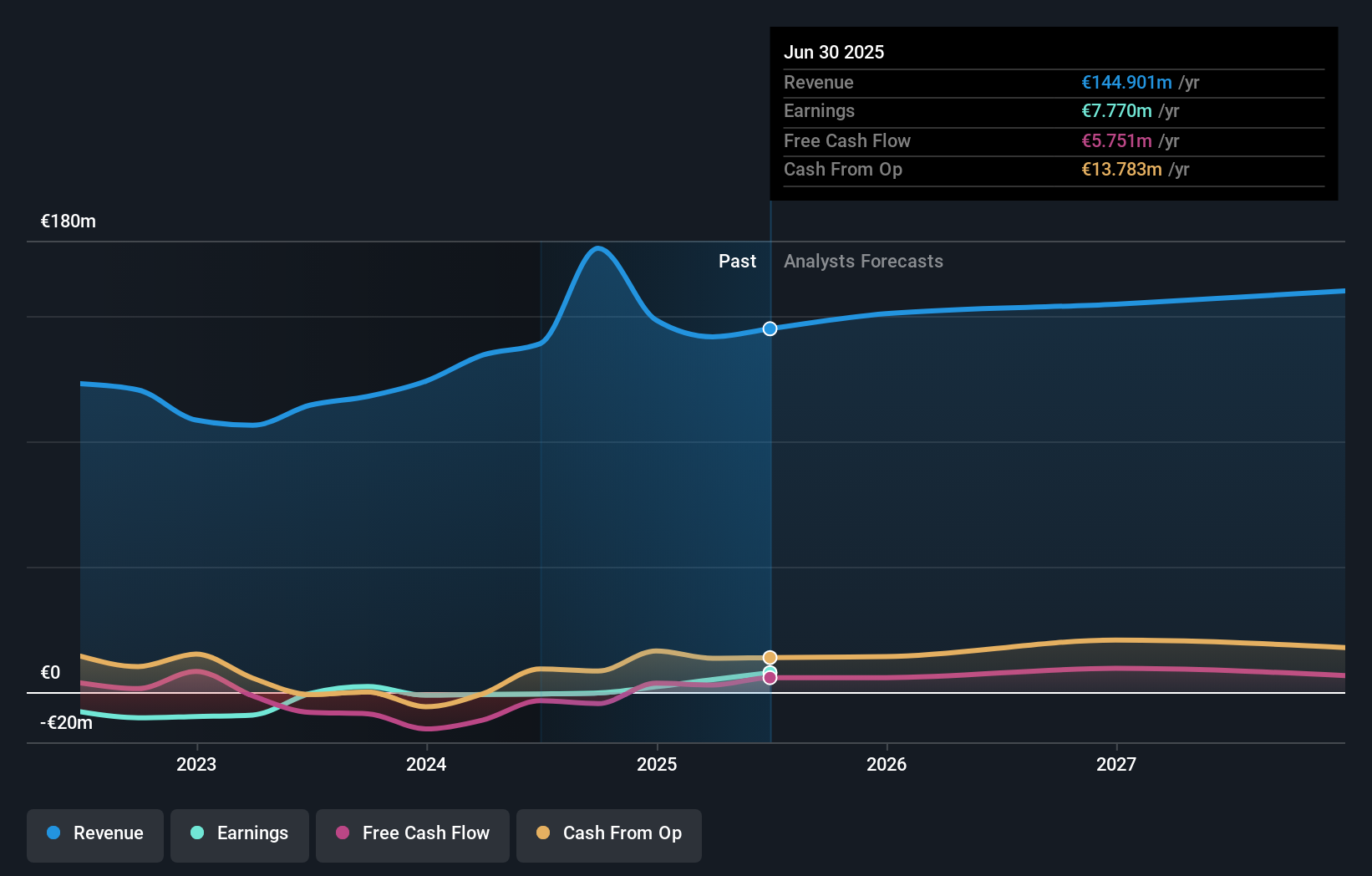

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that AD Plastik d.d has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that AD Plastik d.d has rewarded shareholders with a total shareholder return of 94% in the last twelve months. That gain is better than the annual TSR over five years, which is 4%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand AD Plastik d.d better, we need to consider many other factors. For instance, we've identified 2 warning signs for AD Plastik d.d (1 is significant) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Croatian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:ADPL

AD Plastik d.d

Develops, produces, and sells interior and exterior automotive components in Slovenia, Romania, Russia, France, Hungary, Italy, the United Kingdom, Germany, Spain, Serbia, Czech Republic, Vietnam, Slovakia, Croatia, Poland, the United States, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives