Stock Analysis

Top 3 SEHK Stocks Estimated To Be Below Market Value In July 2024

Reviewed by Simply Wall St

Amidst a global landscape where major indices like the Dow Jones and S&P 500 are reaching new heights, the Hong Kong market presents unique opportunities for investors looking for value. In July 2024, certain stocks in the SEHK appear to be undervalued, offering potential for those seeking investments that may not yet reflect their intrinsic worth given current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$40.45 | HK$75.22 | 46.2% |

| China Cinda Asset Management (SEHK:1359) | HK$0.67 | HK$1.29 | 48.1% |

| China Resources Mixc Lifestyle Services (SEHK:1209) | HK$25.00 | HK$48.07 | 48% |

| West China Cement (SEHK:2233) | HK$1.09 | HK$2.15 | 49.4% |

| Zhaojin Mining Industry (SEHK:1818) | HK$15.24 | HK$30.03 | 49.2% |

| BYD (SEHK:1211) | HK$244.20 | HK$464.26 | 47.4% |

| Super Hi International Holding (SEHK:9658) | HK$14.24 | HK$26.06 | 45.4% |

| Zijin Mining Group (SEHK:2899) | HK$17.68 | HK$32.27 | 45.2% |

| Vobile Group (SEHK:3738) | HK$1.23 | HK$2.32 | 46.9% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$11.20 | HK$21.99 | 49.1% |

Let's dive into some prime choices out of from the screener.

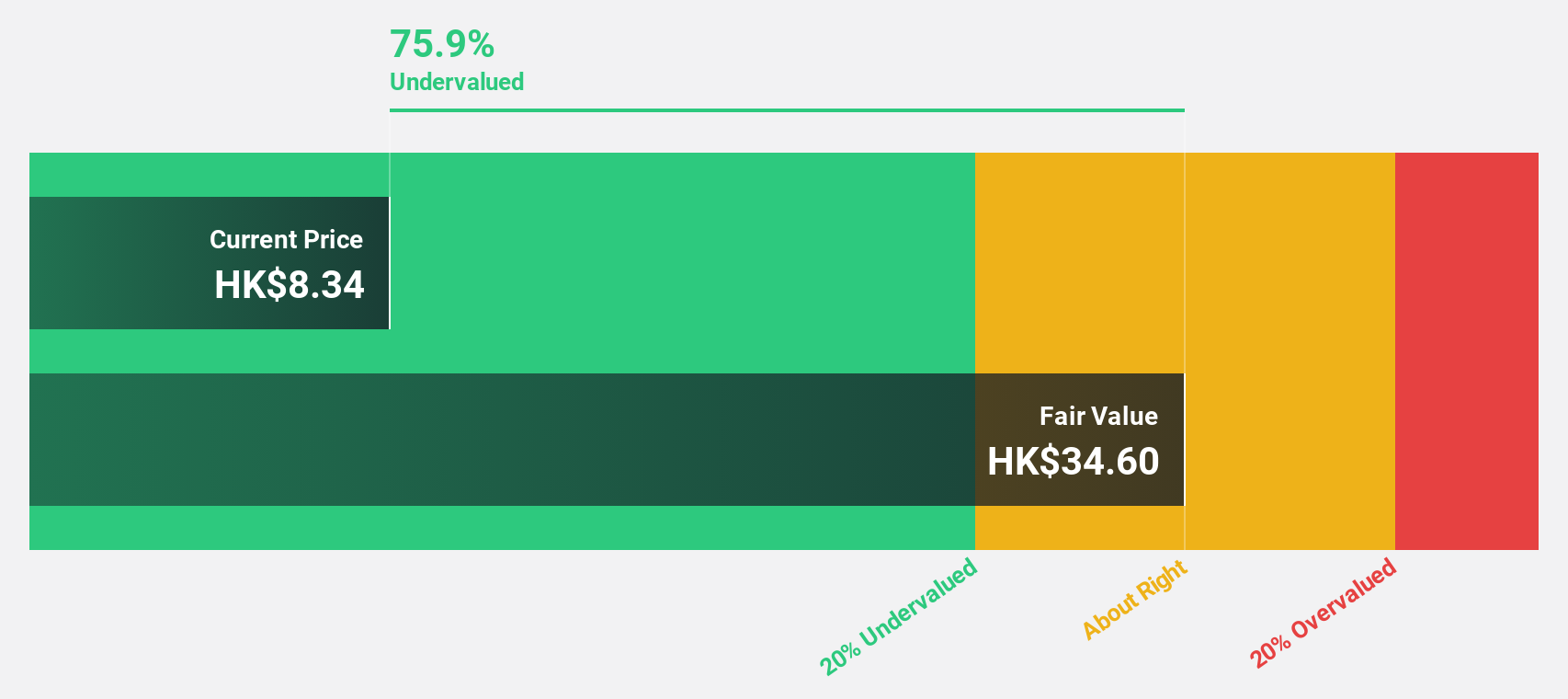

Wasion Holdings (SEHK:3393)

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for the energy supply industries across China, Africa, the US, Europe, and other parts of Asia; it has a market capitalization of approximately HK$6.42 billion.

Operations: Wasion Holdings generates revenue through three primary segments: Advanced Distribution Operations (CN¥2.48 billion), Power Advanced Metering Infrastructure (CN¥2.67 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion).

Estimated Discount To Fair Value: 32%

Wasion Holdings is currently priced at HK$6.45, significantly below the estimated fair value of HK$9.49, indicating a potential undervaluation based on discounted cash flow analysis. Despite a low forecasted return on equity of 16% in three years, the company's earnings have grown by 61% over the past year and are expected to increase by 25.8% annually over the next three years. Revenue growth also outpaces the Hong Kong market average, projected at 22.7% per year compared to 7.7%. However, its dividend track record remains unstable.

- According our earnings growth report, there's an indication that Wasion Holdings might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Wasion Holdings.

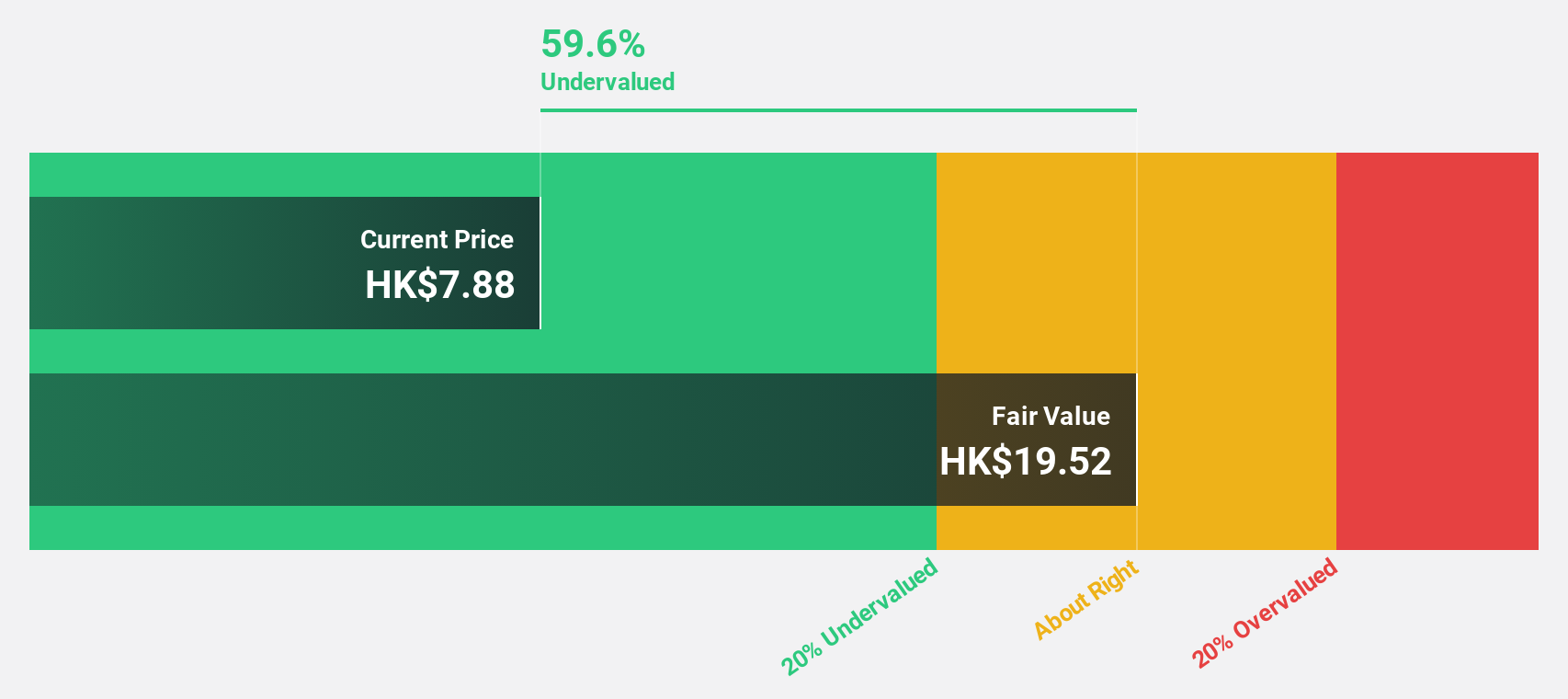

Inspur Digital Enterprise Technology (SEHK:596)

Overview: Inspur Digital Enterprise Technology Limited, primarily operating in the People's Republic of China, engages in software development and other software services, as well as cloud services, with a market capitalization of approximately HK$3.88 billion.

Operations: The company generates revenue through three main segments: cloud services (CN¥2.00 billion), management software (CN¥2.47 billion), and Internet of Things (IoT) solutions (CN¥3.83 billion).

Estimated Discount To Fair Value: 31.7%

Inspur Digital Enterprise Technology is trading at HK$3.4, below the estimated fair value of HK$4.98, suggesting undervaluation based on cash flows. Despite a modest forecasted return on equity of 19.7% in three years, its earnings and revenue growth are robust, expected to increase by 38% and 21.8% annually over the same period—both rates significantly exceeding the Hong Kong market averages of 11.5% and 7.7%, respectively.

