- Hong Kong

- /

- Renewable Energy

- /

- SEHK:579

Beijing Jingneng Clean Energy (SEHK:579): Expanding Margins Reinforce Investor Optimism Despite Slower Growth

Reviewed by Simply Wall St

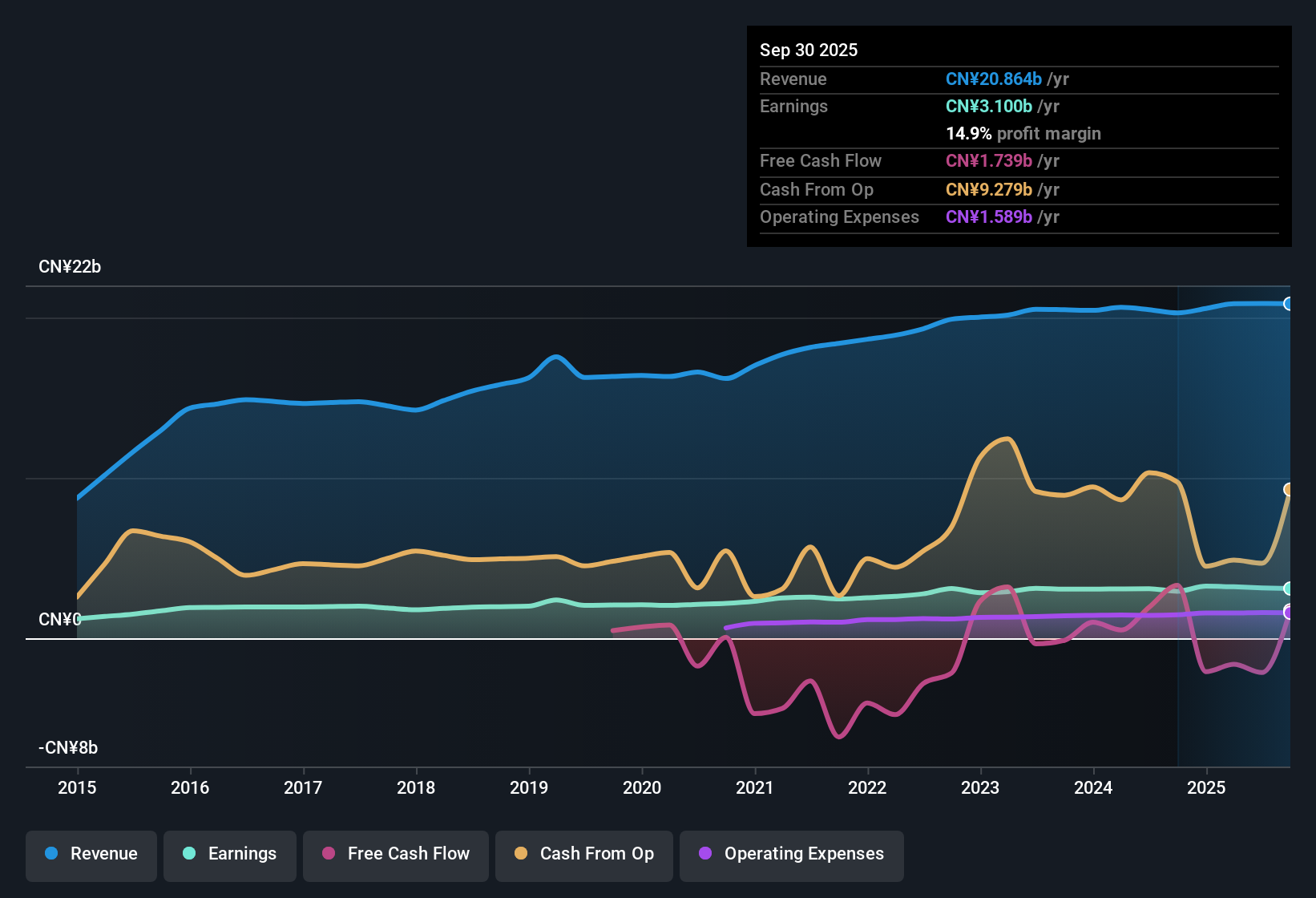

Beijing Jingneng Clean Energy (SEHK:579) posted stable earnings, with average earnings growth of 6.5% per year over the past five years and net profit margins improving from 14.4% to 14.9%. Earnings growth for the most recent year came in at 5.8%, slightly below the company’s longer-term pace. Future earnings are forecast to increase 8.43% per year and revenue is expected to grow at 3.7% per year. Investors will likely focus on the company’s steady profit and revenue performance, as well as modest improvement in margins.

See our full analysis for Beijing Jingneng Clean Energy.The next section will compare these results with current market narratives, highlighting where the numbers reinforce the story and where they may shift investor perspectives.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Edge Higher Despite Slower Top-Line Growth

- Net profit margins rose to 14.9% from 14.4%. This occurred even as annual earnings growth (5.8%) lagged the company’s historical 6.5% average pace.

- Sustained margin expansion supports the view that current government incentives for renewables, combined with Beijing Jingneng Clean Energy’s asset mix, remain effective in shielding profitability during sector-wide challenges.

- While there have been concerns about project delays potentially squeezing profits, profit margins actually improved. This reflects the company’s operational resilience.

- Bulls have highlighted the stability of earnings quality when margins improve, especially as the sector faces cost headwinds and rising competition.

Valuation Discount Versus Industry Remains Wide

- The stock trades at 6x price-to-earnings, a steep discount to the Asian Renewable Energy industry’s 17.2x average and its peer group’s 7.8x. The current share price (HK$2.48) sits well above the DCF fair value of HK$1.01.

- This valuation gap presents a mixed picture. Supportive dividend attributes and steady profit growth help underpin sentiment, but slower forecast revenue and earnings growth relative to the broader Hong Kong market keep some investors on the sidelines.

- Strong profitability and good relative value suggest potential for a rerating. However, the sizable premium over DCF fair value indicates that some bulls may be anticipating longer-term policy momentum or further margin gains that have not yet materialized.

- With forecasted annual earnings and revenue growth both trailing the wider market, bears may focus on the potential for sentiment to turn if the market’s forward outlook fails to meet expectations already reflected in the price.

Minor Financial Position Risks Stand Out

- No major risks have been flagged from recent data. However, there is a caution regarding the company’s financial position, which trails some peers despite steady profit and revenue trends.

- The prevailing analysis notes that modest leverage and sector competition could limit flexibility for new projects if external conditions tighten.

- Consistent growth and margin maintenance help offset these concerns, but the company’s ability to keep up with larger or better-capitalized peers is worth monitoring if cost pressures or delays emerge.

- The lack of major red flags means investors’ focus shifts primarily to day-to-day execution and policy support rather than acute financial stress.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Beijing Jingneng Clean Energy's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite stable margins and earnings, Beijing Jingneng Clean Energy’s weaker balance sheet and modest leverage could restrain flexibility if external conditions worsen.

If a stronger financial position is what you want, check out solid balance sheet and fundamentals stocks screener (1973 results) for companies with robust balance sheets built to weather uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jingneng Clean Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:579

Beijing Jingneng Clean Energy

Generates gas-fired power and heat energy, wind power, photovoltaic power, and hydropower in Mainland China and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives