- Hong Kong

- /

- Renewable Energy

- /

- SEHK:412

Investing in Shandong Hi-Speed Holdings Group (HKG:412) five years ago would have delivered you a 574% gain

Buying shares in the best businesses can build meaningful wealth for you and your family. While the best companies are hard to find, but they can generate massive returns over long periods. To wit, the Shandong Hi-Speed Holdings Group Limited (HKG:412) share price has soared 574% over five years. If that doesn't get you thinking about long term investing, we don't know what will. In more good news, the share price has risen 12% in thirty days. Anyone who held for that rewarding ride would probably be keen to talk about it.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for Shandong Hi-Speed Holdings Group

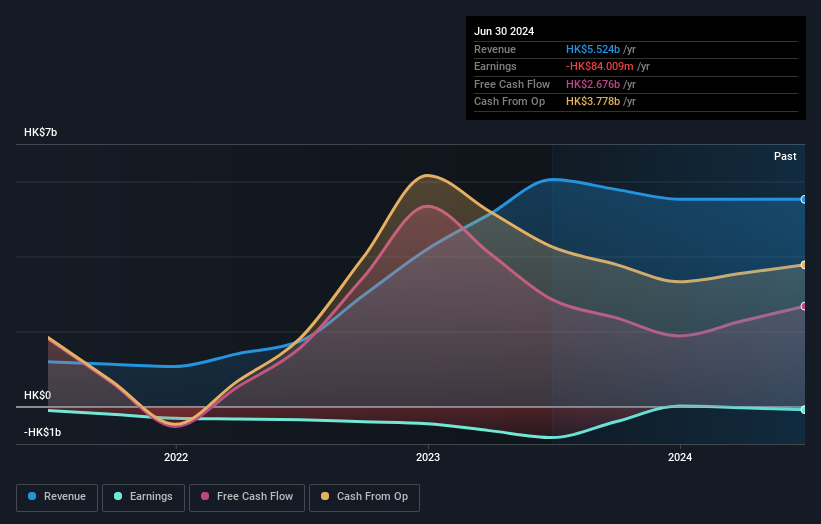

Given that Shandong Hi-Speed Holdings Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Shandong Hi-Speed Holdings Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 25% in the last year, Shandong Hi-Speed Holdings Group shareholders lost 4.0%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 46%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You could get a better understanding of Shandong Hi-Speed Holdings Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Shandong Hi-Speed Holdings Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:412

Shandong Hi-Speed Holdings Group

An investment holding company, operates photovoltaic and wind power plants in the People’s Republic of China.

Slight risk with questionable track record.

Similar Companies

Market Insights

Community Narratives