- Insights from our recent growth report point to a promising forecast for Inspur Digital Enterprise Technology's business outlook.

- Unlock comprehensive insights into our analysis of Inspur Digital Enterprise Technology stock in this financial health report.

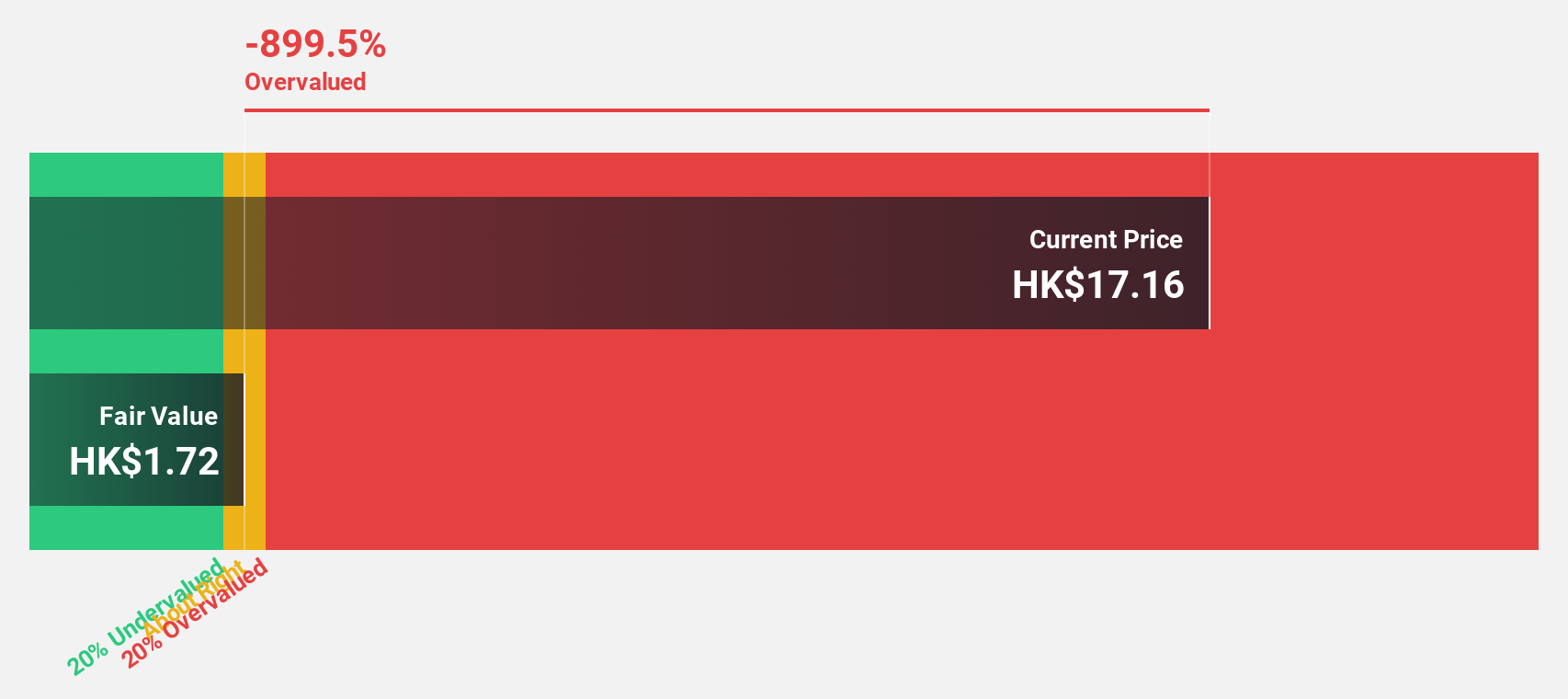

Hangzhou SF Intra-city Industrial (SEHK:9699)

Overview: Hangzhou SF Intra-city Industrial Co., Ltd. is an investment holding company that offers intra-city on-demand delivery services in the People’s Republic of China, with a market capitalization of approximately HK$10.53 billion.

Operations: The company generates revenue primarily through its intra-city on-demand delivery service, totaling CN¥12.39 billion.

Estimated Discount To Fair Value: 40.8%

Hangzhou SF Intra-city Industrial is trading at HK$11.5, significantly below the calculated fair value of HK$19.43, indicating a potential undervaluation based on cash flows. Recent expansions into Hong Kong's on-demand delivery market could enhance growth prospects, supported by a strong increase in local courier revenues and high market growth forecasts in mainland China. Despite this positive outlook, the company's return on equity is expected to remain low at 10.9% over the next three years.

- Our growth report here indicates Hangzhou SF Intra-city Industrial may be poised for an improving outlook.

- Click here to discover the nuances of Hangzhou SF Intra-city Industrial with our detailed financial health report.

Next Steps

- Embark on your investment journey to our 44 Undervalued SEHK Stocks Based On Cash Flows selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou SF Intra-city Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9699

Hangzhou SF Intra-city Industrial

An investment holding company, provides intra-city on-demand delivery services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.