Stock Analysis

- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1277

Exploring Three Undervalued Small Caps In Hong Kong With Insider Actions

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets, Hong Kong's small-cap stocks present a unique landscape for investors seeking potential value. As the broader market contends with economic shifts and insider actions hint at strategic moves, understanding the underlying factors that drive small-cap success becomes crucial in identifying undervalued opportunities.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Xtep International Holdings | 10.7x | 0.8x | 43.68% | ★★★★★★ |

| Wasion Holdings | 11.7x | 0.8x | 30.65% | ★★★★☆☆ |

| Sany Heavy Equipment International Holdings | 7.7x | 0.7x | -19.26% | ★★★★☆☆ |

| Nissin Foods | 14.7x | 1.3x | 40.28% | ★★★★☆☆ |

| China Leon Inspection Holding | 10.1x | 0.7x | 25.05% | ★★★★☆☆ |

| China Overseas Grand Oceans Group | 2.9x | 0.1x | -4.60% | ★★★★☆☆ |

| Transport International Holdings | 11.4x | 0.6x | 44.94% | ★★★★☆☆ |

| Giordano International | 8.7x | 0.8x | 36.02% | ★★★☆☆☆ |

| Shenzhen International Holdings | 8.1x | 0.8x | 12.94% | ★★★☆☆☆ |

| Kinetic Development Group | 4.2x | 1.8x | 15.31% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

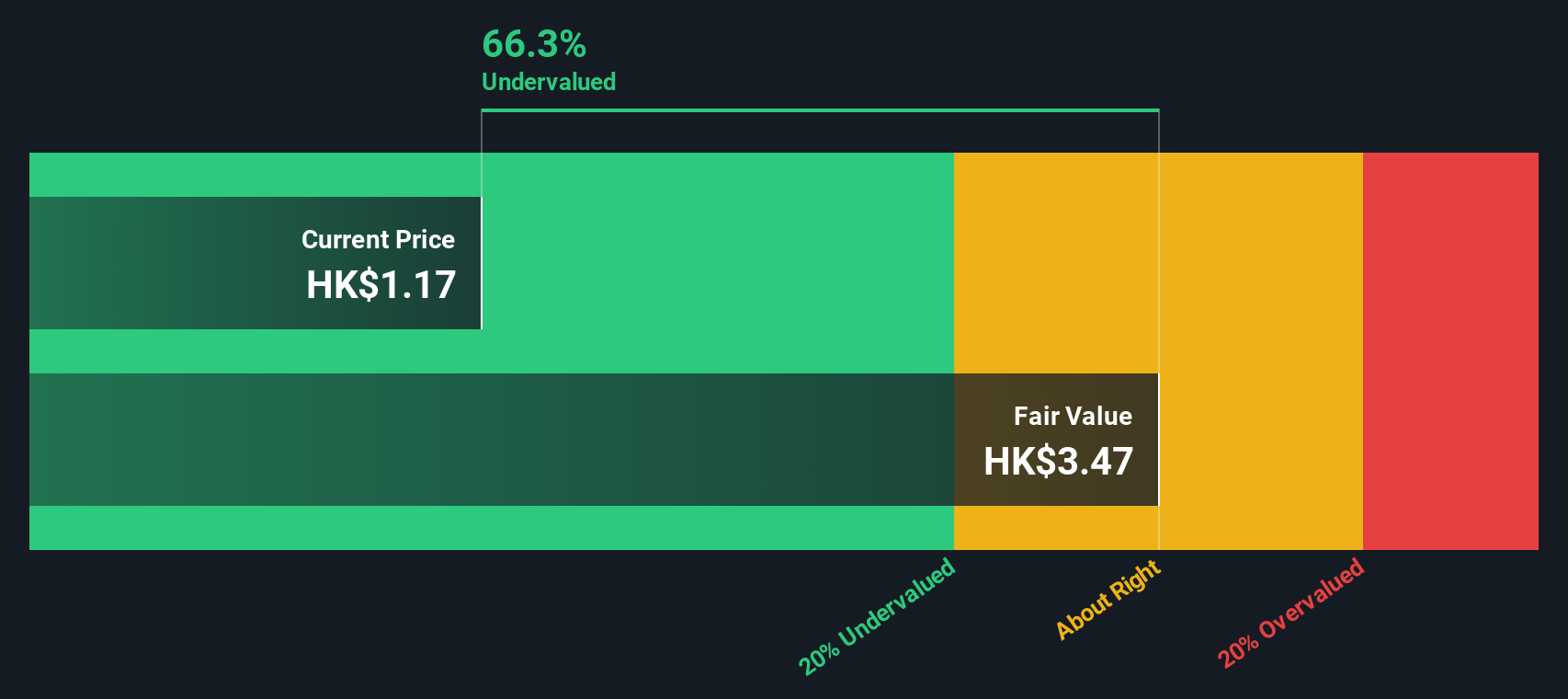

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kinetic Development Group is a company focused on various business sectors, with a market capitalization of approximately CN¥1.27 billion.

Operations: The company generates revenue from the sale of goods, consistently achieving a gross profit margin that has risen from 9.05% in September 2013 to approximately 59.07% by July 2024, reflecting increasing efficiency or pricing power. Over the same period, net income has shown significant improvement, turning from a loss to a substantial gain with the latest reported net income margin at about 43.79%.

PE: 4.2x

Kinetic Development Group, a notable player in Hong Kong's market, recently saw insiders confidently purchasing shares, signaling strong belief in the company’s prospects. Despite a dividend cut to HK$0.05 per share and changes to its corporate governance structure approved on May 7, 2024, the firm remains attractive due to its financial health and strategic adjustments. With all liabilities backed by external borrowing—a riskier yet aggressive funding strategy—Kinetic is poised for intriguing developments post their Q1 2024 earnings report expected on May 31. This blend of insider activity and corporate adjustments paints a picture of a company recalibrating for future growth within its industry landscape.

- Click here and access our complete valuation analysis report to understand the dynamics of Kinetic Development Group.

Gain insights into Kinetic Development Group's past trends and performance with our Past report.

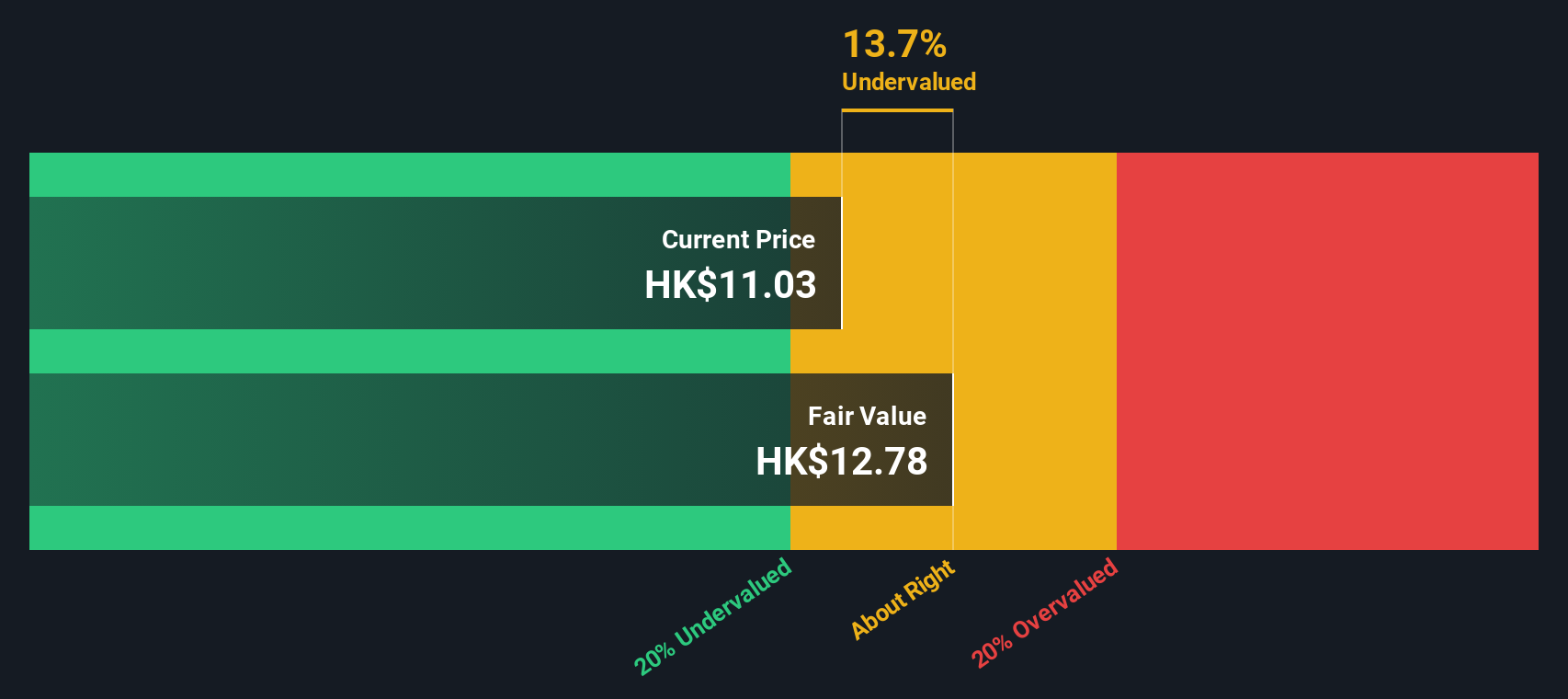

Transport International Holdings (SEHK:62)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Transport International Holdings operates primarily in franchised bus operations, supplemented by engagements in property holdings and development, with a minor segment in other businesses.

Operations: Franchised Bus Operation is the primary revenue generator, contributing HK$7.57 billion, while Property Holdings and Development add a smaller share of HK$87.36 million. The company's Gross Profit Margin has shown an upward trend, increasing from 22.29% to 27.93% over the observed periods.

PE: 11.4x

Transport International Holdings, reflecting a strategic reshuffle with the recent board appointment of Ms. LAU Man-Kwan, signals a fresh perspective in leadership. Despite a 14.1% annual decline in earnings over the past five years and lower profit margins this year compared to last, the company maintains appeal through its HK$0.50 per share dividend affirmed recently. Insider confidence is evident as Winnie J. Ng recently purchased 124,000 shares for HK$1.11 million, suggesting potential underappreciated value in this Hong Kong-based entity's stock amidst its challenges.

- Unlock comprehensive insights into our analysis of Transport International Holdings stock in this valuation report.

Understand Transport International Holdings' track record by examining our Past report.

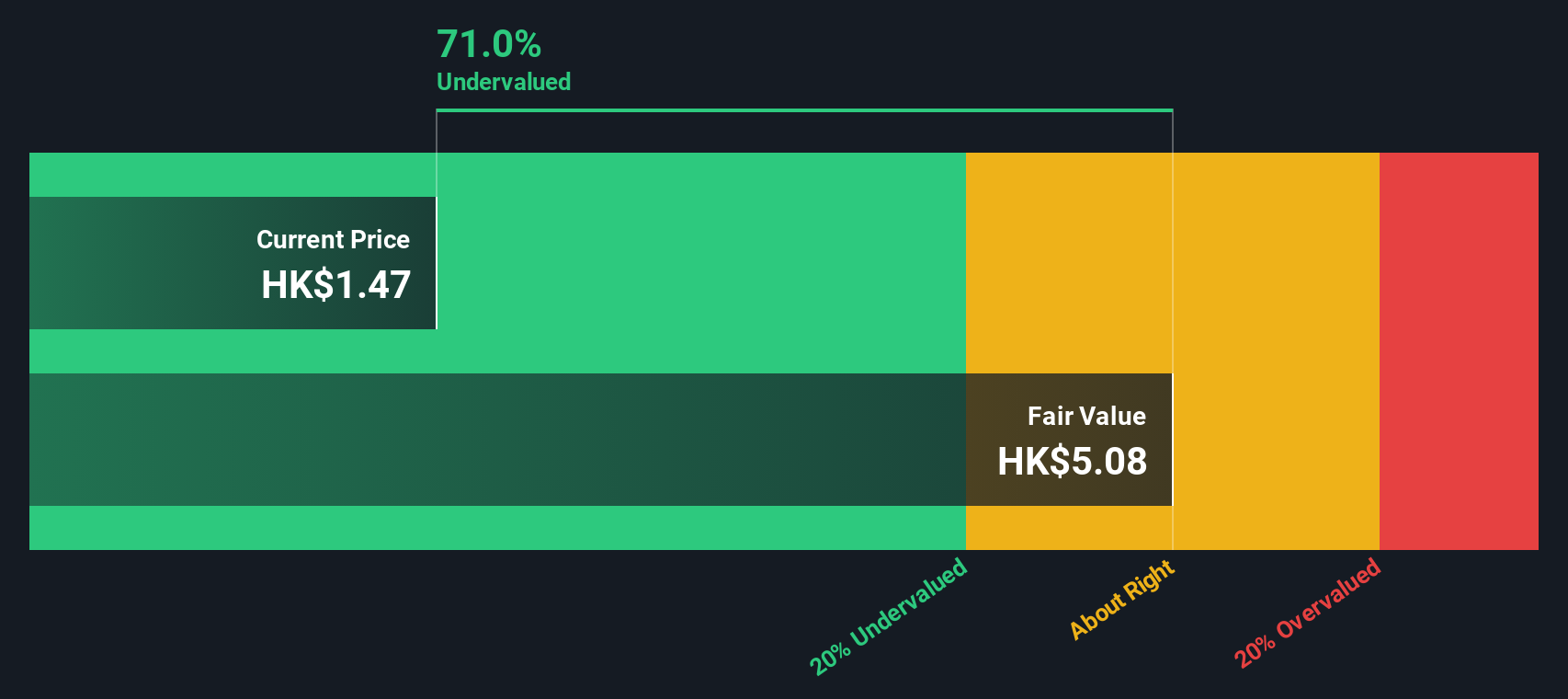

Giordano International (SEHK:709)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Giordano International is a global apparel retailer, operating across various regions including Taiwan, Mainland China, Hong Kong and Macau, the Gulf Cooperation Council, Southeast Asia, Australia, and through wholesale to overseas franchisees.

Operations: The company generates revenue through diverse geographical segments with Southeast Asia and Australia being the highest at HK$1.47 billion, followed by the Gulf Cooperation Council at HK$675 million. Over recent periods, it has reported a gross profit margin of approximately 58.43%, reflecting its cost management in relation to sales revenue.

PE: 8.7x

Recently, Giordano International has seen insider confidence manifest through share purchases, signaling a positive outlook from those within. Despite a slight dip in quarterly sales to HK$961 million from HK$972 million year-on-year, the firm's resilience is notable with group same-store sales slightly up. The appointment of seasoned executives like Mr. Chau hints at strategic strengthening, potentially enhancing governance and future performance prospects in Hong Kong’s competitive retail landscape.

Next Steps

- Take a closer look at our Undervalued Small Caps With Insider Buying list of 16 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Kinetic Development Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1277

Kinetic Development Group

An investment holding company, engages in the extraction and sale of coal products in the People’s Republic of China.

Excellent balance sheet with proven track record.