- Hong Kong

- /

- Water Utilities

- /

- SEHK:1026

Shareholders in Universal Technologies Holdings (HKG:1026) have lost 73%, as stock drops 11% this past week

As every investor would know, not every swing hits the sweet spot. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Universal Technologies Holdings Limited (HKG:1026) investors who have held the stock for three years as it declined a whopping 73%. That'd be enough to cause even the strongest minds some disquiet. And the ride hasn't got any smoother in recent times over the last year, with the price 42% lower in that time. Furthermore, it's down 56% in about a quarter. That's not much fun for holders.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Universal Technologies Holdings

Universal Technologies Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Universal Technologies Holdings grew revenue at 0.2% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. Nonetheless, it's fair to say the rapidly declining share price (down 20%, compound, over three years) suggests the market is very disappointed with this level of growth. We generally don't try to 'catch the falling knife'. Before considering a purchase, take a look at the losses the company is racking up.

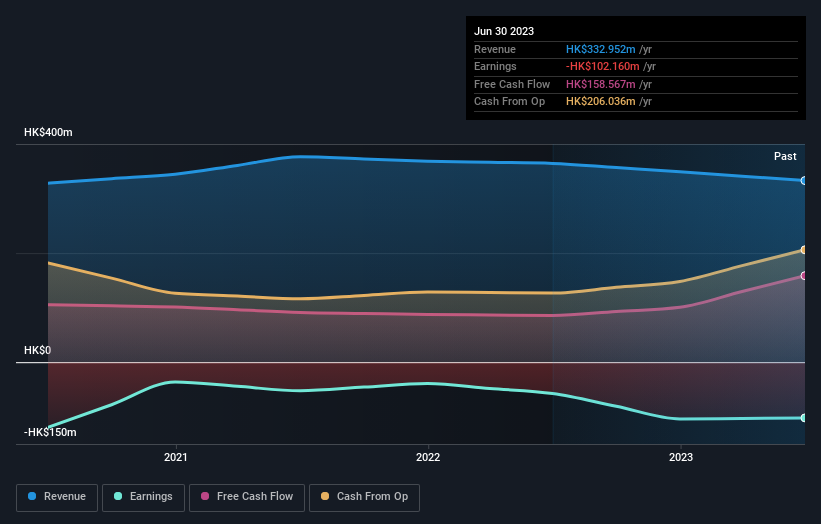

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Universal Technologies Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 8.5% in the twelve months, Universal Technologies Holdings shareholders did even worse, losing 42%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Universal Technologies Holdings better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Universal Technologies Holdings you should be aware of, and 1 of them is a bit concerning.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1026

Universal Technologies Holdings

An investment holding company, primarily engages in the water supply and related services business in the People’s Republic of China, Hong Kong, and internationally.

Slightly overvalued with imperfect balance sheet.