- Hong Kong

- /

- Water Utilities

- /

- SEHK:6136

Kangda International Environmental (HKG:6136) Has No Shortage Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Kangda International Environmental Company Limited (HKG:6136) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Kangda International Environmental

What Is Kangda International Environmental's Net Debt?

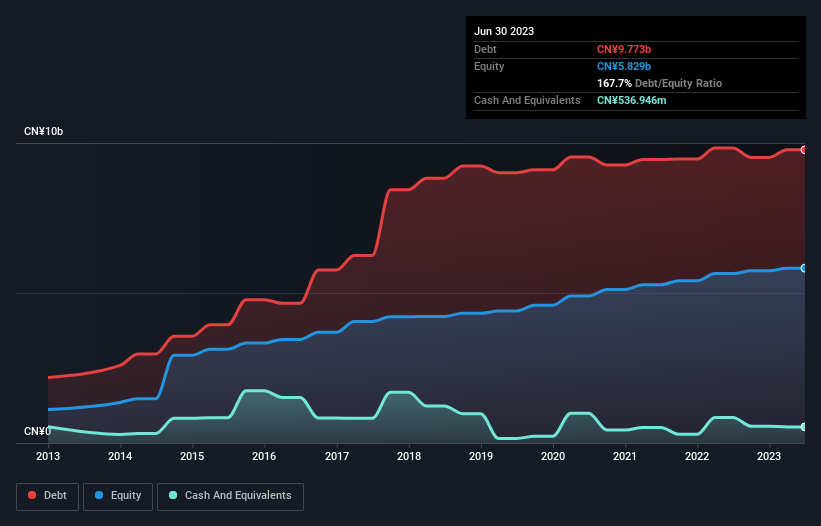

As you can see below, Kangda International Environmental had CN¥9.77b of debt, at June 2023, which is about the same as the year before. You can click the chart for greater detail. However, it does have CN¥536.9m in cash offsetting this, leading to net debt of about CN¥9.24b.

A Look At Kangda International Environmental's Liabilities

Zooming in on the latest balance sheet data, we can see that Kangda International Environmental had liabilities of CN¥5.44b due within 12 months and liabilities of CN¥7.88b due beyond that. Offsetting this, it had CN¥536.9m in cash and CN¥4.83b in receivables that were due within 12 months. So it has liabilities totalling CN¥7.96b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the CN¥490.8m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Kangda International Environmental would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Kangda International Environmental shareholders face the double whammy of a high net debt to EBITDA ratio (10.9), and fairly weak interest coverage, since EBIT is just 1.4 times the interest expense. This means we'd consider it to have a heavy debt load. Even worse, Kangda International Environmental saw its EBIT tank 27% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Kangda International Environmental's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Kangda International Environmental's free cash flow amounted to 21% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both Kangda International Environmental's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And furthermore, its interest cover also fails to instill confidence. We should also note that Water Utilities industry companies like Kangda International Environmental commonly do use debt without problems. We think the chances that Kangda International Environmental has too much debt a very significant. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 5 warning signs with Kangda International Environmental (at least 2 which are significant) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Kangda International Environmental might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6136

Kangda International Environmental

An investment holding company, engages in the urban water treatment, water environment comprehensive remediation, and rural water improvement businesses in Mainland China.

Good value with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success