- Hong Kong

- /

- Water Utilities

- /

- SEHK:1542

Does Taizhou Water Group (HKG:1542) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Taizhou Water Group Co., Ltd. (HKG:1542) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Taizhou Water Group

What Is Taizhou Water Group's Net Debt?

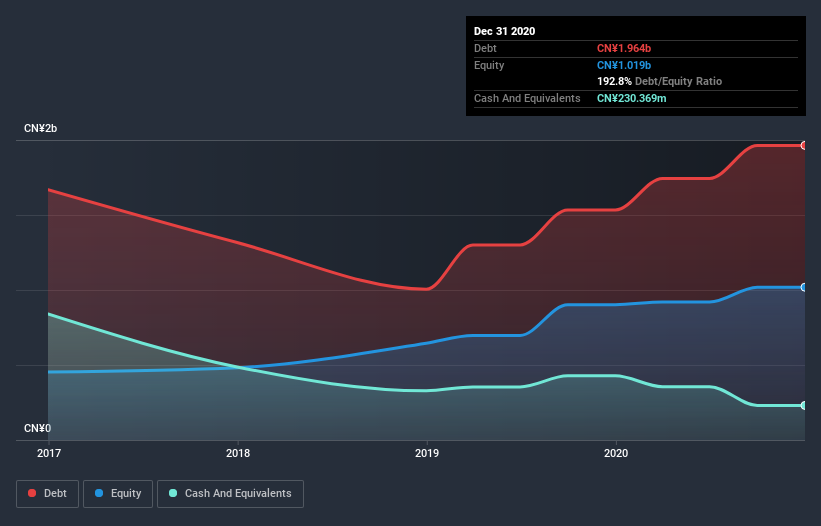

The image below, which you can click on for greater detail, shows that at December 2020 Taizhou Water Group had debt of CN¥1.96b, up from CN¥1.53b in one year. However, it does have CN¥230.4m in cash offsetting this, leading to net debt of about CN¥1.73b.

How Strong Is Taizhou Water Group's Balance Sheet?

According to the last reported balance sheet, Taizhou Water Group had liabilities of CN¥442.2m due within 12 months, and liabilities of CN¥2.04b due beyond 12 months. Offsetting these obligations, it had cash of CN¥230.4m as well as receivables valued at CN¥101.6m due within 12 months. So it has liabilities totalling CN¥2.15b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CN¥548.9m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Taizhou Water Group would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

As it happens Taizhou Water Group has a fairly concerning net debt to EBITDA ratio of 8.4 but very strong interest coverage of 15.9. So either it has access to very cheap long term debt or that interest expense is going to grow! We saw Taizhou Water Group grow its EBIT by 7.1% in the last twelve months. That's far from incredible but it is a good thing, when it comes to paying off debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Taizhou Water Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Taizhou Water Group saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Taizhou Water Group's conversion of EBIT to free cash flow left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its interest cover is a good sign, and makes us more optimistic. We should also note that Water Utilities industry companies like Taizhou Water Group commonly do use debt without problems. Overall, it seems to us that Taizhou Water Group's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example Taizhou Water Group has 3 warning signs (and 1 which can't be ignored) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Taizhou Water Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taizhou Water Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1542

Taizhou Water Group

Engages in supplying raw water, municipal water, pipeline direct drinking water, packaged drinking water, and tap water directly to end-users in Mainland China.

Low risk and slightly overvalued.

Market Insights

Community Narratives