- Hong Kong

- /

- Water Utilities

- /

- SEHK:270

Did Leadership Changes and Rising Earnings Just Shift Guangdong Investment’s (SEHK:270) Investment Narrative?

Reviewed by Sasha Jovanovic

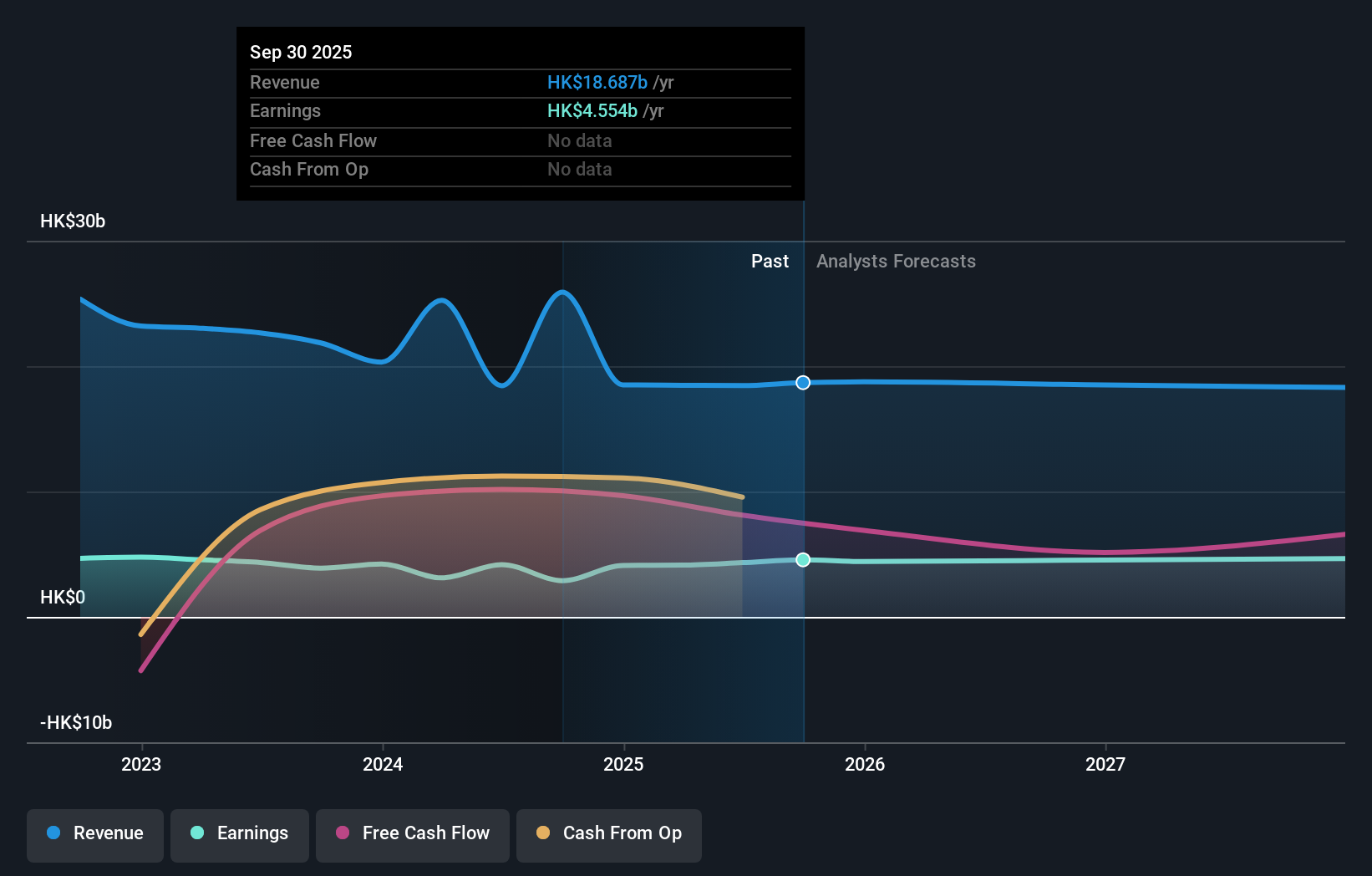

- Guangdong Investment Limited recently announced the appointment of Mr. He Zhifeng as a new Non-Executive Director, alongside the resignation of Ms. Wang Surong, and reported improved earnings for the nine months ended September 30, 2025, with sales and net income both higher year-over-year.

- Mr. He's extensive background across various subsidiaries of Guangdong Holdings, the company's controlling shareholder, signals deep connections with the group’s leadership and investment activities.

- We'll explore how Guangdong Investment's recent leadership changes and its higher net income shape the company's broader investment story.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Guangdong Investment's Investment Narrative?

At its core, Guangdong Investment appeals to those who see value in stable utility assets, profit generation, and the group's strong ties to its state-owned parent. The steady rise in net income reported for the nine months to September 2025 reinforces this view, even as expectations point to flat or slightly declining revenue growth ahead. The appointment of Mr. He Zhifeng as Non-Executive Director further deepens connections with Guangdong Holdings, but for most investors, this leadership shuffle is unlikely to alter the important near-term catalysts or shift fundamental risks. The key concerns remain: an extensive director turnover, forecast low return on equity, lingering questions about dividend sustainability, and earnings growth running noticeably below the broader Hong Kong market. Ultimately, the latest board moves may steady the ship, but don't significantly change the underlying risk profile.

But, fewer than half the directors are independent, a point investors should keep in mind. Guangdong Investment's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Guangdong Investment - why the stock might be worth just HK$8.01!

Build Your Own Guangdong Investment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guangdong Investment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Guangdong Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guangdong Investment's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:270

Guangdong Investment

An investment holding company, engages in water resources, property investment and development, department store operation, hotel ownership, energy project operation and management, and road and bridge operation businesses.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives