SEHK Value Stocks That Might Be Trading Below Their Estimated Worth In October 2024

Reviewed by Simply Wall St

As Hong Kong's Hang Seng Index experiences a significant rally, driven by China's robust stimulus measures and renewed investor confidence, the market presents intriguing opportunities for value-seeking investors. In this environment, identifying stocks that are potentially trading below their estimated worth involves looking beyond current market exuberance to find companies with strong fundamentals and growth potential that may have been overlooked.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$34.40 | HK$64.55 | 46.7% |

| Giant Biogene Holding (SEHK:2367) | HK$55.00 | HK$97.68 | 43.7% |

| FIT Hon Teng (SEHK:6088) | HK$2.43 | HK$4.35 | 44.1% |

| MicroPort NeuroScientific (SEHK:2172) | HK$9.87 | HK$18.93 | 47.9% |

| China Ruyi Holdings (SEHK:136) | HK$2.23 | HK$4.14 | 46.2% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$29.00 | HK$56.27 | 48.5% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$13.94 | HK$25.89 | 46.2% |

| Nayuki Holdings (SEHK:2150) | HK$1.88 | HK$3.40 | 44.6% |

| Digital China Holdings (SEHK:861) | HK$3.01 | HK$5.89 | 48.9% |

| Akeso (SEHK:9926) | HK$69.15 | HK$134.26 | 48.5% |

We'll examine a selection from our screener results.

Melco International Development (SEHK:200)

Overview: Melco International Development Limited is an investment holding company involved in the leisure and entertainment industry across Macau, the Philippines, and Cyprus, with a market cap of HK$8.49 billion.

Operations: The company's revenue primarily comes from its casino and hospitality segment, generating HK$34.27 billion.

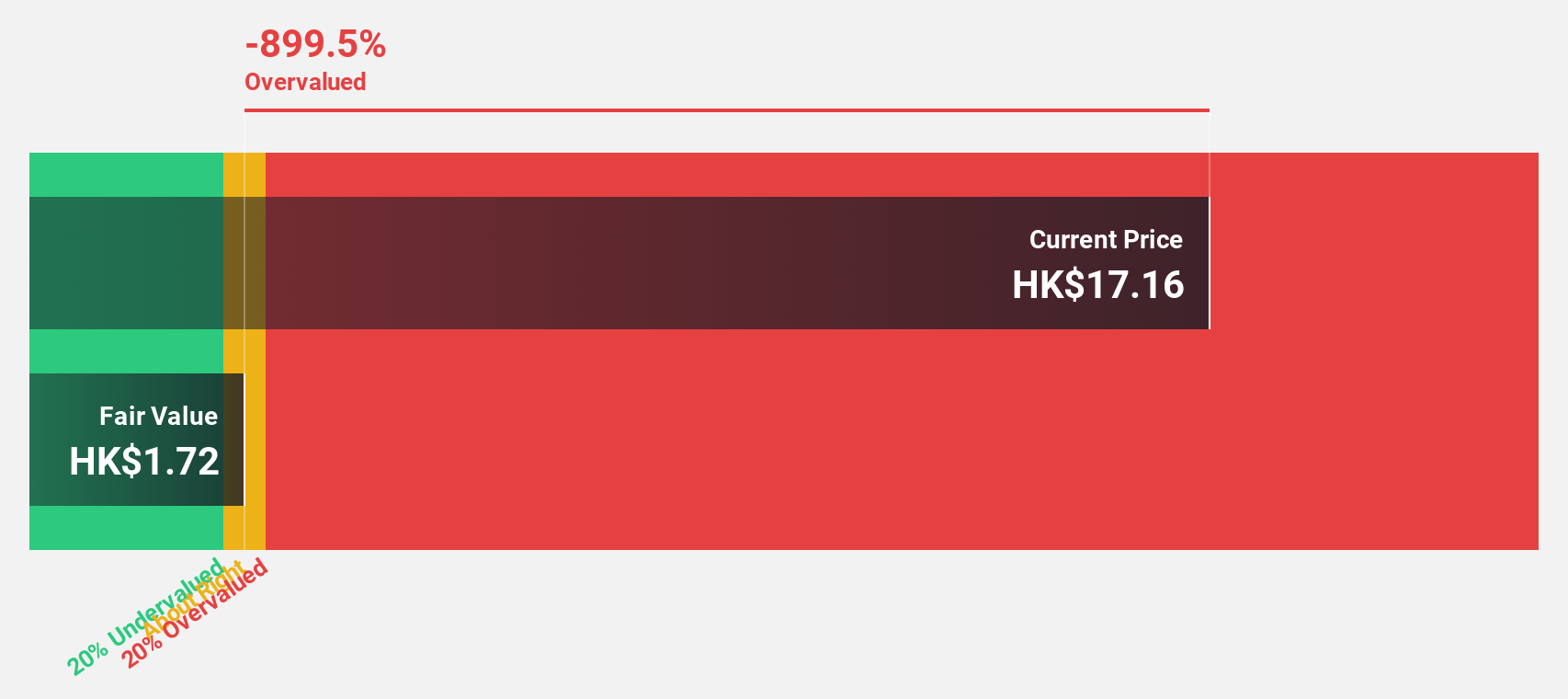

Estimated Discount To Fair Value: 35.9%

Melco International Development is trading at HK$5.6, significantly below its estimated fair value of HK$8.74, suggesting it may be undervalued based on cash flows. Recent earnings show improved performance with sales increasing to HK$17.77 billion and a reduced net loss of HK$253.22 million for the first half of 2024. Forecasts indicate strong profit growth over the next three years, alongside a high return on equity projected at 41.3%.

- Upon reviewing our latest growth report, Melco International Development's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Melco International Development.

Bairong (SEHK:6608)

Overview: Bairong Inc. is a cloud-based AI turnkey services provider in China with a market cap of HK$5.38 billion.

Operations: The company generates revenue from its data processing segment, amounting to CN¥2.76 billion.

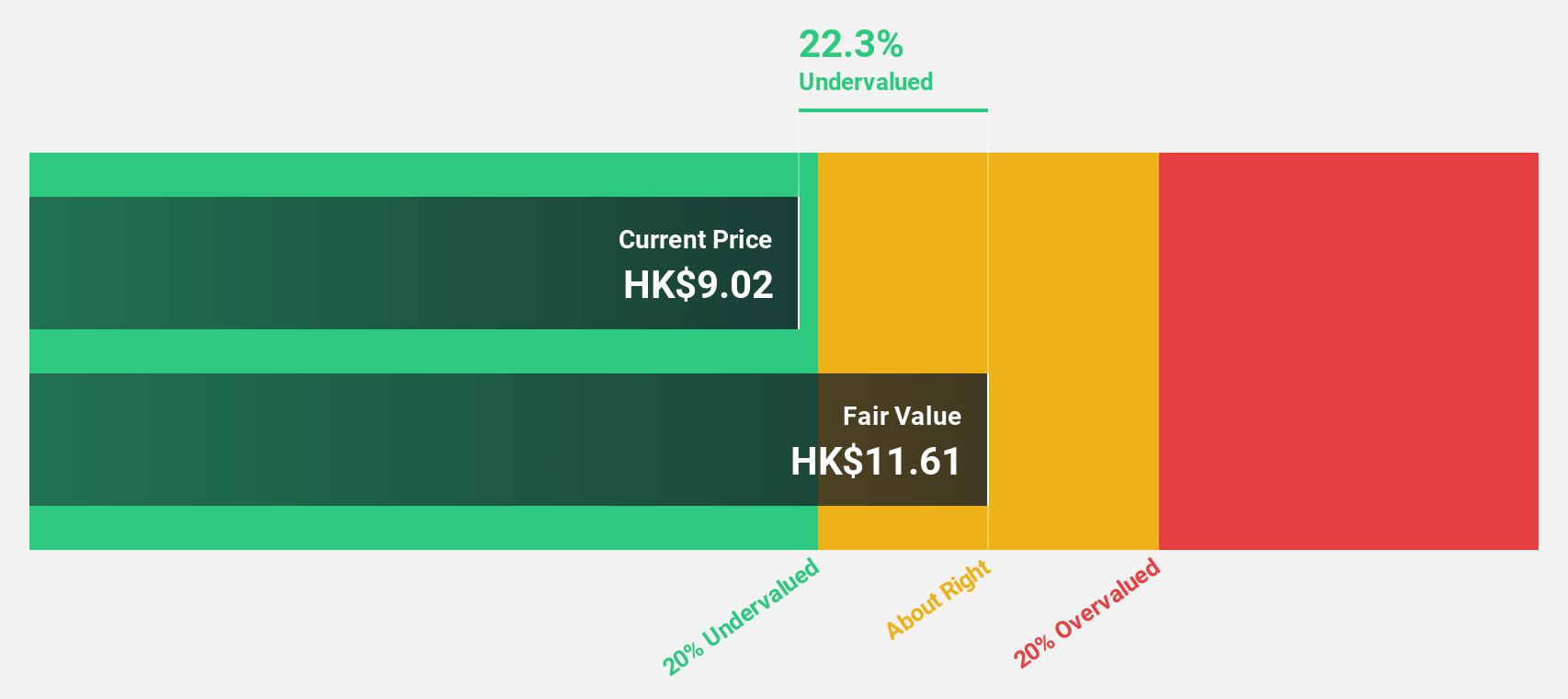

Estimated Discount To Fair Value: 31.1%

Bairong is currently trading at HK$11.62, below its estimated fair value of HK$16.86, highlighting potential undervaluation based on cash flows. Despite a decline in net income to CNY 139.96 million for the first half of 2024 from CNY 205.25 million last year, earnings are forecasted to grow significantly by over 28% annually in the coming years, outpacing the Hong Kong market's growth rate of 12.2%.

- Our growth report here indicates Bairong may be poised for an improving outlook.

- Click here to discover the nuances of Bairong with our detailed financial health report.

Hangzhou SF Intra-city Industrial (SEHK:9699)

Overview: Hangzhou SF Intra-city Industrial Co., Ltd. is an investment holding company that offers intra-city on-demand delivery services in the People's Republic of China, with a market cap of approximately HK$11.52 billion.

Operations: The company generates revenue of CN¥13.52 billion from its intra-city on-demand delivery service business in the People’s Republic of China.

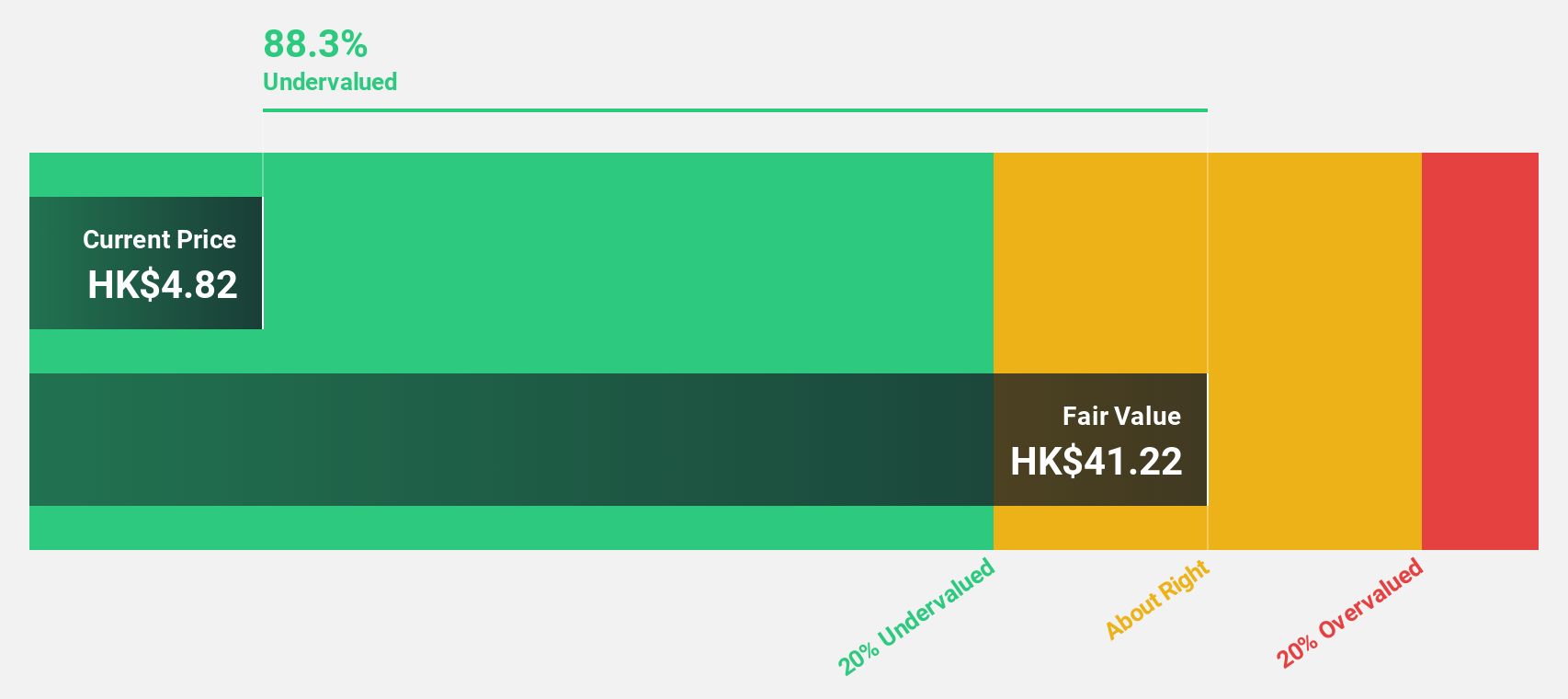

Estimated Discount To Fair Value: 36.2%

Hangzhou SF Intra-city Industrial is trading at HK$12.6, significantly below its estimated fair value of HK$19.76, suggesting it may be undervalued based on cash flows. The company reported a net income increase to CNY 62.17 million for the first half of 2024, up from CNY 30.31 million the previous year, driven by improved operating efficiency and revenue growth strategies. Earnings are projected to grow substantially by over 54% annually, surpassing market expectations.

- According our earnings growth report, there's an indication that Hangzhou SF Intra-city Industrial might be ready to expand.

- Get an in-depth perspective on Hangzhou SF Intra-city Industrial's balance sheet by reading our health report here.

Seize The Opportunity

- Unlock our comprehensive list of 36 Undervalued SEHK Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou SF Intra-city Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9699

Hangzhou SF Intra-city Industrial

An investment holding company, provides intra-city on-demand delivery services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.