- Hong Kong

- /

- Renewable Energy

- /

- SEHK:2380

Should Leadership Change and Sales Decline Prompt a Strategic Rethink at China Power (SEHK:2380)?

Reviewed by Sasha Jovanovic

- China Power International Development recently announced that President Mr. Gao Ping has resigned and will be succeeded by Mr. Zhao Yonggang, an experienced industry executive, with the change effective from October 30, 2025.

- This leadership transition follows the company's disclosure of a year-on-year decline in electricity sales for both September and the first nine months of 2025, highlighting operational challenges amid management changes.

- We'll explore how the combination of leadership succession and lower sales volumes could reshape China Power International Development's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is China Power International Development's Investment Narrative?

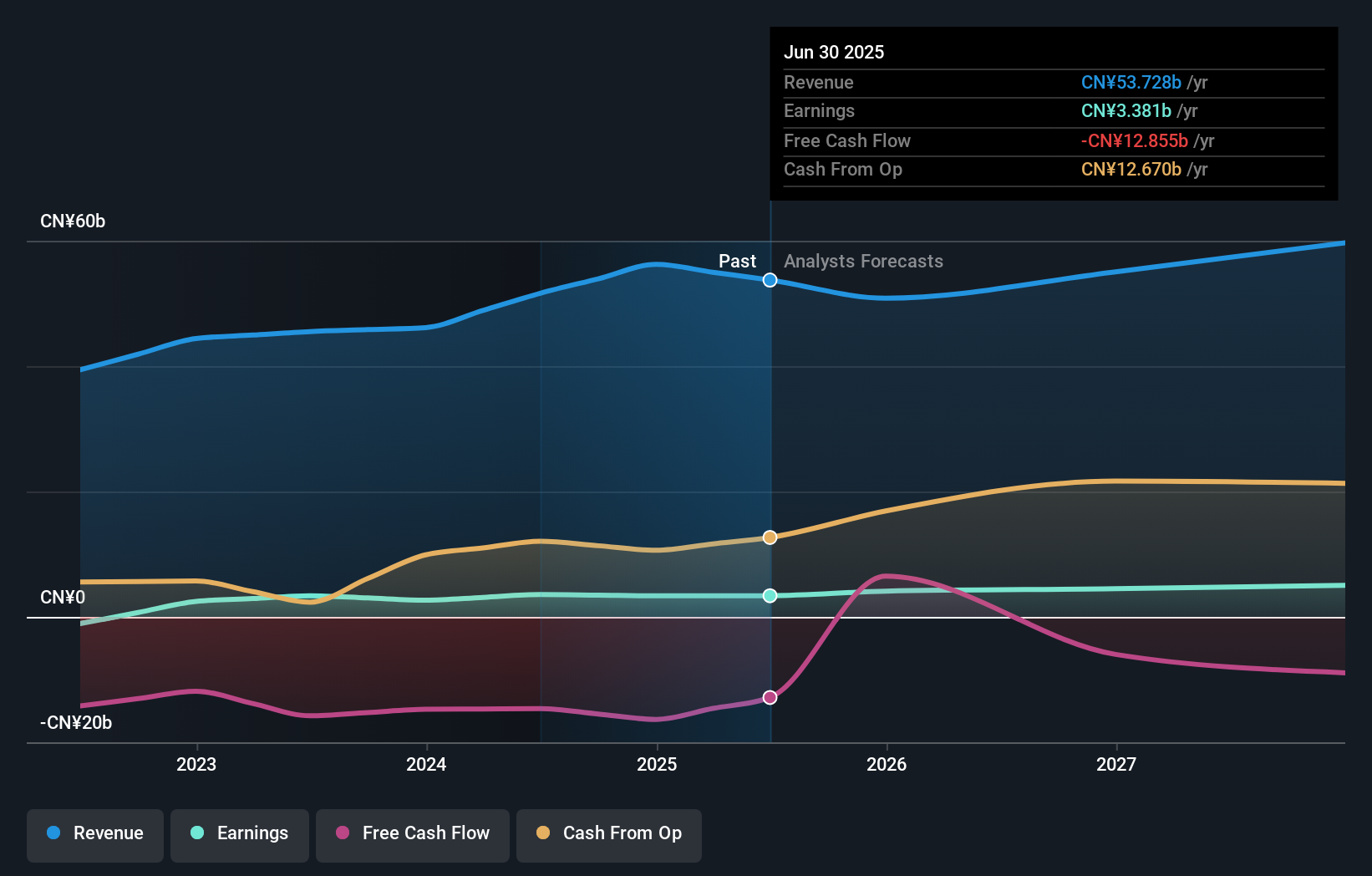

To believe in China Power International Development, an investor needs confidence in its ability to deliver stable returns through its diverse and growing renewable projects, while managing industry volatility and capital demands. The sudden leadership change, Mr. Gao Ping’s resignation and Mr. Zhao Yonggang’s appointment as President, comes right as the company disclosed a year-on-year drop in electricity sales for both September and the first nine months of 2025. This shift may affect short-term catalysts like near-term earnings momentum and operational strategies, with the immediate risk that management inexperience could slow strategic execution or disrupt investor confidence. The board’s recent turnover adds to these uncertainties, especially when paired with only moderate revenue growth and pressure on dividend sustainability. Market reactions so far have been measured, but investors should watch closely to see if the new management can address softer sales and governance concerns in the quarters ahead. On the other hand, shifting board experience could present challenges not reflected in recent results.

China Power International Development's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on China Power International Development - why the stock might be worth as much as 6% more than the current price!

Build Your Own China Power International Development Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Power International Development research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Power International Development research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Power International Development's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2380

China Power International Development

An investment holding company, develops, constructs, owns, operates, and manages power plants in the People’s Republic of China and internationally.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives