- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1193

Can China Resources Gas Group’s Latest Board Appointment Strengthen Governance for Investors in SEHK:1193?

Reviewed by Sasha Jovanovic

- China Resources Gas Group Limited recently announced the appointment of Mr. ZHANG Shenwen as a non-executive director and member of the Audit and Risk Management Committee, while also proposing the adoption of new Articles of Association.

- Mr. ZHANG brings decades of corporate management and investment expertise from various senior positions within China Resources Group, which may signal an increased emphasis on governance and risk oversight at the company.

- We'll explore how Mr. ZHANG's appointment and the proposed bylaw changes could shape China Resources Gas Group's investment appeal going forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is China Resources Gas Group's Investment Narrative?

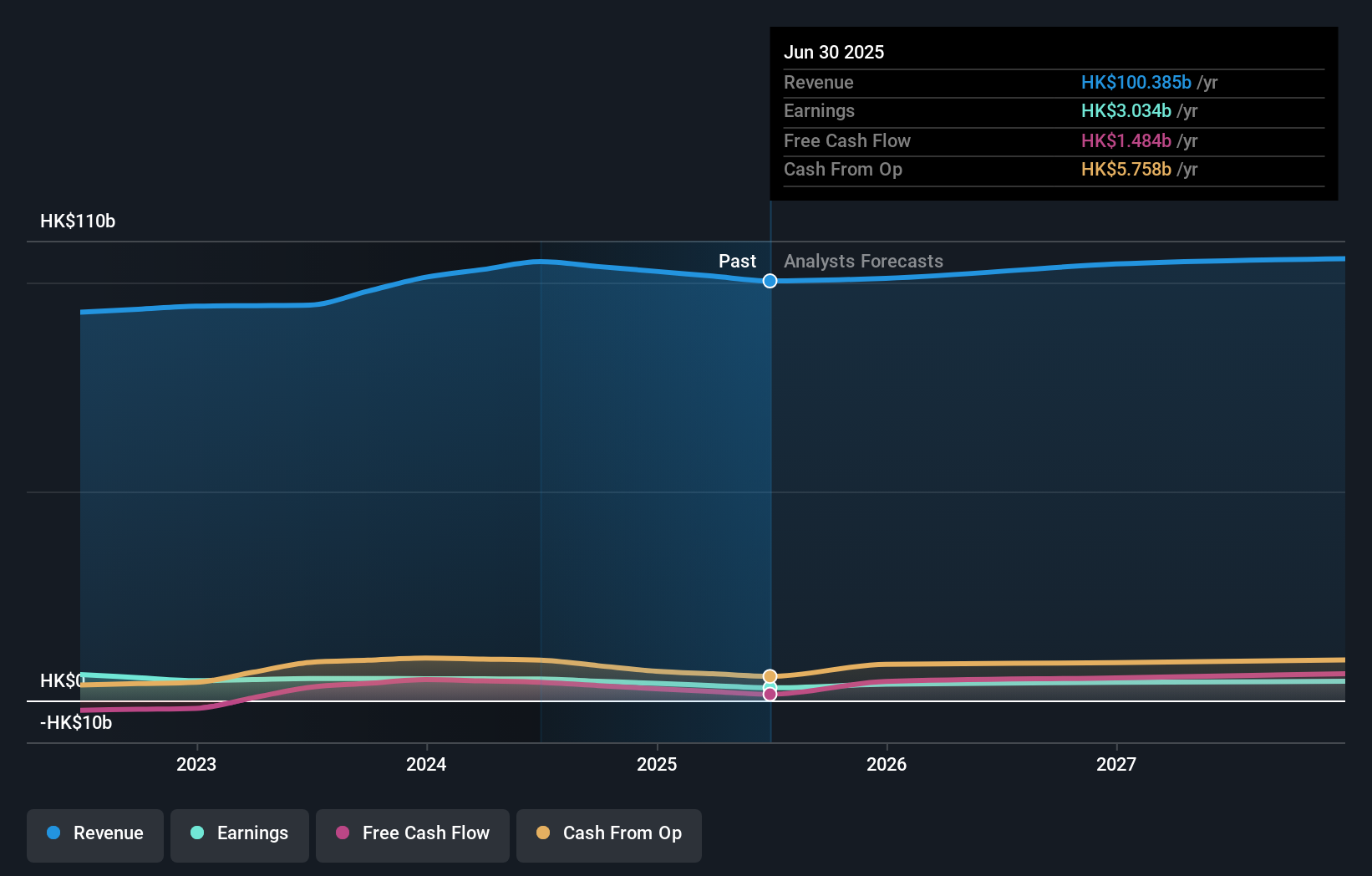

To believe in China Resources Gas Group as a shareholder, you’d need confidence in its ability to navigate slower revenue growth, underperformance versus the Hong Kong market, and pressure on profit margins, while delivering steady dividends and improving governance. The recent board additions, especially Mr. ZHANG Shenwen joining as non-executive director and Audit and Risk Management Committee member, come at a time when board stability and governance have been under scrutiny given high director turnover and a relatively inexperienced board. The proposal to adopt new Articles of Association could bring more robust oversight, but given the company’s lack of immediate catalysts and earnings forecasts already priced in, these changes may not be material to near-term performance. The company’s forecast for modest annual profit growth continues to be offset by risks around dividend sustainability and below-industry revenue gains, even with the new governance measures in motion.

However, most investors may not realize how persistent the company’s board turnover risk remains.

Exploring Other Perspectives

Explore 2 other fair value estimates on China Resources Gas Group - why the stock might be worth just HK$21.68!

Build Your Own China Resources Gas Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Resources Gas Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Resources Gas Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Resources Gas Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1193

China Resources Gas Group

An investment holding company, engages in the sale of natural and liquefied gas and connection of gas pipelines.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives